-

The online lender, which raised $240 million, wants to take its artificial intelligence technology for evaluating borrowers to the next level and expand its partnerships with banks, its CEO says.

December 20 -

The $10 billion portfolio of what are described as high-quality private student loans will be serviced by Nelnet.

December 19 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 11-17

December 18 -

The agency's rule outlines steps collectors must take to inform consumers about an outstanding debt, and prohibits companies from pursuing lawsuits after a statute of limitations has ended.

December 18 -

With infection rates rising and unemployment claims increasing since Thanksgiving, mortgages in coronavirus-related forbearance rose by 37,000 last week, according to Black Knight.

December 18 -

Investment firms and hedge funds are increasingly engineering bankruptcy loans and side deals to take control of Chapter 11 reorganizations from the outset, locking in rich rewards for themselves while potentially locking out rivals and lower-ranking creditors with little transparency. The trend is sure to speed up cases, but it also forces judges to make quick decisions that may shortchange some valid claims.

December 17 -

The percentage of seriously delinquent loans hit 5.8% in the third quarter, up from 1.5% a year earlier but down from 6.8% in the second quarter.

December 16 -

Promising vaccines may not reach the general public fast enough to save a number of struggling companies next year, and workout professionals and distressed investors are expecting smaller private companies will search for cash in 2021. They’re also anticipating that businesses of all sizes may struggle to adjust to changing consumer habits in a post-pandemic world.

December 16 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13 -

While 12,000 mortgages exited forbearance, the most borrowers entered forbearance protection in a week since early September, according to Black Knight.

December 11 -

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

December 11 -

The new revolving platform will allow the credit-card issuer to periodically assign new accounts into the existing collateral pool without having to establish a new trust for each issuance.

December 9 -

A program that lets firms bundle Small Business Administration loans is on hold while Congress spars over a new budget. The impasse is causing headaches for banks that rely on loan sales for fee income.

December 9 -

The automaker is reportedly planning to apply for a bank charter so it could collect deposits and grow its own auto-finance business. That could create more competition for Ally, which was spun off from GM in 2006 but remains a key lending partner.

December 9 -

The more-than-$550 billion market for bonds backed by U.S. commercial mortgages may face losses even after promising Covid-19 vaccines become widespread, as key parts of the real estate market may not return to full strength anytime soon.

December 8 -

A trial to get underway this week over one of the biggest banking errors in recent memory will be closely watched on Wall Street, and its outcome could have a significant impact on the industry.

December 7 -

The $310.47 million GLS Auto Receivables Issuer Trust 2020-4 collateralizes 13,316 loans with an average borrower FICO of 573. That is lower subprime territory, but is slightly higher than any of GLS’ most recent securitizations, according to a report from DBRS Morningstar.

December 3 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

The $175.9 million securitization of legacy trust-preferred securities issued by community banks prior to 2007 carries a double-A rating from Moody's.

November 23 -

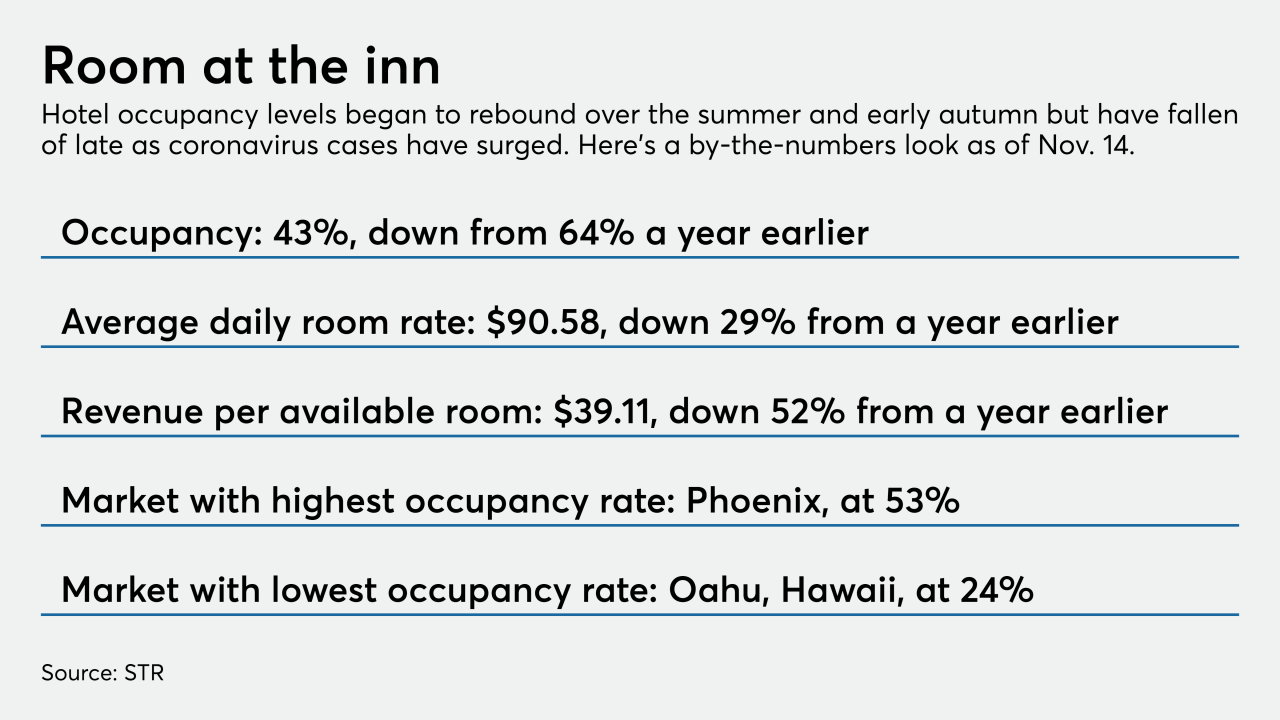

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23