-

Risk retention rules that Japan's Financial Services Agency has proposed for securitizations may not apply to U.S. collateralized loan obligations after all, according to the LSTA.

January 29 -

Guggenheim, Carlyle Group, Credit Suisse and Blackstone have launched four deals totaling €1.74 billion, all with AAA spreads of at least 100 basis points over Euribor.

January 29 -

Cadogan Square CLO XIII DAC will be Credit Suisse Asset Management's fourth euro-denominated CLO issued in the past 12 months.

January 24 -

That's significantly wider than 121 basis points average for new CLOs backed by broadly syndicated loans that were issued in December.

January 22 -

GoldenTree's $757 million CLO is the first deal seeking to price in the 2019 primary market, while Octagon Credit Investors is refinancing a $791.5M, 2014-vintage CLO (for a second time).

January 18 -

The Japan Financial Services Agency is considering increasing capital requirements for holdings of securitizations if the sponsors do not have "skin in game."

January 16 -

A few took advantage of deep discounts to scoop up collateral for new deals on the cheap; others swapped out some of their weakest credits for more highly rated loans.

January 15 -

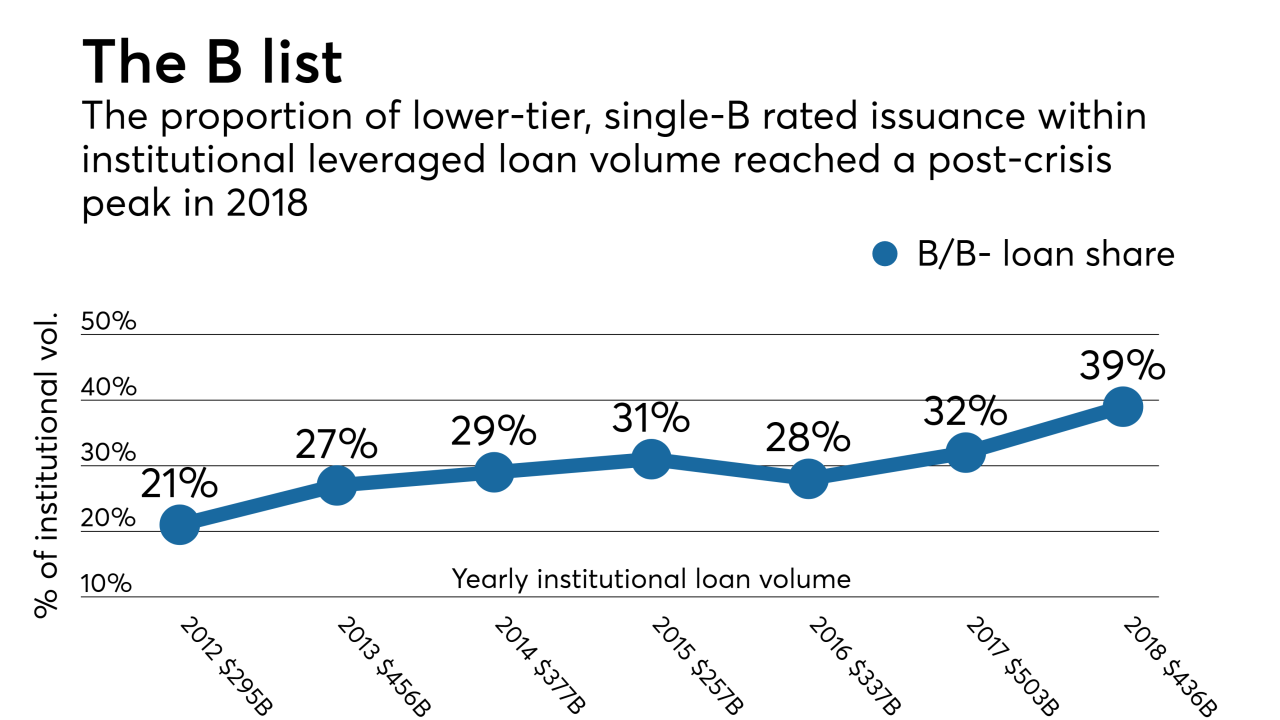

Z Capital's $350M CLO can hold up to 50% of its assets in risky triple-C rated assets, giving it a wide cushion to bulk up on the growing supply of single-B loans near the CCC-rating threshold.

January 9 -

The market has not seen a prolonged period of widening spreads since an eight-month period before early 2016, which was the launching point for a nearly two-year run of AAA spread narrowing.

January 8 -

The global asset manager is sponsoring its first post-crisis CLO in a €409.8 million transaction that priced through Barclays on Monday.

January 3 -

Since Nov. 21, investors have withdrawn a net $14.88B from the loan fund market amid concerns the Fed will limit rate hikes in 2019; the exodus makes loans even more of a buyer's market for CLOs.

January 2 -

A Wells Fargo report this week shows that market spreads for the triple-A notes backed by collateralized loan obligation assets are at 128, a level not seen since May 2017.

December 21 -

The $500 million AIG CLO 2018-1, AIG's first deal since selling off its asset management business in 2010, is priced at 132 basis points over three-month Libor.

December 20 -

The €350 million Providus CLO II is backed exclusively by loans to mid-market firms that meet the private equity firm's sustainability criteria; at closing, 90% of the collateral has been identified.

December 20 -

The LA-based manager is pricing the replacement AAA notes of Oaktree EIF III Series 1 inside recent market averages through a limited, brief noncall extension.

December 17 -

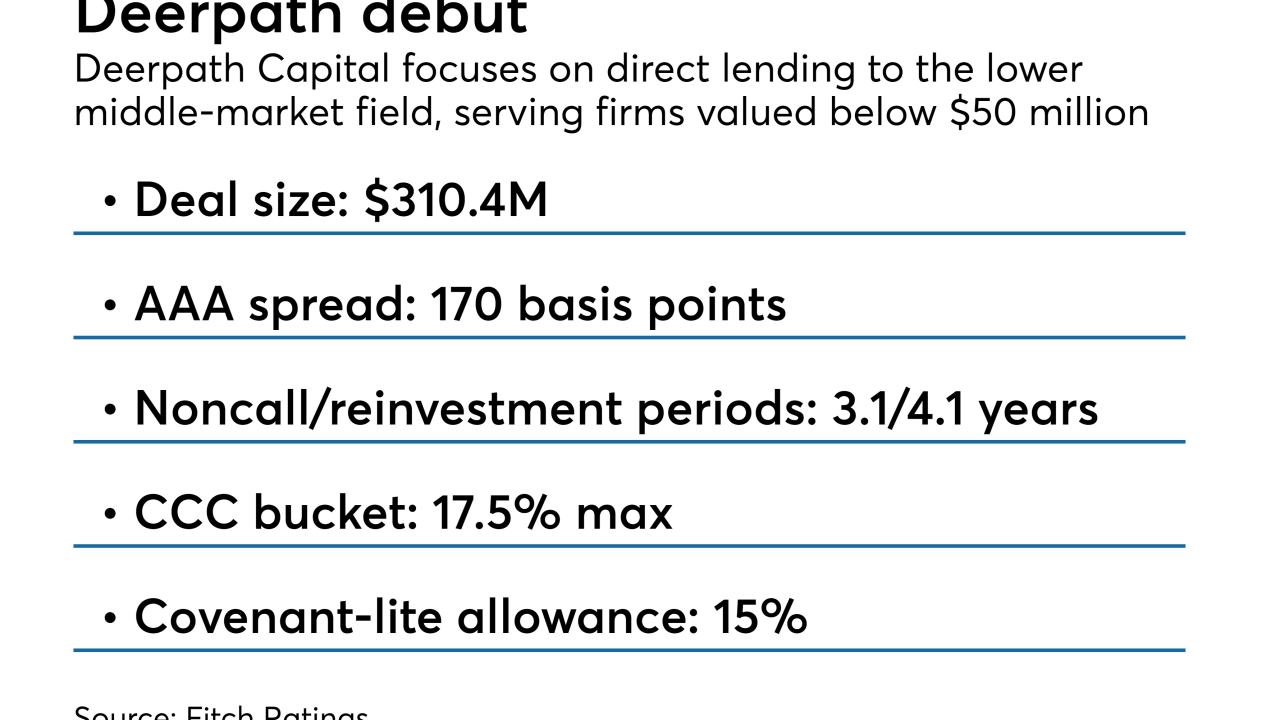

The $308 million Deepath CLO 2018-1 has an unusually large allowance for riskier triple-C loans of up to 17.5% of the portfolio.

December 11 -

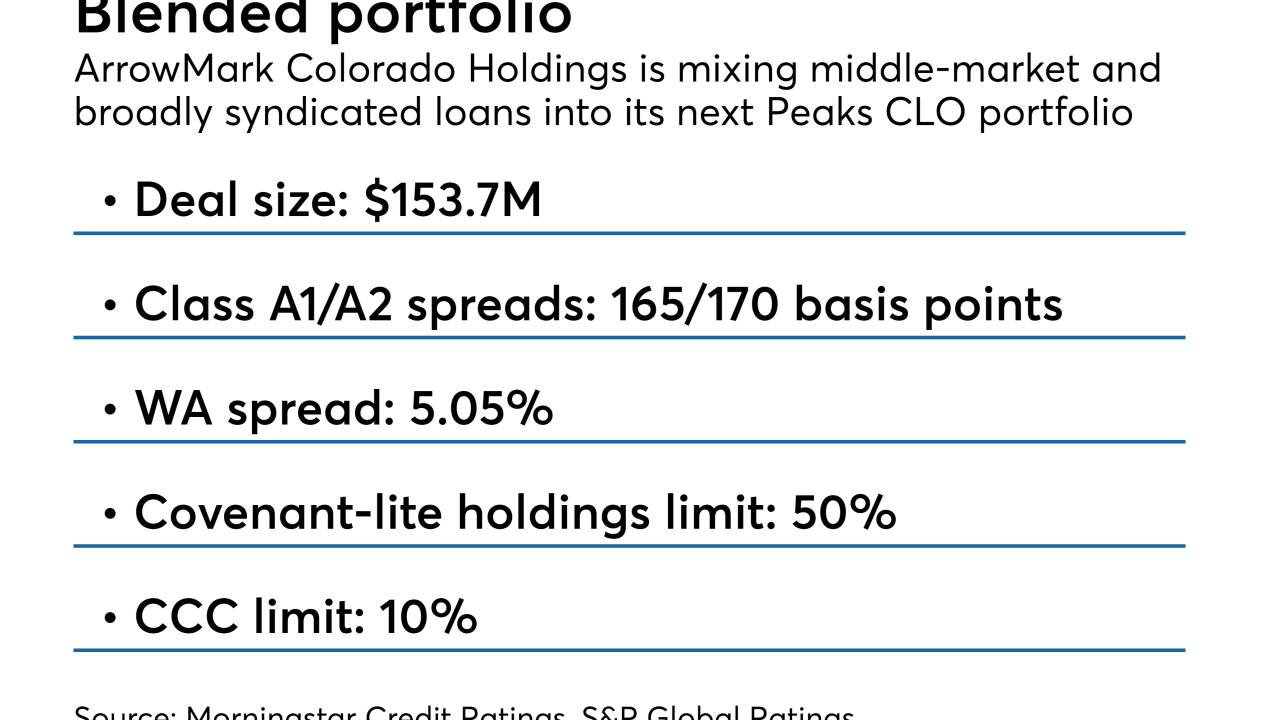

The $153.7 million Peaks CLO 3 also features a high ceiling for triple-C-rated loans and for "current-pay" loans that meet one or more criteria for default.

December 10 -

Both managers are pricing their 3rd CLOs of 2018; the 135 basis point spread on Zais' is among the widest this year for a deal backed by broadly syndicated loans.

November 27 -

Guggenheim joins GSO/Blackstone and Bain Capital as longtime CLO managers expanding into the SME space this year.

November 21 -

More collateralized loan obligations are failing weighted-average lift tests due to the dearth of available loans whose near-term maturities could provide some relief to portfolios.

November 20