Another middle-market direct lender is turning to the CLO market to finance its loans to privately held small and medium-sized companies.

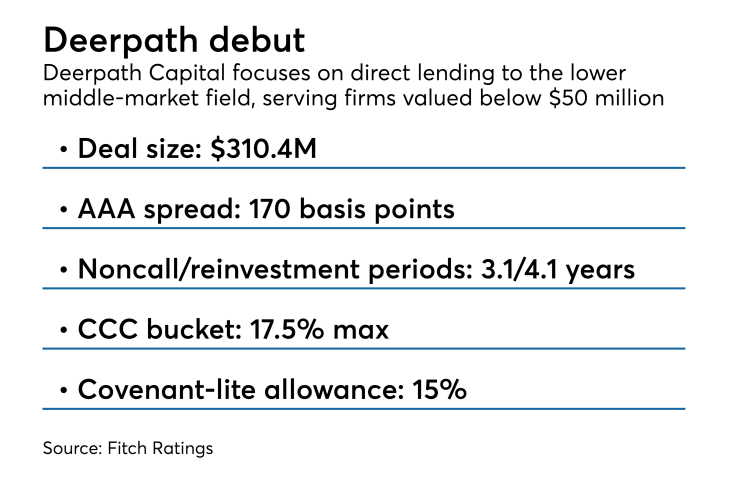

Deerpath Capital Management is sponsoring a first publicly rated million collateralized loan obligation, a $310 million deal backed by loans to firms valued at $50 million and below. It follows in the footsteps of several other direct lenders that have launched middle-market platforms this year, including

The $308 million Deerpath CLO 2018-1 will issue two tranches of Class A notes with preliminary triple A ratings from Fitch Ratings: $136 million in floating rate bonds expected to price at 170 basis points over three-month Libor, and a Class A-2 fixed-rate tranche that will carry a coupon of 4.52%. The 170 basis-point AAA spread compares to an average of 140 basis points in the last three months, and is the widest spread of the fourth quarter among middle-market CLO issuers, according to Fitch Ratings.

Deerpath, which was founded in 2007, has a exclusive middle-market focus on first-lien loans, which it funds through four investment vehicles, according to Fitch. The firm has $1 billion in assets under management; Fitch reports the company manages no other CLOs.

The company is under the control of its three founding principals including management committee chairman Gary Wendt, a former chair and chief executive of GE Capital and GE Credit.

Deerpath provides direct lending for private equity sponsorship of small and medium enterprise companies. Deerpath typically invests between $5 million and $40 million for companies with under $200 million in annual revenue, according to the company's website.

The Deerpath 2018-1 portfolio consists of 54 loans totaling $308 million. About 72% of the 53 middle-market obligors in the portfolio are rated either through public or private ratings or Fitch’s own credit opinion of the borrower.

Deerpath 2018-1 will have a large allowance for loans rated CCC and below: up to 17.5%, compared to the standard 7.5% in many open-market CLOs. But only 15% of the portfolio's loans may be held without maintenance covenants, and the bucket of second-lien of first-lien/last-out loans can account for a maximum of 5%.

The deal has a longer-than-normal noncall period of 3.1 years, nested within a 4.1-year reinvestment period.

The portfolio has a weighted average life covenant of eight years, which will gradually step down.

Deerpath is also retaining $59.3 million in preferred shares included in the transaction.