-

Many of the prime jumbo loans backing the transaction, JP Morgan 2017-4, were contributed by originators with limited history in that product, according to DBRS.

October 18 -

The transaction, Bellemeade Re 2017-2, appears to be similar to programs that Fannie and Freddie use to offload the risk of losses on residential mortgages they insure to capital markets investors.

October 17 -

A report released Friday calls risk retention "an imprecise mechanism" for encouraging the alignment of interest between sponsors and investors. It recommends creating loan-specific requirements under which managers would receive relief.

October 6 -

Belmont Green Finance, which began originating loans in late 2016, has gathered up its first round of originations through 3Q2017 in a transaction that will issue up to £230.6 million in notes.

October 6 -

Select Portfolio Servicing grew its mortgage servicing rights portfolio by over 14% in the second quarter by targeting opportunities in the nonagency loan market.

October 5 -

Ocwen Financial Corp. received more breathing room on the legal front as the Securities and Exchange Commission is not pursuing an enforcement action against the company regarding its debt collection practices.

October 4 -

The REIT has previously issued unrated bonds backed by loans that were once delinquent but are now making timely payments. It has also completed five offerings of bonds backed by prime jumbo loans between 2008 and 2012.

October 1 -

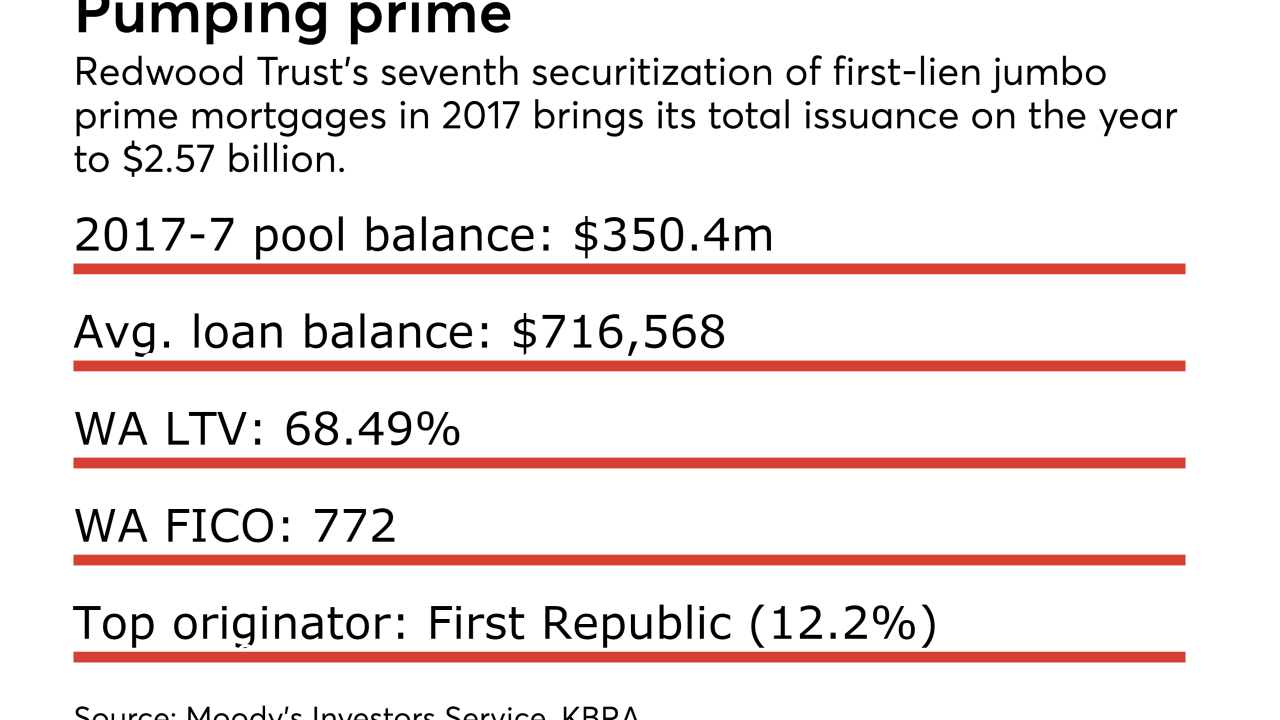

The deal is the real estate investment trust's seventh of 2017; the collateral was contributed by 135 originators, including Quicken Loans and First Republic Bank.

September 28 -

Nearly half of the properties are in New York (30.3%), New Jersey (10.4%) or Florida (8.7%), states that require a court to sign off on a foreclosure, a lengthy process that could affect the timing of payments.

September 26 -

Regulatory relief remains uncertain, but there's plenty to celebrate as some more esoteric asset classes, such as franchise fees and aircraft leases, move into the mainstream, while others, such as nonprime RMBS, are starting to revive.

September 21