-

The loans are secured by single-family residential properties, townhouses, planned-unit developments, condominiums, and two- to four-family residential properties.

July 10 -

The portfolio has high credit quality loans and geographic concentration.

July 8 -

The WA original term is about 68 months for all three pools. That is shorter than the term on the previous series, but within the range of terms on recent deals.

May 16 -

The market for estate loans packaged into debt slowed dramatically after the Federal Reserve sharply raised interest rates in 2022.

May 14 -

Yields, are expected to come in ranging from 4.4% on the class A notes, to 4.5% on the class A4 notes.

April 28 -

Cross 2025-H3 has moderate leverage, according to KBRA, with a weighted average (WA) loan-to-value ratio of 72.3%, and a debt-to-income ratio of 33.5%.

April 14 -

Borrowers' high incomes and the abundance of monthly free cash flow speed up repayments and mitigate the transaction's exposure to economic downturns.

March 28 -

The current pool has smaller exposures to the construction and turf sectors compared to the 2024-2 series, which have seen higher loss rates than the agriculture sector.

February 21 -

All the class A notes benefit from total initial hard credit enhancement totaling 21.0% of the pool balance. Classes B, C and D benefit from 17.0%, 11.5% and 6.5%, respectively.

February 6 -

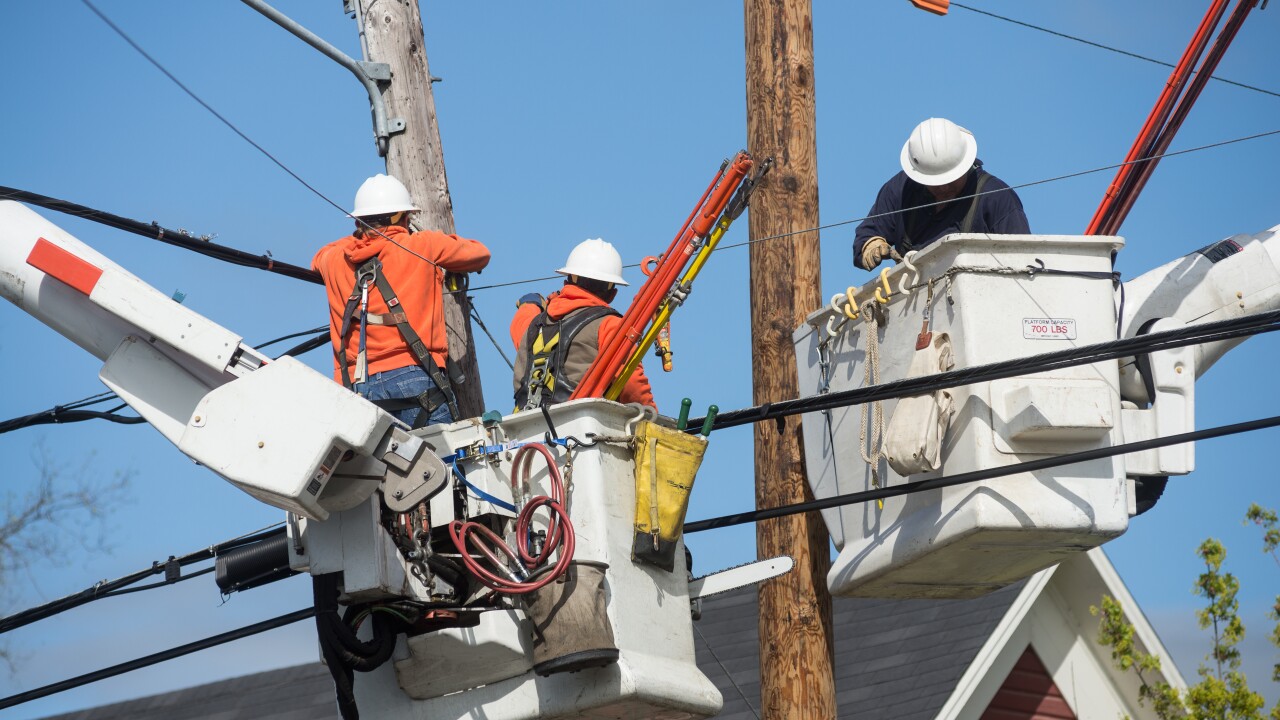

Residential customers made up 70.1% of NYSEG's sales revenue, while commercial and industrial customers account for the other 30% of sales. The latter is a relatively high exposure for such deals.

February 4