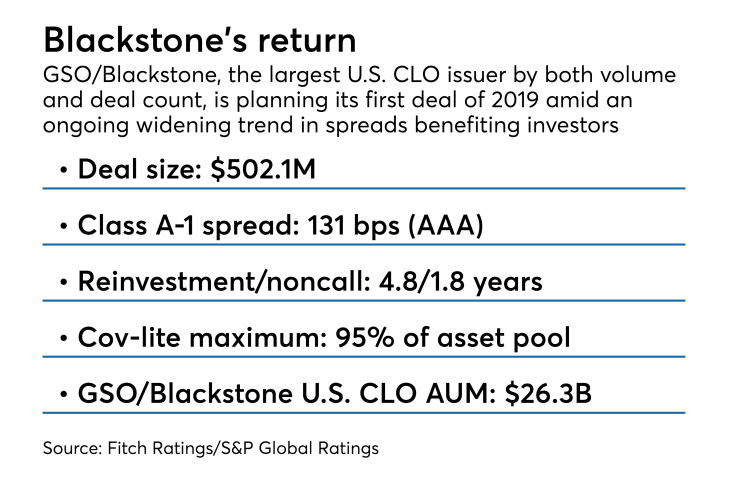

GSO/Blackstone Debt Funds Management joins the ranks of CLO managers issuing their first deals of 2019 at wider spreads than their last deals of 2018.

The $502.1 million Buckhorn Park CLO will issue a senior tranche of triple A rated notes that pay 131 basis points over three-month Libor, according to S&P Global Ratings and Fitch Ratings. That's 131 wider than he triple a tranche of the sponsor's prior CLO, the $716.3 million Harbor Park CLO, issued in November 2018.

Still, the spread on the new deal was in line with those of deals priced by its peers last week, according to a Deutsche Bank roundup of deals (citing S&P LCD deal data). Those managers included Neuberger Berman (133), KKR Credit Advisors, (136) Assurant Investment Management (135) and Sound Point Capital Management (137).

Buckhorn Park will also issue a Class A-2 tranche, which is also rated triple A and pays a higher coupon of 165 basis points. (With a subordinate senior-note structure, investors will usually gain higher rates in exchange for lesser subordination protection as well as longer tenor).

The capital stack includes five other tranches of notes with ratings from S&P that range from AA through BB-.

The deal has a 4.8-year reinvestment period and is non-callable for1.8 years. It has a 3.41% weighted average spread. Blackstone, which surpassed the Carlyle Group last year as the largest U.S. CLO manager, will build its assets under management to $26.3 billion with the Buckhorn deal.

GSO/Blackstone Debt Funds Management is an affiliate of the Blackstone Group’s GSO Capital Partners credit-focus business unit.