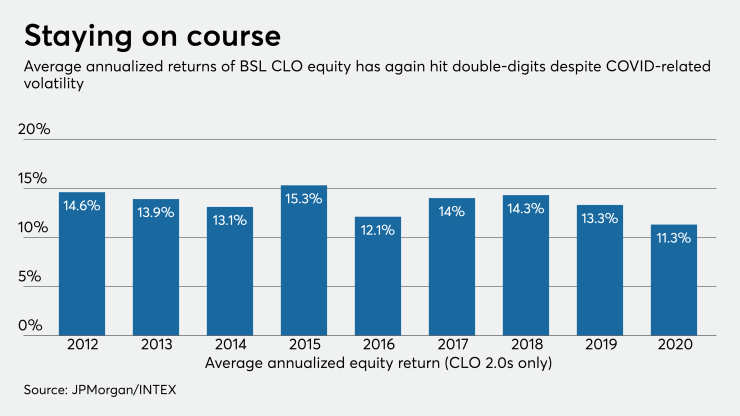

The performance of U.S. CLO equity made a “stunning rebuke” of doubters with a strong October that carried annualized returns into double digits for a 10thconsecutive year.

According to a newly published securitized research report from JPMorgan, the ownership stakes of collateralized loan obligations delivered an annualized cashflow return of 11.3% as of Oct. 28, and 95% of CLOs currently in a reinvestment period (in a JPMorgan sampling) made a payment to equity holders with no cashflow diversion to higher-priority debt securities in the capital stack.

“The performance is a stunning rebuke of negative views on CLOs” that had clouded the asset class earlier in the year, the report stated.

Of 107 U.S. CLO managers tracked by JPMorgan, the top quartile had an average equity return of 15.1%. And of those 27 managers 15 were also in the top quartile for long-term average annualized return (since the CLOs were issued).

In the months following the coronavirus outbreak, asset management firms with primary investments in U.S. CLO equity saw considerable deterioration in their books as expectations grew of mounting corporate bankruptcies - and

“US CLO equity prices were volatile this year dropping to post-crisis lows,” according to the report. “Performance varied by vintage in the recovery in recent months, with the 2020 vintage experiencing the fastest recovery.

JPMorgan analysts concede that the month-to-month volatility has taken its toll on investor faith, with prices that still “remain well below pre-COVID levels (negative performance will likely outweigh the cashflow return,” according to the report).

“But it is helpful to place CLO equity in broader context,” the report continued. “High return in fixed income is scarce.” JPMorgan noted only about 6% of the approximate $2 trillion loan and high-yield bond indices produce yields over 10%, and negative-yielding debt of $16.8 trillion is near the all-time peak of $17 trillion in August 2019.