World Omni Financial is upping the credit quality of receivables in its latest offering of $660.68 million in notes backed by prime auto loans for Toyota vehicles.

The deal, World Omni Receivables Trust 2017-B, features four senior class-A tranches, including a $118 million unrated money market tranche and three term tranches rated triple-A by Fitch Ratings and Standard & Poor’s. There is also an $11.65 million subordinated tranche rated double-A maturing in 2024.

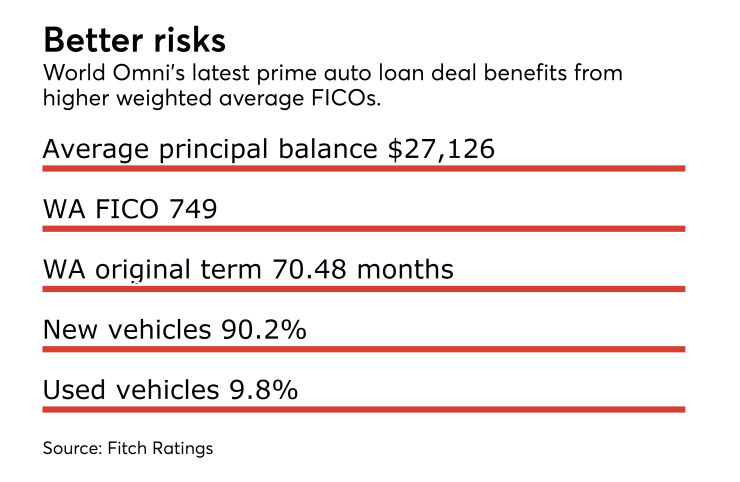

Fitch Ratings expects net losses to reach 1.45% over the life of the deal, down from prior deals, thanks to the introduction of a selection criteria that stipulates a minimum FICO score of 650.

The improved credit quality of the collateral for this deal allowed World Omni to achieve the same credit ratings as recent transactions despite lowering the credit enhancement for both the senior and subordinate notes. The senior notes benefit from 2.75% credit enhancement, down 245 basis points from the sponsor’s previous two securitizations. The subordinate notes have 1% credit enhancement, down 1.5% from the prior deal.

This is the first World Omni securitization to require a minimum FICO score, set at 650. As a result, the average credit score of borrowers in the pool increased to 749 from 724 in the prior deal. Borrowers with credit scores over 700 comprise 74% of the total pool, compared with 61% in the earlier offering.

Just over 50% of obligors with loans in the pool are located in Florida. While World Omni specializes in business in the Southeast US, this is the second highest single-state concentration in the company’s securitization history. Fitch noted that this large concentration of Florida borrowers exposes the pool to risk from rolling recessions and regional economic downturns.

The transaction also features the largest concentration of long-term loans in a World Omni securitization with just under 85% of the loans scheduled to mature after a period of 60 months or greater. Historically, extended-term loans have produced higher losses since borrowers end up owing more than a vehicle’s value as it depreciates over time. According to Fitch, the increase in term length can be partially attributed to new subvention programs offered by Toyota.

World Omni Financial offers auto loans and leases for Toyota and Scion vehicles to retail customers in Florida, Georgia, Alabama, and the Carolinas. It is a subsidiary of JM Family Enterprises, which offers a full range of automotive-related distribution and financial services to Toyota and Scion dealerships in the five-state region.