-

Since Nov. 21, investors have withdrawn a net $14.88B from the loan fund market amid concerns the Fed will limit rate hikes in 2019; the exodus makes loans even more of a buyer's market for CLOs.

January 2 -

A Wells Fargo report this week shows that market spreads for the triple-A notes backed by collateralized loan obligation assets are at 128, a level not seen since May 2017.

December 21 -

The $500 million AIG CLO 2018-1, AIG's first deal since selling off its asset management business in 2010, is priced at 132 basis points over three-month Libor.

December 20 -

The €350 million Providus CLO II is backed exclusively by loans to mid-market firms that meet the private equity firm's sustainability criteria; at closing, 90% of the collateral has been identified.

December 20 -

The LA-based manager is pricing the replacement AAA notes of Oaktree EIF III Series 1 inside recent market averages through a limited, brief noncall extension.

December 17 -

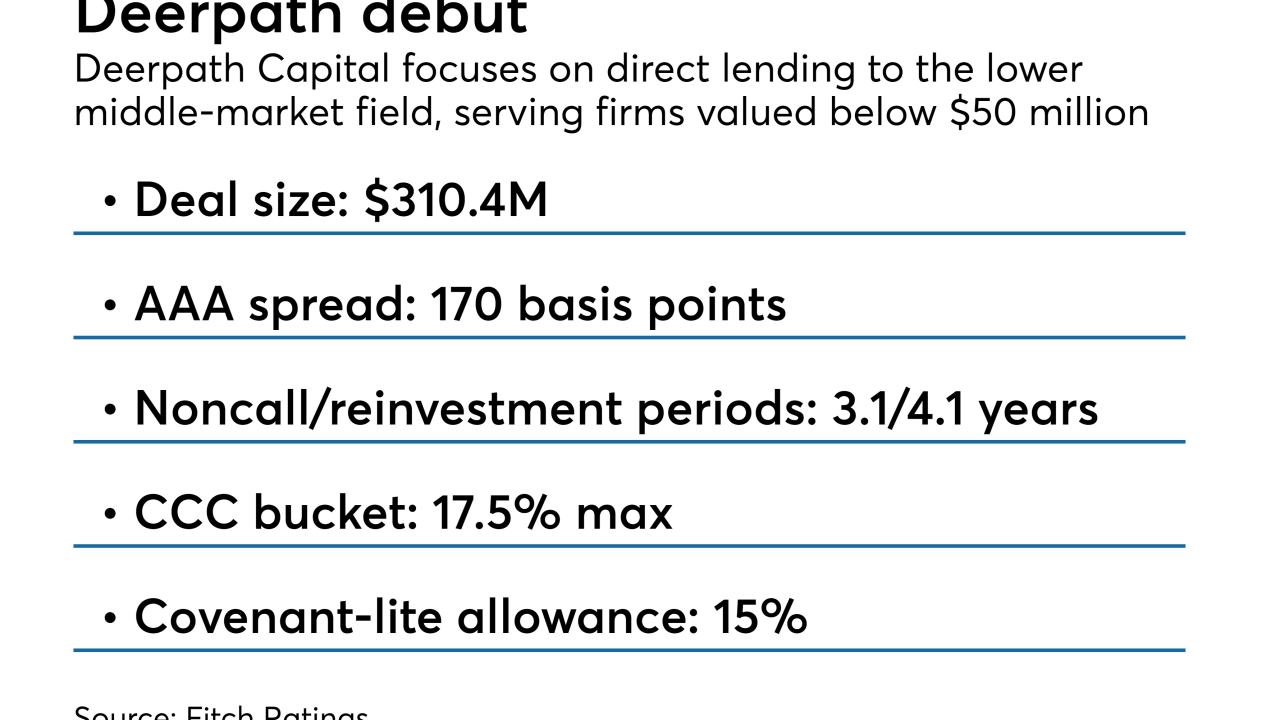

The $308 million Deepath CLO 2018-1 has an unusually large allowance for riskier triple-C loans of up to 17.5% of the portfolio.

December 11 -

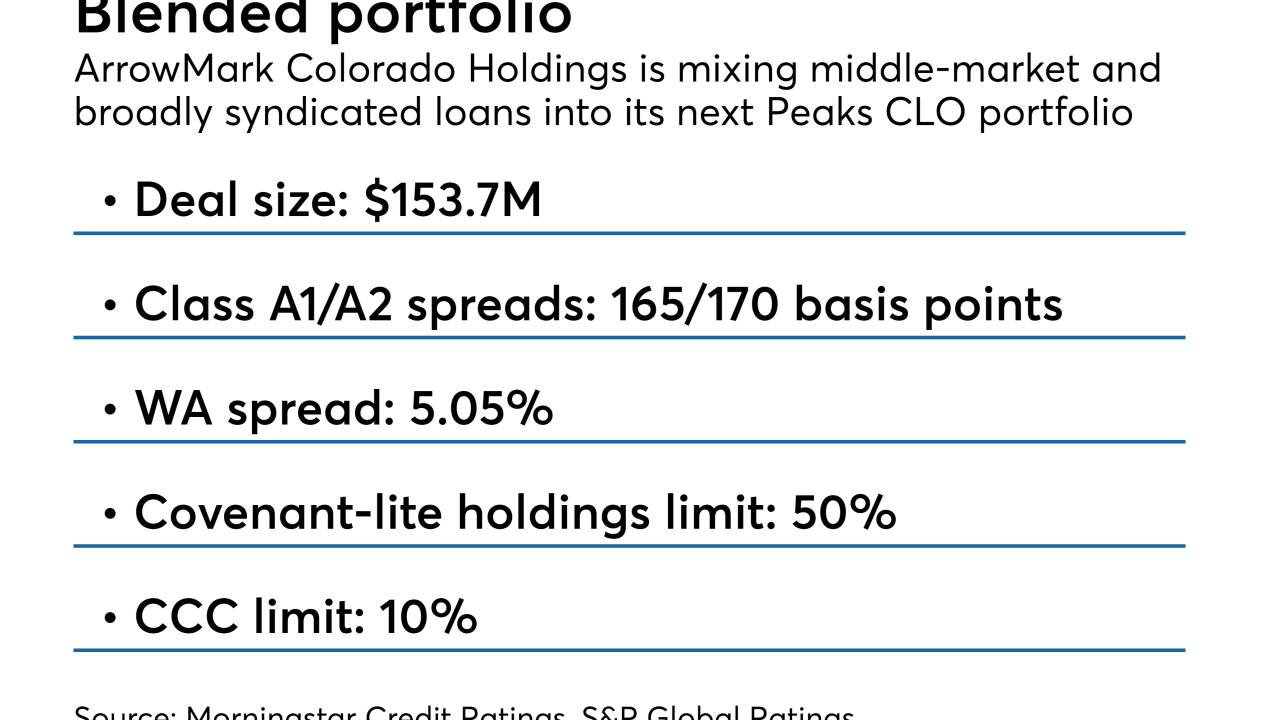

The $153.7 million Peaks CLO 3 also features a high ceiling for triple-C-rated loans and for "current-pay" loans that meet one or more criteria for default.

December 10 -

Both managers are pricing their 3rd CLOs of 2018; the 135 basis point spread on Zais' is among the widest this year for a deal backed by broadly syndicated loans.

November 27 -

Guggenheim joins GSO/Blackstone and Bain Capital as longtime CLO managers expanding into the SME space this year.

November 21 -

More collateralized loan obligations are failing weighted-average lift tests due to the dearth of available loans whose near-term maturities could provide some relief to portfolios.

November 20 -

Kroll assigned an AA+ to the Class A-1 tranche of EJF’s $351 million TruPS transaction, up two notches from AA- on the sponsor's prior transaction.

November 16 -

Eagle Point's CEO criticized "hyperbole" about growing risks in leveraged loans and CLOs, noting the benefits that price volatility can present to equity buyers.

November 15 -

The structured credit specialist will more than double its $2.9 billion in assets by acquiring a portfolio of three collateralized loan obligations that Trimaran Advisors runs from KCAP Financial.

November 12 -

According to presale reports, PGIM is marketing a $509.5 million Dryden 61 CLO transaction in the states, while also prepping a €411 million Dryden 66 Euro CLO portfolio.

November 6 -

The firm's risk profile has not altered, executives said on a third-quarter earnings call Wednesday; it remains "appropriately cautious."

November 1 -

The €411 million deal puts it in the small club of UK managers that have completed three or more transactions in 2018.

October 31 -

The New York-based firm is adding 4.9 years to the reinvestment period of the $518.6 million Neuberger Berman CLO XVIII.

October 30 -

The London-based manager is including two classes of fixed-rate notes, including a rare triple-A rated nonvariable-rate tranche, in its €412 million Contego VI DAC portfolio.

October 25 -

It seems a lot of CLO managers who were worried about competing amid heavy supply in the fourth quarter have put issuance on hold until 1Q 2019.

October 23 -

S&P also upgraded five more senior tranches of the deals citing paydowns, which in one CLO was accelerated by the diversion of interest from sub notes.

October 17