-

The president-elect’s plan to eliminate $10,000 of debt would help borrowers meet other loan obligations, reducing their risk of default. Yet the banking industry seems wary of the precedent it could set.

December 11 -

The new revolving platform will allow the credit-card issuer to periodically assign new accounts into the existing collateral pool without having to establish a new trust for each issuance.

December 9 -

A program that lets firms bundle Small Business Administration loans is on hold while Congress spars over a new budget. The impasse is causing headaches for banks that rely on loan sales for fee income.

December 9 -

The automaker is reportedly planning to apply for a bank charter so it could collect deposits and grow its own auto-finance business. That could create more competition for Ally, which was spun off from GM in 2006 but remains a key lending partner.

December 9 -

The more-than-$550 billion market for bonds backed by U.S. commercial mortgages may face losses even after promising Covid-19 vaccines become widespread, as key parts of the real estate market may not return to full strength anytime soon.

December 8 -

A trial to get underway this week over one of the biggest banking errors in recent memory will be closely watched on Wall Street, and its outcome could have a significant impact on the industry.

December 7 -

The $310.47 million GLS Auto Receivables Issuer Trust 2020-4 collateralizes 13,316 loans with an average borrower FICO of 573. That is lower subprime territory, but is slightly higher than any of GLS’ most recent securitizations, according to a report from DBRS Morningstar.

December 3 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25 -

The $175.9 million securitization of legacy trust-preferred securities issued by community banks prior to 2007 carries a double-A rating from Moody's.

November 23 -

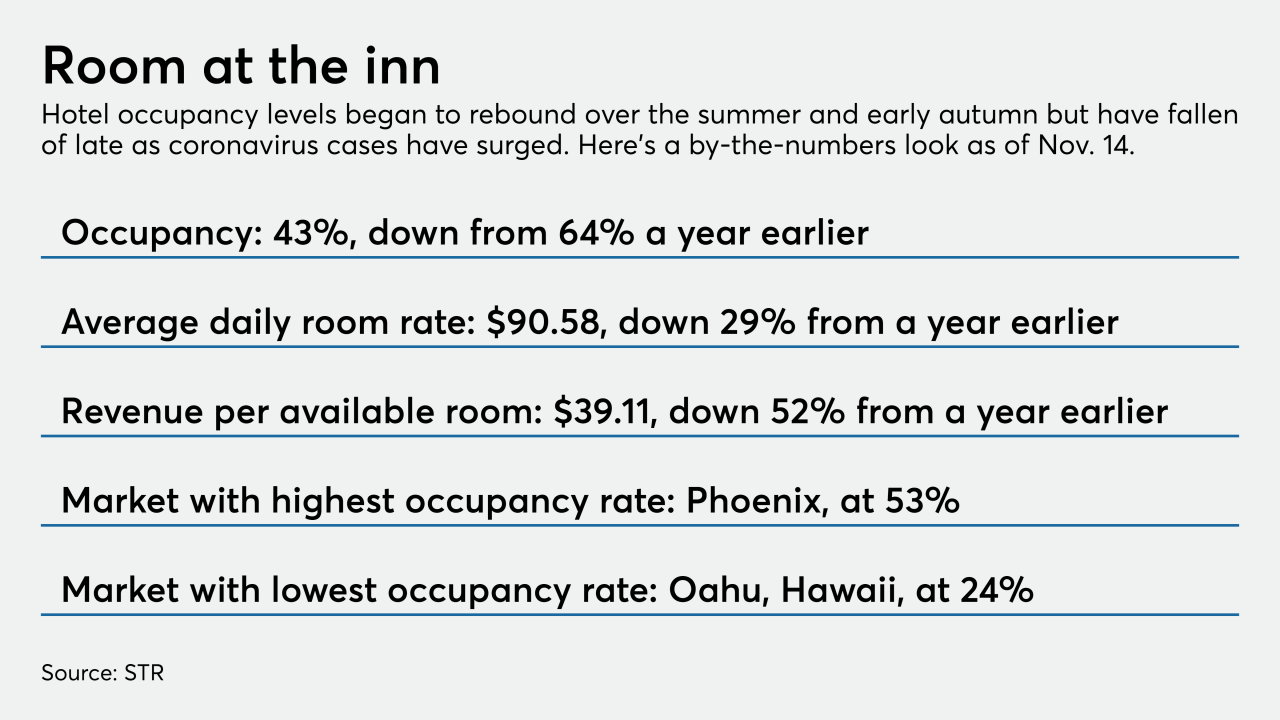

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

Mortgage delinquencies dropped to the lowest level since March but, particularly at the seriously delinquent level, they're still much higher than pre-coronavirus rates, according to Black Knight.

November 23 -

The move comes a day after the Federal Reserve had balked at the Treasury Department's demand that it return funds meant for pandemic relief that have so far gone unused.

November 20 -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

Auto-loan securitizations from AmeriCredit and Santander add to a briskly flowing 2020 subprime-deal pipeline, while Ford and JPMorgan are marketing notes backed by prime-loan receivables.

November 12 -

The overall mortgage delinquency rate improved in the third quarter as the economy got healthier while late-stage delinquencies hit a decade high, according to the Mortgage Bankers Association.

November 11 -

Demand trends were mixed in the third quarter, with consumers showing more willingness than businesses to take on new debt, according to the Fed’s most recent survey on bank lending practices.

November 9 -

While the overall rate fell in October, S&P noted a sharp rise in the proportion of loans overdue 60 days as many roll out of COVID-19 forbearance.

November 9 -

After issuance dampened during the presidential election week, corporate bonds and loans are expected to roll out amid a large trove of post-election earnings reports.

November 9 - LIBOR

The statement comes after multiple small and midsize institutions earlier this year warned the agencies that the secured overnight financing rate was ill-suited to them.

November 6