JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

May 14 -

To help pull off the biggest media deal of the year, JPMorgan Chase embraced a Wall Street practice that fell out of favor after the financial crisis.

May 10 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

Urfer co-founded a business with the banking automation pioneer John Diebold, worked for Chase Manhattan and other major banks, and played an important role in the Nixon administration, phasing out exchange controls.

April 12 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

The upstart lenders have been chipping away at credit cards’ consumer-lending dominance by offering fixed-rate loans with predictable repayment plans. Now the card giants are fighting back.

March 8 -

The foray into digital consumer lending follows a similar move by rival Citigroup.

February 26 -

The Renaissance and Grand Hyatt Seattle, both sponsored by R.C. Hedreen, account for 14.2% of the assets in the $774.1 million JPMCC 2018-COR4.

February 11 -

Automating the loan application process is a potentially game-changing development that could put more car shoppers in control of which bank or credit union finances their purchase.

January 7 -

Cracks may be visible in U.S. leveraged loans, but investor concerns about credit are "somewhat overblown," according to JPMorgan Chase.

November 26 -

JPMorgan is securitizing a $180 million, two-year commercial mortgage backed by a leasehold interest on the 24-story building in a single-asset transaction.

November 26 -

The New York-based online lender plans to spend an additional $15 million next year, largely on bank partnerships and international expansion.

November 6 -

ODX will pursue deals with banks that want to use the New York lender’s technology to offer online small-business loans.

October 16 -

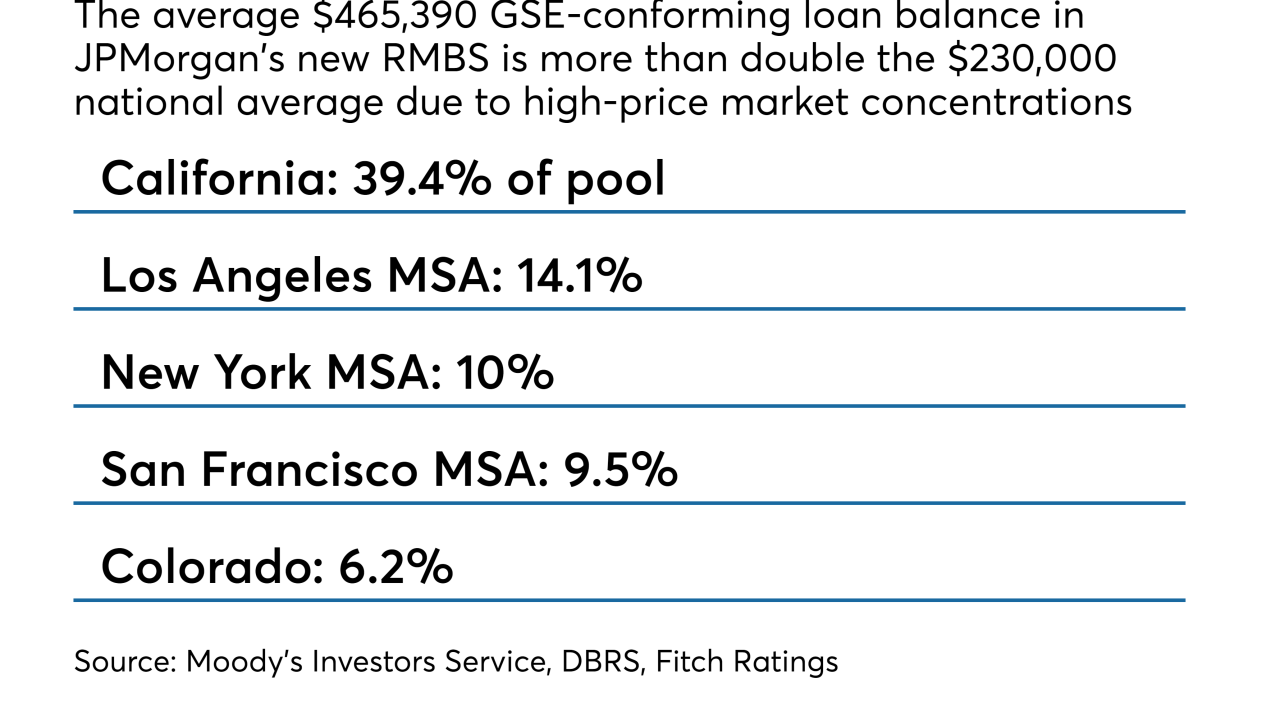

Nearly half the loans were derived outside J.P. Morgan's retail channel, a level not seen in its conforming and prime jumbo securitizations since 2017.

August 15 -

If President Trump’s tariffs on steel and other products stay in place long, big U.S. importers would be hurt and pass on the pain to their midsize and small-business suppliers — which are the bread and butter of commercial lending.

August 3 -

Bank of America’s consumer loans grew a lot. But its rivals? Not so much. The mixed results raise questions about whether BofA’s performance is a leading or trailing indicator, and if credit quality is going to be more of a problem industrywide.

July 16 -

JPMorgan Chase has largely sat on the sidelines of Federal Housing Administration lending due to compliance concerns. But recent regulatory relief efforts have Chase Home Mortgage CEO Mike Weinbach eyeing an opportunity to jump back in.

May 21 -

JPMorgan Chase is sending signals that its homegrown blockchain, Quorum, is alive and well despite a recent shake-up.

April 23 -

The agreement marks the latest example of the banking giant teaming with a fintech to speed up delivery of services to its customers.

January 11 -

Former top commercial mortgage-backed securities strategist Trevor Murray accused the Swiss lender of illegally firing him in 2012 for blowing the whistle on attempts by traders to influence his research reports.

December 22