DRB Capital, a structured settlements firm backed by the Blackstone Group, is tapping the securitization market for the first time, according to Morningstar Credit Ratings.

The $59.9 million transaction has an unusual risk: the beneficiaries who sold their structured settlement revenue to DRB in exchange for a lump sum payment could die. That’s because the collateral includes what are known as life-contingent structured settlement receivables. That means the insurer stops making payments when the beneficiary dies. By comparison, most structured securitizations to date, at least the publicly rated ones, were backed by guaranteed structured settlements: the insurer makes a certain number of payments, no matter what – or at least until it goes bust.

Untimely death isn't the only downside, however. It's also possible that there could be a delay in reporting a death to the servicer, meaning that the life contingent annuity will continue paying to the trust longer than it should. In such a case, the funds that should not have been paid will have to be returned, reducing the funds available to the noteholders subsequently. A third-party mortality tracking company, the Berwyn Group, has been engaged in order to address this risk.

Life-insurance policies also hedge a portion of the life-contingent structured settlement receivables,

As of closing, the collateral pool consists of 601 structured settlements, of which 176 are guaranteed, 252 are unhedged, and 173 are hedged. The weighted average remaining months to maturity of the receivables is 261 months.

All of the structured settlement receivables backing the transaction have gone through a court-approval process, and guaranteed annuities have obtained an acknowledgement by the obligor, according to Morningstar Credit Ratings. They have been entered into the National Association of Settlement Purchasers antifraud database, mitigating risk of payment diversion from fraud.

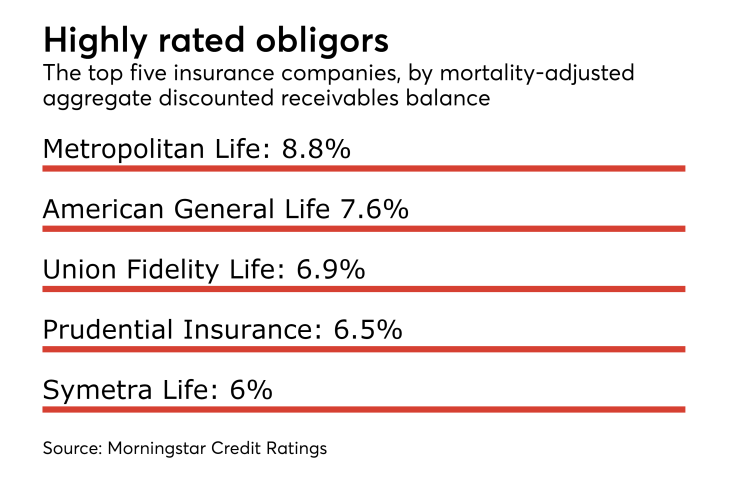

Also, both the structured settlements payments and life insurance policies in the collateral pool are obligations of highly-rated insurance companies; investment grade rated insurance companies back more than 85% of the collateral.

Three classes of notes will be issued in the transaction, DRB Capital Securitization, Series 2017-A: $44 million of Class A notes that benefit from 34.9% credit enhancement are provisionally rated AAA by Morningstar Credit Ratings and a $5 million tranche of Class B notes with 26.6% credit support is rated A+. The $2 million tranche of Class C notes is unrated, as is the $3 million residual interest.

In addition to subordination and overcollateralization, the noteholders will benefit from a $5 million reserve account funded at closing with a minimum target balance of 11.36% of the Class A note balance on future payment dates.

DRB Capital is the second-largest originator of structured settlements with both retail and wholesale originations totaling over $135 million in 2016. It was formed in October 2013 through the acquisition of Imperial Trading and Finance’s structured settlement group by an investor group led by the Blackstone Tactical Opportunities investing platform. The company is headquartered in Delray Beach, Florida, and has over 170 employees.

Wells Fargo is the backup servicer for the transaction.

Stifel, Nicolaus is the initial purchaser of the notes.