-

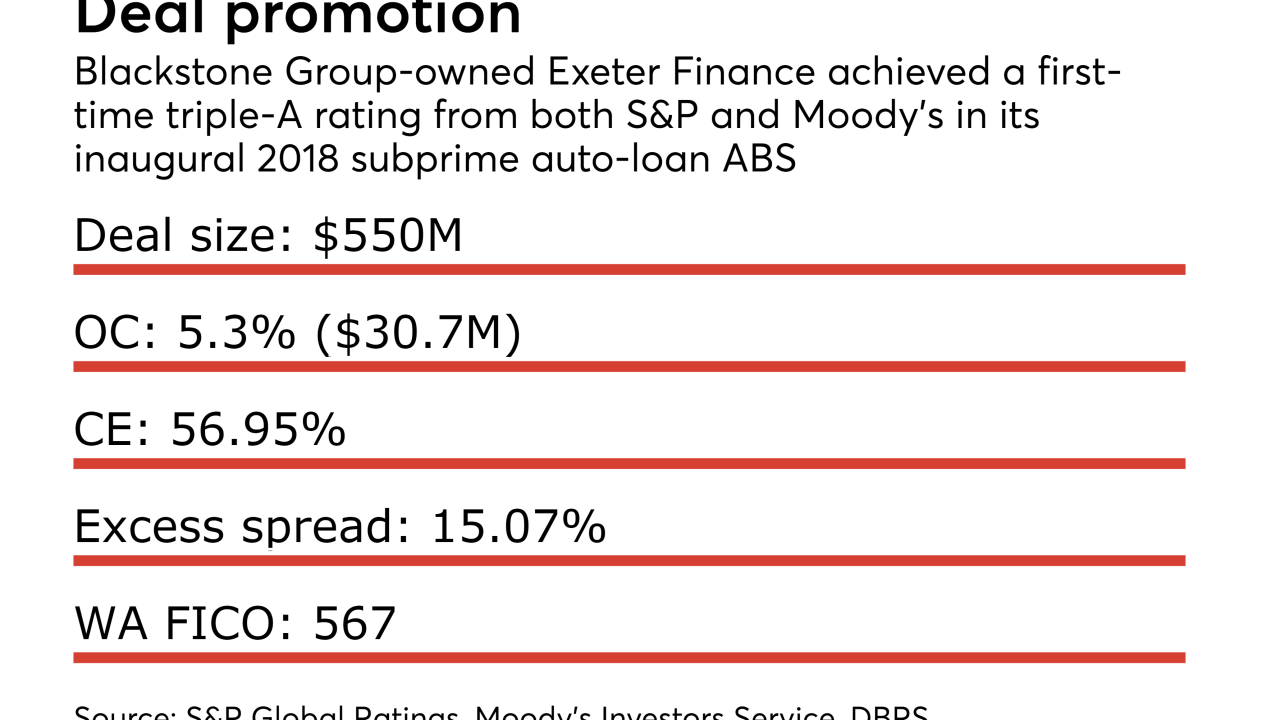

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

January 19 -

Hertz Vehicle Financing II LP, Series 2018-1, is a master trust, and the notes share collateral on a pari passu, or equal basis, with Hertz’ other outstanding series of notes.

January 15 -

The Dallas consumer lender plans to boost originations again after retooling and taking stock, even as other lenders scale back in the face of rising defaults and delinquencies.

January 8 -

Rather than jump right away into lending to car buyers, Access National will start by offering CRE and M&A financing to dealerships.

January 5 -

The first subprime auto ABS deal for 2018 is the 30th overall for Consumer Portfolio Services, with caters to deep subprime borrower pools.

January 5 -

Limiting the deductibility of interest to a percentage of a taxpayer's income will make securitization uneconomical for auto and equipment rental companies, the Structured Finance Industry Group says.

January 4 -

The $1.24 billion deal is the first GMCAR transaction to be rated by Fitch; it looks a lot like the three deals completed last year, with high FICOs, a high (but declining) concentration of long-term loans, and high concentration of trucks.

January 4 -

Electric vehicles are starting to show up in pools of collateral for auto leases, but it's harder to predict what they will be worth when they are repossessed or come off lease, says Moody's Investors Service.

December 26 -

Two proposals, limiting deductibility of interest and like-kind exchanges, would make securitization uneconomical for auto and equipment lessors, according to the industry trade group.

December 15 -

The German automaker continues to reduce its reliance on asset-backed financing as fallout from an emissions scandal fades.

December 7 -

Despite boosting credit enhancement, the sponsor was only able to earn an 'A' from S&P Global Ratings, which cited heightened competition and adverse borrower selection.

December 1 -

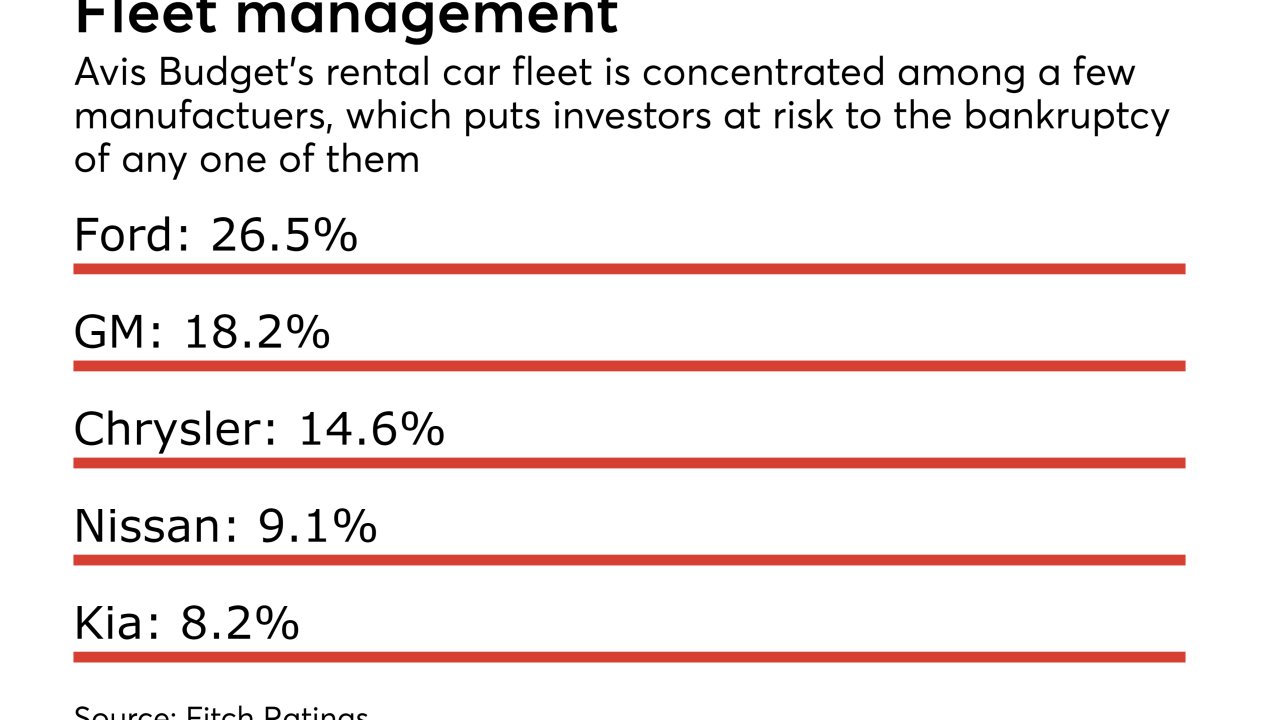

The issuer, Avis Budget Rental Car Funding, is a master trust, and the $400 million of notes to be issued in the Series 2017-2 transaction rank pari passu with the issuer’s other outstanding series of notes.

December 1 -

In its third securitization of cash-out auto loans, OneMain will for the first time include originations from the 1,000 legacy offices acquired from CitiFinancial.

November 30 -

Kroll expects cumulative net losses on the collateral for American Credit Acceptance 2017-4 to be as high as 29.9%; the senior notes have 66.35% initial credit enhancement.

November 29 -

The securitization market is weathering risk retention and rising interest rates, though Fitch Ratings is keeping its eye on some consumer asset classes as the credit cycle lengthens.

November 15 Fitch Ratings

Fitch Ratings -

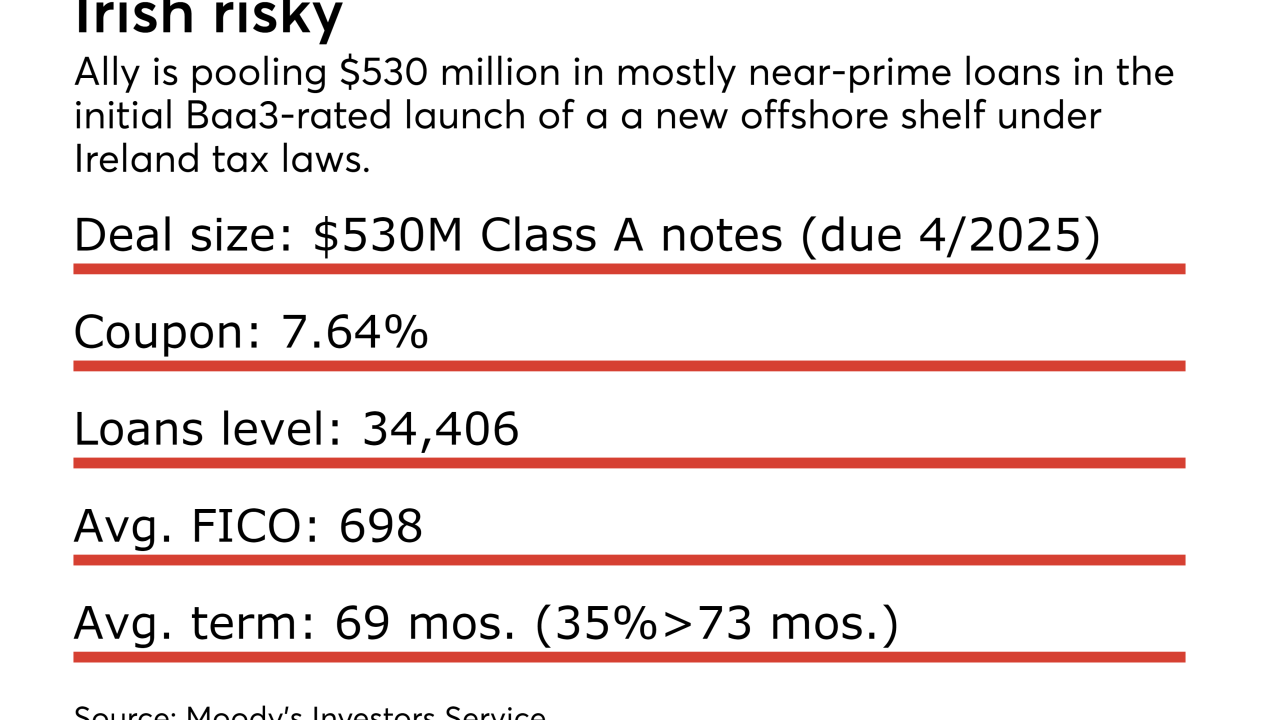

Juniper Receiveables DAC, a new offshore shelf for Ally U.S. auto-loan receivables, has received an early 'Baa3' rating from Moody's Investors Service on its initial $530 million issuance.

November 14 -

Nearly one-third of the vehicles in CIG Financial's $172 million transaction have mileage above 100,000; the highest-mileage car financed has 197,387.

November 13 -

That's only half as large as the lender's four previous deals, which ranged from $1.02 billion and $1.12 billion; company executives recently touted a shift toward more financing from deposits.

November 9 -

Over 80% of collateral for the $2 billion transaction consists of trucks, SUVs and crossovers; the deal is also the largest that the captive finance company has sponsored in the last three years.

November 9 -

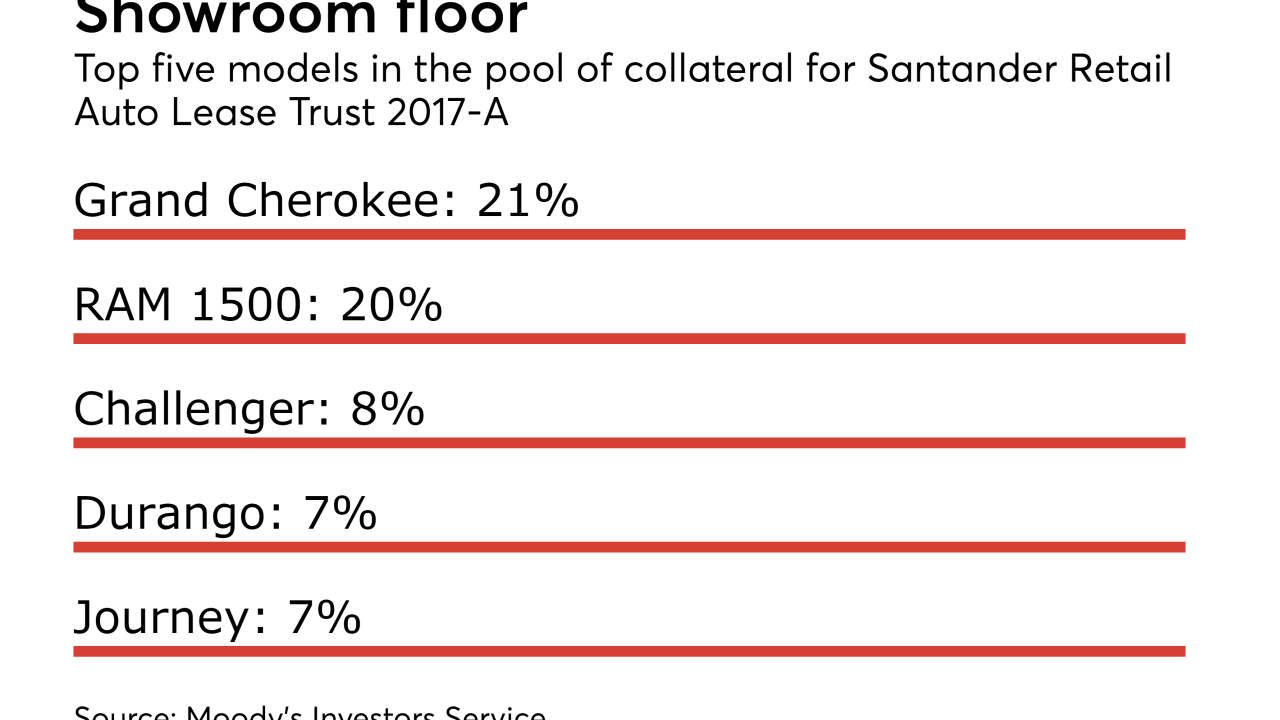

Unlike Santander’s existing retail auto loan platform, Santander Retail Auto Lease Trust 2017-A is backed by prime quality collateral. The leases were originated by its Chrysler Capital division, through dealers of Fiat Chrysler vehicles.

November 9