-

Octagon Investor Partners 40 limits “covenant-lite” loans to 60% of its portfolio, below the 65% cap on it's previous new-issue deal completed in November.

February 14 -

Although mostly active as a middle-market CLO manager, asset manager Golub Capital is printing a new open-market CLO sourced by its large-corporate loan investments.

February 13 -

The global insurance firm, which operates a three-year-old CLO management affiliate, has now launched private credit unit that will pursue controlling interests in deals managed by others.

February 12 -

The firm founded by mortgage veteran Michael Vranos looks for leveraged loans it considers "misrated" with strong covenants; many of these loans also amortize relatively quickly.

February 7 -

The 131 basis-point spread for Buckhorn Park CLO is 14 basis points wider than Blackstone's previous deal in November, but in line with peer deals from recent weeks.

February 6 -

About half of collateralized loan obligations purchased loans at prices below face value in order to boost the par value of assets, improving overcollateralization.

February 6 -

That's one notch lower than the sponsor's prior deal; the only substantial change is the valuation of securities that are deferring dividend payments.

February 5 -

Jonathan Levine, who represents asset managers and private funds in their investments in distressed situations, joins the firm from Morrison & Foerster.

February 5 -

They join Blackstone/GSO, PGIM, Credit Suisse, Guggenheim Securities and the Carlyle Group in reopening a new-issue market that was dormant in December.

February 2 -

At least 50% of the U.S. dollar-denominated fund's investments will be in triple-B tranches of U.S. and European CLOs.

January 30 -

Risk retention rules that Japan's Financial Services Agency has proposed for securitizations may not apply to U.S. collateralized loan obligations after all, according to the LSTA.

January 29 -

Guggenheim, Carlyle Group, Credit Suisse and Blackstone have launched four deals totaling €1.74 billion, all with AAA spreads of at least 100 basis points over Euribor.

January 29 -

Cadogan Square CLO XIII DAC will be Credit Suisse Asset Management's fourth euro-denominated CLO issued in the past 12 months.

January 24 -

That's significantly wider than 121 basis points average for new CLOs backed by broadly syndicated loans that were issued in December.

January 22 -

GoldenTree's $757 million CLO is the first deal seeking to price in the 2019 primary market, while Octagon Credit Investors is refinancing a $791.5M, 2014-vintage CLO (for a second time).

January 18 -

The Japan Financial Services Agency is considering increasing capital requirements for holdings of securitizations if the sponsors do not have "skin in game."

January 16 -

A few took advantage of deep discounts to scoop up collateral for new deals on the cheap; others swapped out some of their weakest credits for more highly rated loans.

January 15 -

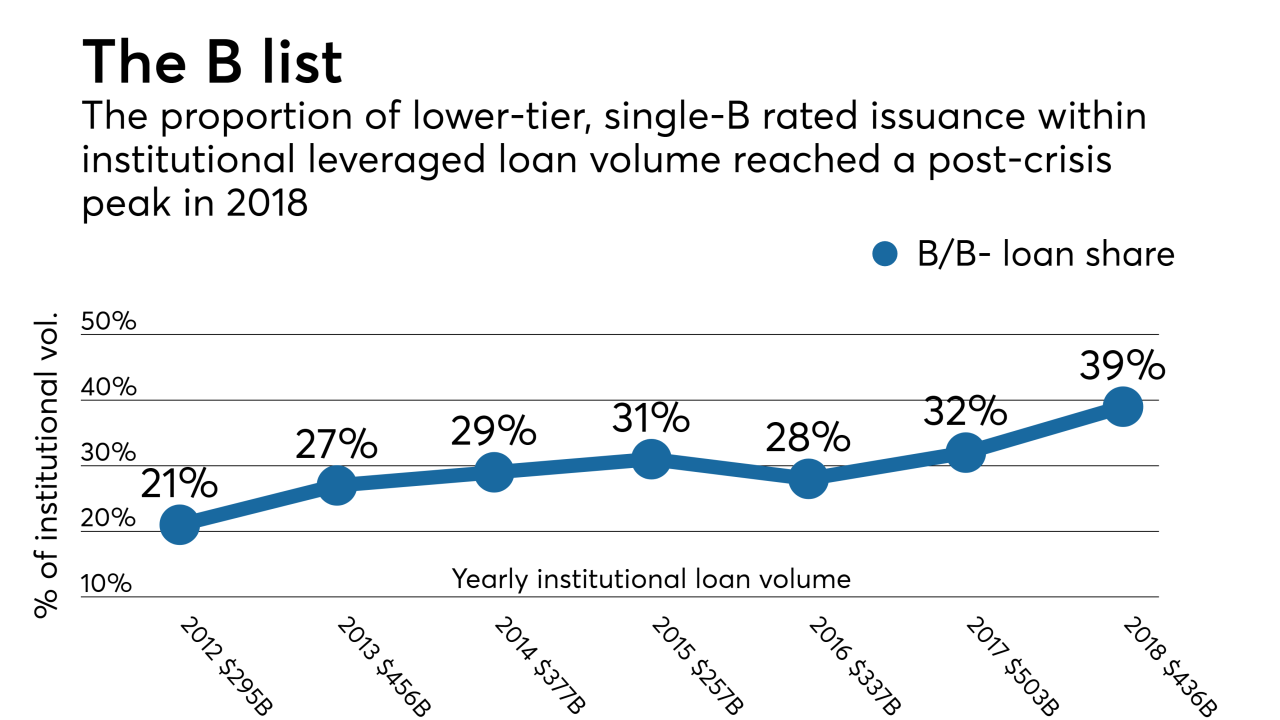

Z Capital's $350M CLO can hold up to 50% of its assets in risky triple-C rated assets, giving it a wide cushion to bulk up on the growing supply of single-B loans near the CCC-rating threshold.

January 9 -

The market has not seen a prolonged period of widening spreads since an eight-month period before early 2016, which was the launching point for a nearly two-year run of AAA spread narrowing.

January 8 -

The global asset manager is sponsoring its first post-crisis CLO in a €409.8 million transaction that priced through Barclays on Monday.

January 3