Z Capital Credit Partners has closed on a $350 million “opportunistically” positioned CLO that will be loading up on bargain, high-risk corporate loans.

In a release Tuesday, the credit fund management arm of the $2.3 billion asset Z Capital Partners disclosed that its new Z Capital Credit Partners 2018-1 portfolio includes an allowance for up to half its assets in triple-C loans – an extremely risky cross-section of leveraged loans that most open-market CLOs formally cap at no more than 7.5% of an asset pool.

Andrew C. Curtis, managing director for Z Credit Capital Partners, said in a statement the new CLO – the firm’s first publicly rated deal since 2015 – “is well-positioned to take advantage of current loan market volatility and future dislocations.”

"We think the transaction is a creative application of CLO structuring, which is suited to the late innings of the current credit cycle and consistent with our strategy of investing opportunistically."

James Zenni, Z Capital’s chief executive, said the firm’s track record in stressed/distressed loans is a “strong match with the investment flexibility of this vehicle," according to the release.

The executives declined further comment beyond the statements in the release.

The company’s announcement came a day after Moody’s Investors Service issued ratings on the deal’s seven classes of notes, ranging from Aaa to its Ba3 rating (the equivalent to BB).

Z Capital’s deal is the third deal since the early fall to feature a high triple-C rated asset limit. According to media reports, HPS Investment Partners and Ellington Management Group also have issued deals with the built-in flexibility to hold up to 50% in triple-C loans.

By raising the CCC ceiling, the deal adds cushion for a higher proportion of the large supply of lower-rated single B loans that are within one or two notches of the triple-C threshold.

At the standard 7.5% cap, many managers may be wary of acquiring and holding low single-B loans because enough downgrades could inadvertently trip the limit and trigger the portfolio’s ratings factor portfolio test, or force them to sell off loan interests that would price well below par in slow secondary market.

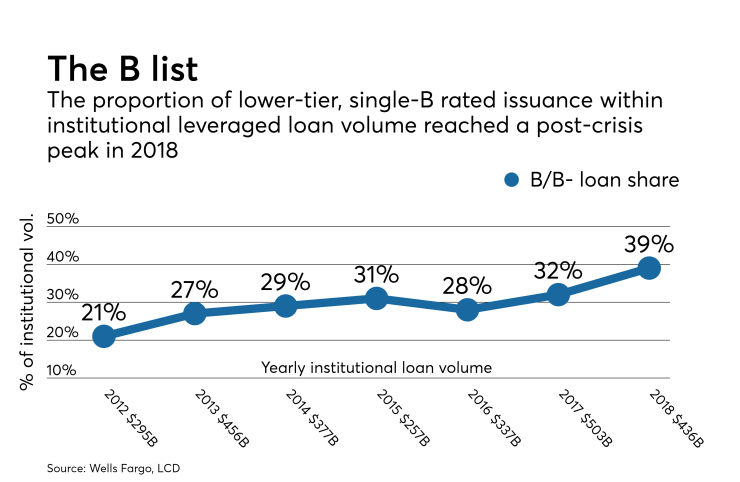

Single-B loans became a larger portion of the $1.3 trillion speculative-grade loan issuance market in 2018. In December, Moody’s noted that year-to-date loan issuance of single B’s was over 43% of year-to-date through November, compared to 37% in 2017.

Z Capital is paying up for the added risk, having priced the CLO’s $188.5 million triple-A notes at 156 basis points over three-month Libor on Nov. 29 – well wide of the average CLO AAA spread of 120 basis points that month, according to market data from Refinitiv.

Z Capital Credit Partners 2018-1 will have a four-year reinvestment period in which it will actively manage the portfolio, which is projected to have an eight-year weighted average life.

Amherst Pierpont was the placement agent.