EJF Capital’s next securitization of trust-preferred securities offers fewer investor protections than its prior deal, and that has earned it a lower credit rating from Kroll Bond Rating Agency.

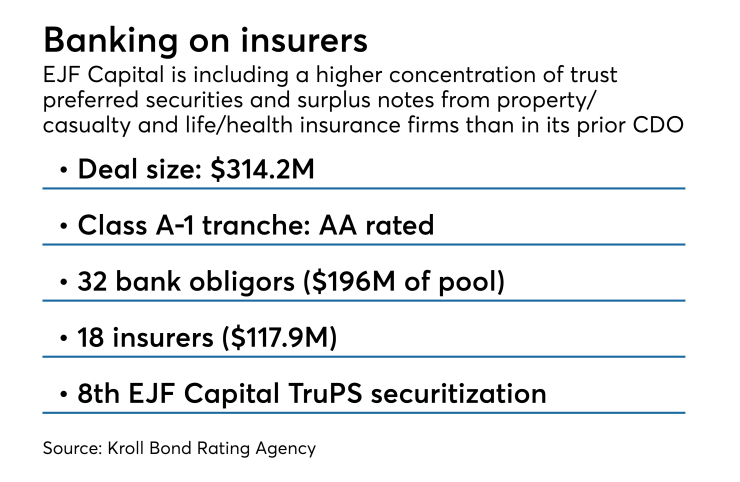

The $314.2 million TruPS Financial Note Securitization (TFINS) 2019-1 will issue three tranches of rated notes; the most senior is rated AA by Kroll, which is one notch lower than the comparable tranche of a deal completed in November.

The collateral for the latest deal is more concentrated in securities of fewer obligors than the November deal, which brings some added risk, but that's not the change Kroll is most concerned about. It says the only "substantial" change is the treatment of securities in the collateral pool that are deferring dividend payments, something trust-preferreds can do for a limited number of years.

In past deals, obligations that were not making dividend payments were valued at 10% of their principal balance, for the purpose of determining overcollateralization, or the excess value of the collateral over the value of notes issued in a deal. But for TFINS 2019-1, deferred obligations will be valued at 25% of face value. Kroll considers this to be "credit negative," since it typically delays the time for the coverage tests to fail and trigger changes in payment priorities that protect senior noteholders. “An additional obligor will likely be needed to fail the tests,” the presale report states.

The deal also includes a $24.3 million Class A-2 tranche with a single-A rating, and a $44.8 million Class B tranche carrying a BB. An EJF capitalized affiliate will maintain a $56.8 million residual holding in the deal for U.S. risk-retention compliance purposes under the Dodd-Frank Act.

Kroll’s double-A rating on the Class A notes (which pay a coupon of 2.05% above three-month Libor) remains higher than two earlier EJF TruPS CDOs that Kroll has rated prior to last fall's transaction. Both TFINS 2018-1 and 2017-2 were rated AA-.

The new deal has some credit-positive adjustments compared to EJF’s previous CDO transaction. Kroll notes there increased fixed-rate obligations, less collateral with a spread under 200 basis points.

There is also a larger percentage of collateral issued by insurers (37.6% vs 21% in TFINS 2018-2).

Kroll has rated four of the eight TruPS-backed offerings sponsored by EJF Capital since it launched its CDO platform in 2015 to re-securitize existing trust-preferreds that remained outstanding from previously repaid CDO vehicles.

In total, the new transaction is backed by $313.9 million in outstanding securities and surplus notes from 32 regional and community banks as well as 18 life insurance firms. The median balance of the obligations is $7 million for the banks, $4.5 million for life and health insurers and $7.6 million for property and casualty insurers.

Individual obligations range from $552,000 to $9.05 million, according to Kroll.

About $255 million, or 81.3% of the portfolio, is maturing in approximately 14-16 years (Kroll stated the deal has fewer tail-end maturities than the prior TFINS transaction).

The static deal is non-callable for two years. It is being managed by affiliate EJF CDO Manager, and was underwritten by Bank of America Merrill Lynch and Pierce, Fenner & Smith.

EJF Capital has $7.3 billion under management.