-

The performance of outstanding transactions issued via the Capital Auto Receivables Trust platform is weakening, so rating agencies are demanding additional investor protections.

March 8 -

Credit enhancement on the senior notes has risen to 36.25% from 28.7% to account for higher expected losses on the collateral; Kroll's base-case range is for 6.75% to 8.75% over the life of the deal.

March 8 -

DriveTime's improving loss performance in recent securitizations allowed it to relax the enhancement levels on its first securitization of the year.

March 2 -

The transaction is the second this year involving Santander's Chrysler Capital preferred-lender unit; in January Santander sold bonds on its first-ever deal backed by Fiat Chrysler leases.

March 1 -

Despite riskier terms, rising delinquencies and falling used car values, investors keep buying bonds backed by prime and subprime auto loans and leases.

February 28 -

Credit support on the senior tranche of the $800 million transaction is 19.25%, up 250 basis points on the comparable tranche of the sponsor's previous deal to offset the impact of falling used car prices.

February 27 -

It's deep and liquid, and spreads are tight. To many, a deal with a few idiosyncratic risks — not to mention cool factor — just offers a chance to pick up a little extra yield.

February 2 -

Over 94% of the collateral pool consists of diesel-engine vehicles, even though diesel cars have had waning interest among French drivers in the past decade.

February 1 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

The single-B rated company is facing a large cash requirement as it ramps up production of its Model 3; but leases backed by electric vehicles pose additional risks for investors in asset-backeds.

January 26 -

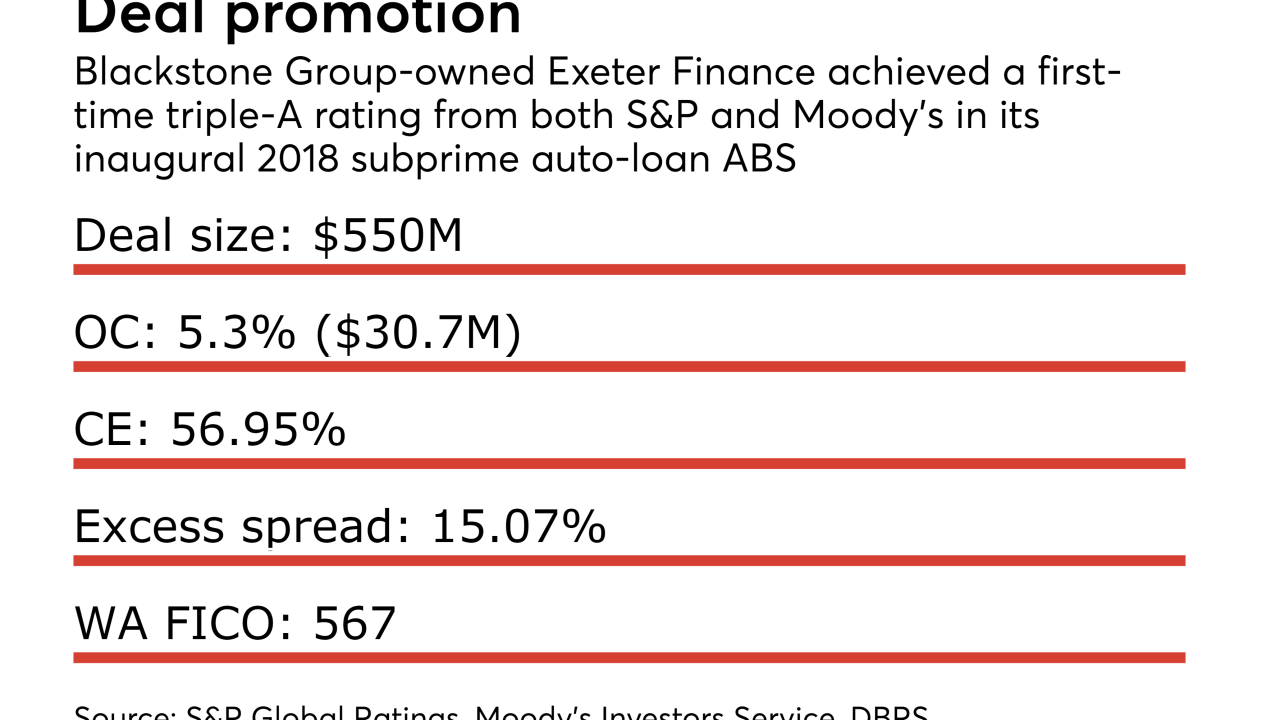

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

January 19 -

Hertz Vehicle Financing II LP, Series 2018-1, is a master trust, and the notes share collateral on a pari passu, or equal basis, with Hertz’ other outstanding series of notes.

January 15 -

The Dallas consumer lender plans to boost originations again after retooling and taking stock, even as other lenders scale back in the face of rising defaults and delinquencies.

January 8 -

Rather than jump right away into lending to car buyers, Access National will start by offering CRE and M&A financing to dealerships.

January 5 -

The first subprime auto ABS deal for 2018 is the 30th overall for Consumer Portfolio Services, with caters to deep subprime borrower pools.

January 5 -

Limiting the deductibility of interest to a percentage of a taxpayer's income will make securitization uneconomical for auto and equipment rental companies, the Structured Finance Industry Group says.

January 4 -

The $1.24 billion deal is the first GMCAR transaction to be rated by Fitch; it looks a lot like the three deals completed last year, with high FICOs, a high (but declining) concentration of long-term loans, and high concentration of trucks.

January 4 -

Electric vehicles are starting to show up in pools of collateral for auto leases, but it's harder to predict what they will be worth when they are repossessed or come off lease, says Moody's Investors Service.

December 26 -

Two proposals, limiting deductibility of interest and like-kind exchanges, would make securitization uneconomical for auto and equipment lessors, according to the industry trade group.

December 15 -

The German automaker continues to reduce its reliance on asset-backed financing as fallout from an emissions scandal fades.

December 7