Federal Reserve

Federal Reserve

-

The bond market faces a bigger threat than recent rate hikes: the notion that rates will stay elevated even after the U.S. central bank's inflation fight is all over.

February 21 -

In a speech on the central bank's regulatory agenda for the year, Federal Reserve Board Gov. Michelle Bowman said the merger-and-acquisition review process could benefit from added transparency.

February 13 -

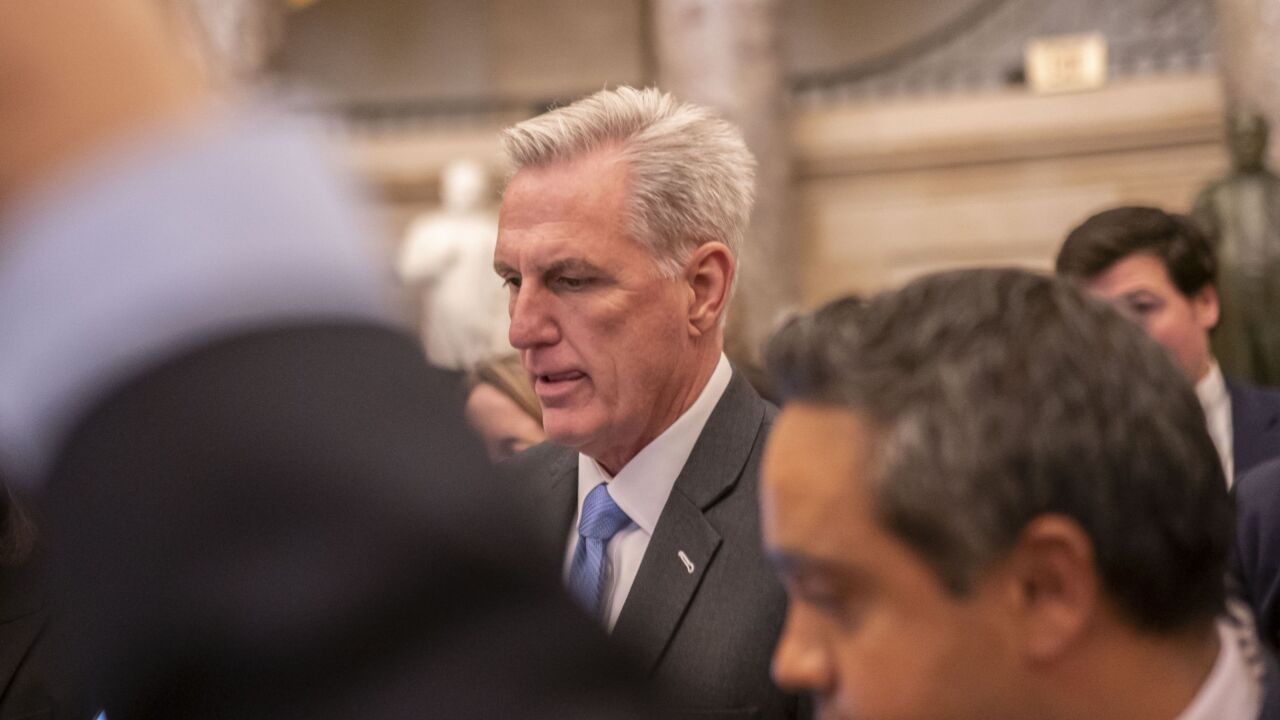

The duo's interactions over the next several months will have a significant impact on the economy and, by extension, their political futures.

February 2 -

The Federal Reserve Chair urged Congress to raise the debt ceiling, warning the impacts of not doing so could go beyond the central bank's ability to mitigate.

February 1 -

The Federal Open Market Committee is expected to raise rates by 25 bps at the conclusion of its meeting Wednesday, bringing its benchmark to a target range of 4.5% to 4.75%.

February 1 -

The current president, Esther George, is set to leave office on Jan. 31. The reserve bank's search committee has no deadline for finding a full-time successor.

January 30 -

Repo markets and the bank deposit business, in particular, would be upended if the U.S. were to default on its debt, experts say.

January 27 -

Speaking at an event hosted by the Council on Foreign Relations, Federal Reserve Gov. Christopher Waller said the Federal Reserve has a long runway for its balance sheet reduction.

January 20 -

In a speech delivered Thursday afternoon, the Federal Reserve's vice chair said she does not see a wage-price spiral driving inflation, but rather a "price-price spiral."

January 19 -

In remarks delivered at a central banking symposium, Federal Reserve Chair Jerome Powell called for changes to money market funds and the Treasury market.

January 10 -

Esther George, the president of the Federal Reserve Bank of Kansas City, is retiring later this month. What's taking the bank so long to find a successor?

January 9 -

The Federal Reserve raised its benchmark interest rate by half a percent this week, but chair Jerome Powell said the question now is how long to keep monetary policy tight.

December 14 -

Federal Reserve Vice Chair for Supervision Michael Barr said his "holistic" review of capital standards is still underway, but noted the benefits of stronger requirements in a speech Thursday.

December 1 -

John Williams, the president of the Federal Reserve Bank of New York, praised the Fed's new guidelines for granting fintechs and other nonbanks access to the payment system. He also echoed calls for new rules to govern stablecoins and cryptocurrencies.

November 28 -

There's no convincing evidence that central banks' purchases of trillions of dollars of bonds and other financial assets helped any economy.

November 22 -

The Federal Reserve's semiannual financial stability report said the threat of continued high prices and the Fed's response to them are top threats for banks and other market participants.

November 4 -

Legal experts are gaming out the various options for the CFPB after a three-judge panel of the U.S. Court of Appeals for the 5th Circuit ruled on Oct. 19 that the bureau's funding is unconstitutional.

November 1 -

Ahead of this week's Federal Open Market Committee meeting, where it is expected to enact another large rate hike, 11 lawmakers sent a letter to the central bank, urging it not to go too far.

November 1 -

Almost two-thirds of banking executives believe the U.S. will see its highest interest rates this cycle in the first half of next year. And close to 60% of executives said they are concerned the Federal Reserve is hiking rates too quickly.

October 18 -

Interest rate increases by central banks have compounding effects and could exacerbate weaknesses in the global financial system, Federal Reserve Vice Chair Lael Brainard argued in a speech Friday.

September 30