-

The portfolio is one of several particularly large, recent deals related to the cash-flows from mortgage payments, but it has an unusual composition.

February 17 -

"The quality of our new business is high. The pricing of that business does not reflect the capital requirements of our regulatory rule," CEO Hugh Frater said.

February 15 -

However, leadership noted that 2021 was the second record year for new single-family mortgages and also discussed how the government sponsored-enterprise plans to further rebuild its capital.

February 10 -

In addition to hinting at a March rate hike, the central bank this week announced an intention to have Treasury securities make up a greater share of its holdings, which has implications for securitized home loans.

January 27 -

The change aims to streamline the processing of certain pandemic-related loan options that accommodate lower monthly payment amounts for borrowers with long-term economic hardships.

January 24 -

The researchers found that the disparities that emerged from the analysis of 1.8 million appraisals from 2019 and 2020 were statistically significant.

January 21 -

In a Senate confirmation hearing, the acting Federal Housing Finance Agency director echoed her predecessor’s view that restructuring of Fannie Mae and Freddie Mac should fall to Congress, and pointed to measures aimed at mitigating risk for the agencies.

January 13 -

The Duty-to-Serve goals currently under review drew some objections from a coalition of affordable housing groups last year.

January 6 -

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

January 3 -

The Alabama bank is buying Clearsight Advisors to add to its booming capital markets division.

December 17 -

Under the Federal Housing Finance Agency rule, the GSEs would need to lay out how levels will change under a variety of stress tests, including required ratios separately proposed for amendment.

December 16 -

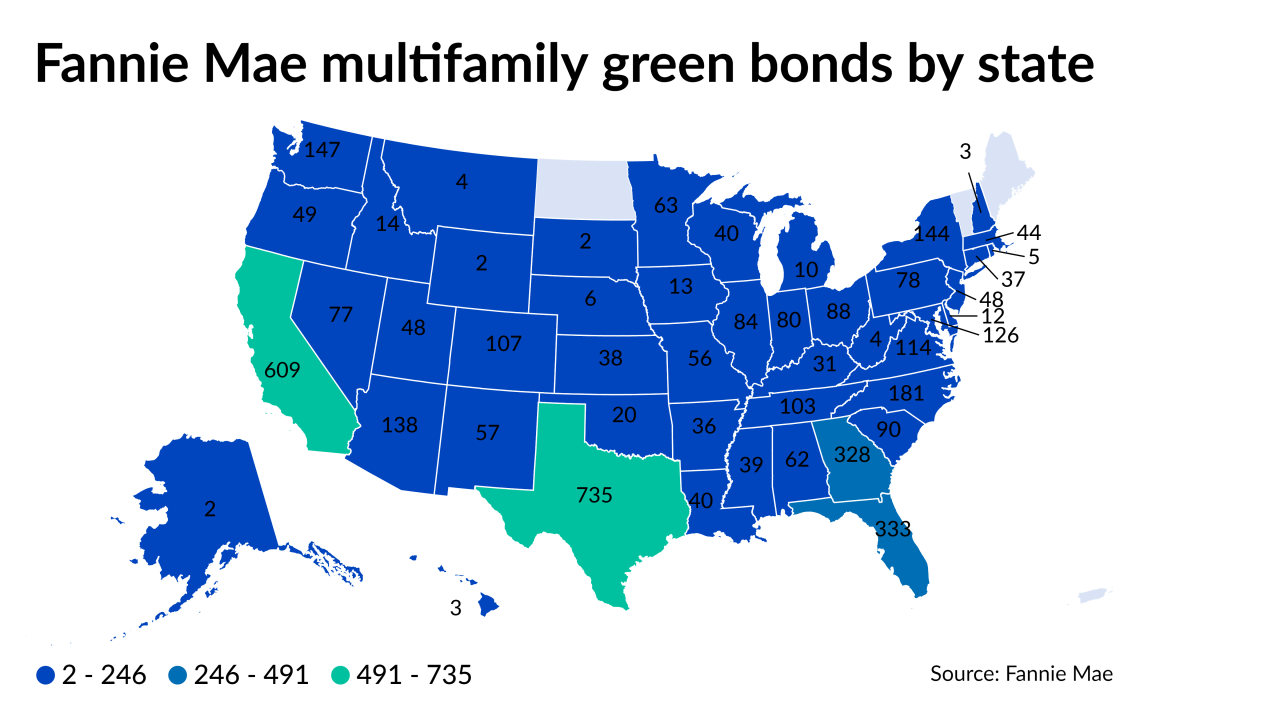

New securitizations of mortgages on energy-efficient rental housing totalled $12.7 billion during the first 11 months of this year, suggesting 2021’s total will come close to matching 2020’s $13 billion.

December 8 -

Acting Federal Housing Finance Agency Director Sandra Thompson and the Housing Policy Council say the new amounts are not good for affordable housing.

November 30 -

However, capacity issues, the suspension of the government-sponsored enterprise purchase caps and higher conforming limits all could affect activity, KBRA said.

November 22 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

The company also locked a record $4.7 billion in jumbo loans and significantly increased its business purpose lending from a year ago as its revenue mix shifted toward its taxable subsidiary.

October 28 -

Button Finance intends to use the capital to develop its underwriting platform and increase hiring.

October 25 -

The reception in the market to structured single-family CRTs' return at the government-sponsored enterprise was strong enough for it to plan to follow up this transaction with another one next month.

October 20 -

The problem loans mature right around when tenants in the offices are due to renew — or end — their leases. That may unsettle investors in commercial mortgage-backed securities, analysts at Moody’s Analytics warned this week.

October 14