-

From product-specific variations in refinancing rates to pockets of depreciation in an otherwise healthy market, here are some details in housing-related data that highlight important underlying trends in the mortgage business.

November 27 -

The former head of the Office of Federal Housing Enterprise Oversight explains why he thinks the mortgage industry is closer than ever to having a truly paperless process, and weighs in on GSE reform.

November 22 -

The dollar volume of mortgages guaranteed by the Department of Veterans Affairs rose nearly 9% in the past fiscal year as interest-rate reduction refinancing loans surged nearly 75%.

November 11 -

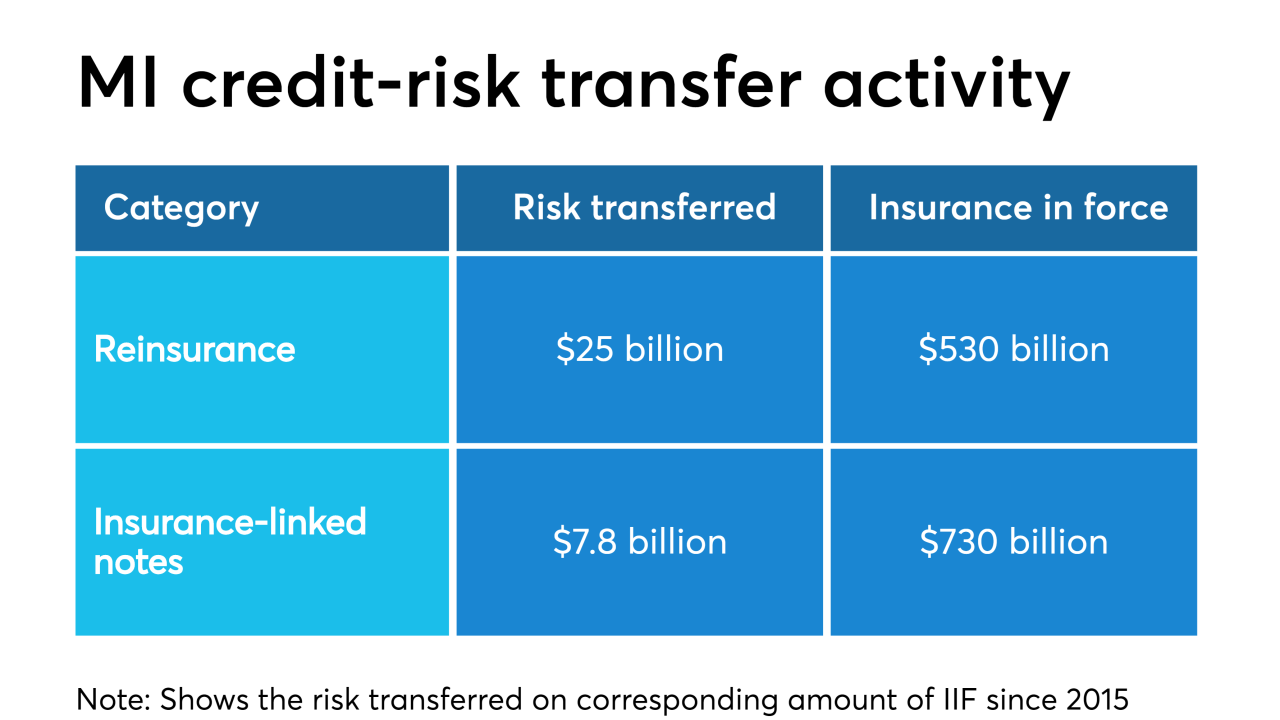

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

When it comes to possible new competitors in the secondary market, the heads of the two current outlets more than welcomed the possibility of additional players in their space because of housing finance reform.

October 28 -

Ginnie Mae is looking for input on its proposed guidelines for electronic promissory notes and other mortgage documents that it plans to test through a digital collateral pilot.

October 28 -

The end of the qualified mortgage patch should further accelerate non-QM origination growth, but is the mortgage industry ready?

October 8 -

The agencies handed banks a significant victory when they finalized revisions to the Dodd-Frank proprietary trading ban, but officials also plan to re-propose changes to the “covered funds” section of the rule.

August 25 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

Lower rates will likely sustain higher levels of origination through at least the third quarter, but supply constraints and economic weakness could limit the purchase market's response in the long term.

August 15