-

The CEO of the Hauppauge, New York credit union is one of American Banker's 2024 Innovators of the Year.

June 21 -

Rep. Andy Barr, R-Ky., is introducing a bill to establish an Office of Supervisory Appeals at each of the banking regulators that would give banks more power over the appeals process.

May 7 -

Congressional Review Act resolutions are ramping up ahead of the 2024 election cycle. Experts say that, although none are likely to become law, the resolutions are still powerful messaging and political tools.

April 24 -

Institutions and their investors are facing pressure from climate activists, cautiously awaiting interest rate cuts and adjusting to new Federal Reserve and FDIC policies.

April 23 -

The House Financial Services Committee also sent to the full House two bipartisan bills, including one that would prevent large banks from opting out of having to recognize Accumulated Other Comprehensive Income in regulatory capital.

April 18 -

The Federal Home Loan Bank System stepped up advances by 37% or more to Silicon Valley, Signature and First Republic banks ahead of their failures, the GAO says in a post-mortem on last year's banking crisis. The findings add to the debate about whether the system should be a lender of last resort.

April 16 -

-

Mortgage rates rose this week as investors priced stronger than expected inflation and jobs affecting Fed moves into the 10-year Treasury.

April 11 -

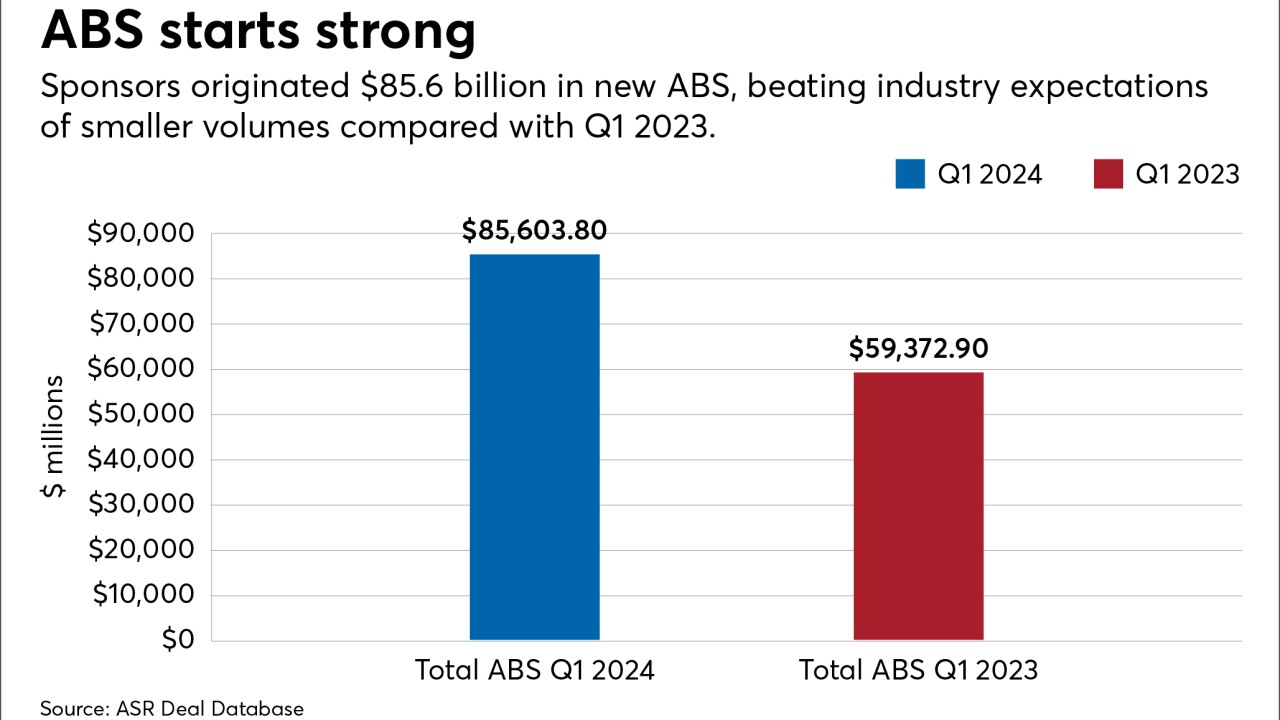

New originations exceeded last year's tally by 30.5%, despite concerns about how rates might impact consumer financial strength. Auto ABS production revved up overall performance.

April 9 -

Mortgage lenders offered more cash-out refinance programs at a time when consumers might be coming to terms with the rate environment.

April 9 -

Bank mergers and acquisitions have slowed in recent years amid recession fears and other economic uncertainties. But bank consolidation is a century-old trend that's expected to rev up again as early as this year due to higher costs, tougher regulation and fierce competition.

March 15 -

Larger banks are responsible for a special assessment to cover the costs of the failures of Silicon Valley Bank and Signature Bank. The price tag has ballooned by $4.1 billion, and trade groups are criticizing the FDIC's process, arguing that it lacks transparency.

March 13 -

The community development financial institution was the nation's top non-qualified mortgage lender last year, according to one ranking.

March 13 -

Sen. Bill Hagerty, R-Tenn., and Sen. Elizabeth Warren, D-Mass., sent separate letters to banking regulators on the anniversary of the failure of Silicon Valley Bank, with Hagerty questioning the Federal Deposit Insurance Corp.'s sale of Signature Bank's assets and Warren urging the regulators to tighten capital and liquidity requirements.

March 11 -

The head of the U.S. Department of Housing and Urban Development under the Biden Administration said she will transition from public life starting March 22.

March 11 -

Regulatory reform – rather than Biden's proposed solutions – is needed to fix the inventory crisis, some say, but others applauded the president's buyer cost-cutting initiatives.

March 8 -

The letter, which was sent to bank regulators, represents a further escalation of lawmaker criticism of the Basel III endgame proposal, and comes just as Federal Reserve Chairman Jerome Powell is set to testify in the House Financial Services Committee.

March 6 -

With tougher capital requirements looming, a number of regionals including U.S. Bancorp, Huntington and Santander are using these new instruments to share risk with nonbank investors and lighten their capital load. Experts point out the pros and cons.

February 1 -

Bank regulators Friday said the existing laws governing safety and soundness and fair lending are adequate to address risks posed by artificial intelligence, noting that while AI may be used to inform lending decisions, banks are ultimately responsible for compliance.

January 19 -

Left-leaning shareholder groups are asking JPMorgan Chase, Goldman Sachs and other large asset managers to explain a recent decline in their support for certain environmental and social policies at public companies.

December 18