-

A slower-than-expected rollout of the COVID-19 vaccines and the threat of social unrest after the Jan. 6 riot at the U.S. Capitol could threaten the recovery, according to an American Bankers Association panel.

January 14 -

The online installment lender is the latest consumer-focused tech company to see its stock price soar on the first day of trading.

January 13 -

Commercial real estate portfolios have held up better than expected during the pandemic. But rising delinquencies and fears of a delayed economic recovery are renewing questions about credit quality.

January 12 -

The subprime auto lender, which specialized in post-bankrutpcy loans, has a greater share of direct-channel loans (typically refis) compared to its lone 2020 asset-backed offering.

January 11 -

The notes offering is the largest among the 21 auto-lease deals HCA has issued since 2011, and the fourth that has topped $1 billion in offered notes.

January 11 -

Distressed debt funds on average gained 11.4%, according to Hedge Fund Research Inc., compared to the riskiest corporate bonds rising 2.3%.

January 11 -

Fitch and Trepp reported that overall commercial mortgage-backed security delinquencies were down, while the MBA reported a slight increase.

January 8 -

The deal between San Francisco-based lender and Social Capital Hedosophia Holdings Corp. V is latest example of a closely held firm going public by merging with a special purpose acquisition company.

January 7 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 31-Jan.7

January 7 -

The largest U.S. shopping center became delinquent on its debt last year after its owner Triple Five Group began skipping mortgage payments, citing hardships from the COVID-19 pandemic.

January 6 -

A panel appointed by the Consumer Financial Protection Bureau said Congress should consider authorizing the bureau — and not the Office of the Comptroller of the Currency — to issue federal charters to fintech companies.

January 5 -

Seven states and the District of Columbia want to invalidate a new federal rule that threatens to hinder states’ power to cap interest rates on consumer loans.

January 5 -

While the balance of newly delinquent loans fell by 50% from November, the ratings agency warned that many borrowers will likely struggle to bring loans current under ongoing pandemic conditions.

January 5 -

The CFPB issued two rulemakings in 2020 that the financial services industry and consumer advocates hoped would finally clarify key issues over how collectors contact debtors and deal with legacy debts. But both sides want the incoming Biden administration to make further changes.

January 5 -

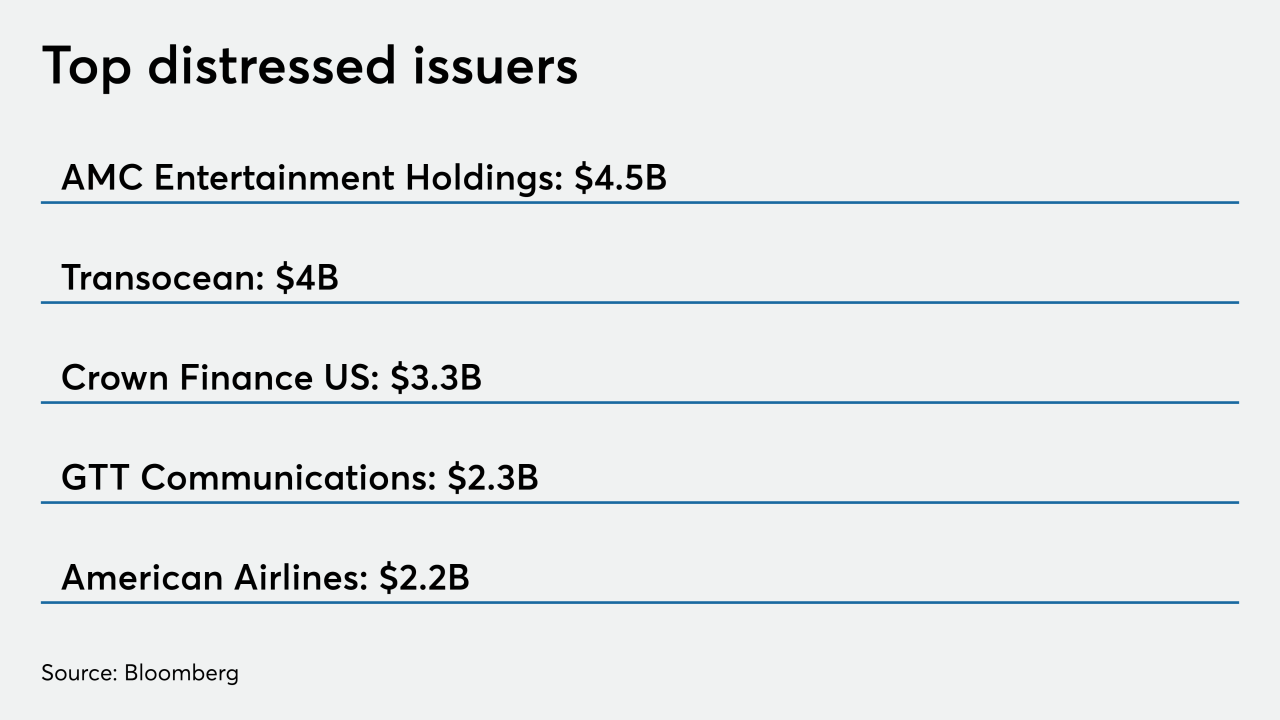

Energy, retail and consumer services companies led a total of 244 filings, according to data compiled by Bloomberg.

January 5 -

Reports indicate distressed owners would rather surrender their hotel or retail properties instead of negotiate workouts on delinquent loans as the pandemic spread carries on.

January 4 -

Bausch, formerly Valeant Pharmaceuticals, has paid down more than $24 billion of the $32 billion in leverage it owed five years ago from a debt-driven acquisition spree — which ended after a drug-pricing scandal.

January 4 -

With limited plan removals due to the holidays, mortgages in coronavirus-related forbearance rose by 15,000, according to Black Knight.

January 4 -

The agency cited improving used-car prices that have elevated resale values of off-lease vehicles that drivers are turning back into dealerships.

December 31 -

The buyout industry has about $3 trillion of unrealized value on its books, according to Preqin. And it’s tapping that to land loans for bolt-on deals, to refinance debt or bail out struggling companies in their portfolios.

December 31