Wells Fargo has tightened up a few credit characteristics in its latest offering of $826 million in commercial mortgage-backed securities (CMBS) notes through the Wells Fargo Commercial Mortgage (WFCM) 2021-C59. The pool has just one loan that received an investment-grade credit opinion and pulls back on concentration of full interest-only loans.

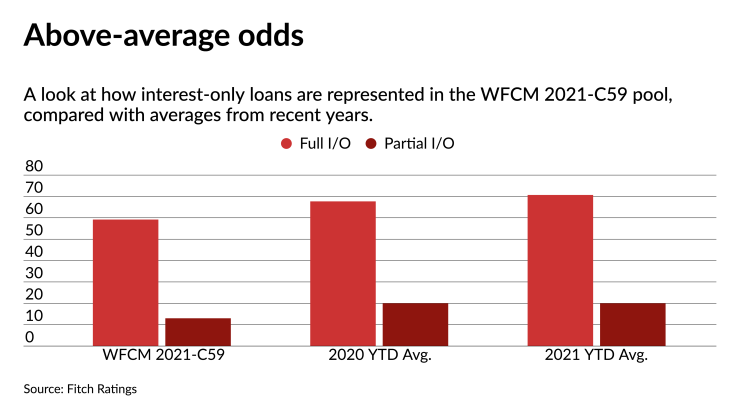

The pool has amortization statistics that are above average. Full interest-only loans account for 59.2% of the pool, which falls below the average of 67.7% through the same period last year, and the 2021 year-to-date average of 70.7%, according to FitchRatings.

The MGM Grand & Mandalay Bay loan, which represents 4.4% of the pool, is the sole loan in the pool that received an investment-grade credit opinion. Fitch gave the loan a ‘BBB+’ rating. Investment-grade opinions were handed down on 24.5% of loans in 2020 deals and 14.7% of loans in 2021 year-to-date.

Other ways in which the WFCM 2021-C59 tightened up its credit in comparison to 2020 deals: 22% of the pool has loans on properties with single-tenant occupancy and 1.9% of the pool has subordinate mezzanine financing.

With these factors Fitch largely gave the senior notes ‘AAA’ through ‘A’ ratings, while subordinate classes earned ‘BBB’ through ‘B’ ratings, all with a stable outlook.

But that doesn’t mean the deal is not without its risks. WFCM 2021-C59 has a high exposure to the office and retail sectors, which perked up interest from the rating agencies considering that those sectors took some of the hardest blows from containment efforts during the COVID-19 pandemic. By loan balance, office properties represent 36.2% of the WFCM pool, and loans secured by retail properties account for 16.3%, according to Fitch.

“Delinquencies may occur in the coming months as forbearance programs are put in place,” Fitch wrote. The extent to which delinquencies impact credit will ultimately depend on how severe and long the pandemic’s negative impacts are, as well as government relief responses for consumers.