Exempting CLOs from “skin in the game” rules allows managers to unload more of the risk in these transactions, which bundle below-investment-grade loans into collateral for bonds. In recent weeks, several managers have been doing this by issuing new deals with notes rated as low as single B.

In some cases, managers are also introducing a single-B tranche when they refinance existing deals.

The whole idea of securitizing leveraged loans is to get a rating uplift by subordinating the claims of a minority of bondholders to those of the majority. So the bulk of securities issued by collateralized loan obligations are issued in four investment grade tranches – Classes A, B, C and D. Most CLOs also issue a fifth tranche of notes with a speculative-grade rating, typically BB (or Ba1-Ba3, in the case of Moody’s Investor Service). These double-B tranches typically make up 5%-6% of the total capital structure and are marketed to investors willing to take on the higher risk in exchange for a much higher coupon.

Occasionally, when risk appetite is strong, CLOs will issue a sixth tranche of notes rated B (or B1-B3 on Moody’s scale) that stands to take losses even sooner than the double-B tranche. (To put that in context, the single-B notes may be riskier than many of the individual leveraged loans used as collateral.)

Since February, 23 new CLOs with single-B tranches have been issued by the likes of Credit Suisse Asset Management and Barings, according to Thomson Reuters LPC.

This is easier to do now that CLO managers no longer have to retain 5% of the economic risk in these transactions. CLO management firms (or their designated affiliates) often fulfilled this requirement by holding or reserving their stake in the most subordinate securities issued in deals, known as the “equity.” CLO equity, which on average accounts for approximately 10% of a capital stack and often represents controlling ownership of a portfolio, is unrated and holders do not receive interest; they are instead entitled to whatever funds are left over after interest and principal are paid to more senior noteholders. Structuring deals with smaller tranches of equity allows managers to carve out a single-B tranche, which typically accounts for 1%-3% of the total note balance (including equity subordinated notes).

“There’s been a lot of money raised by certain firms for investors who want below investment grade debt,” said Sean Solis, a partner at the law firm Milbank, Tweed, Hadley & McCloy. “The double Bs and single Bs – it’s a part of the stack that’s very attractive right now on a risk-adjusted basis.

“Rather than making the equity tranches bigger,” he said, “a lot of bankers have been structuring in single-B classes because there really is a big investor audience for those tranches.”

One new deal with a single B tranche, Credit Suisse’s Madison Park Funding XXVIII, has a $60.4 million residual note (equity) class that represents 8.4% of the $712.4 million deal. The previous issue from the shelf (Madison Park Funding XXVII) that lacked a single B tranche had $74 million, or 9.1%, of that $811 million deal tied up in equity.

The new Madison Park deal’s deferrable $13.5 million Class F notes carry a B minus rating from S&P Global Ratings, and accounts for 1.9% of the portfolio. It priced at 743 basis points over Libor.

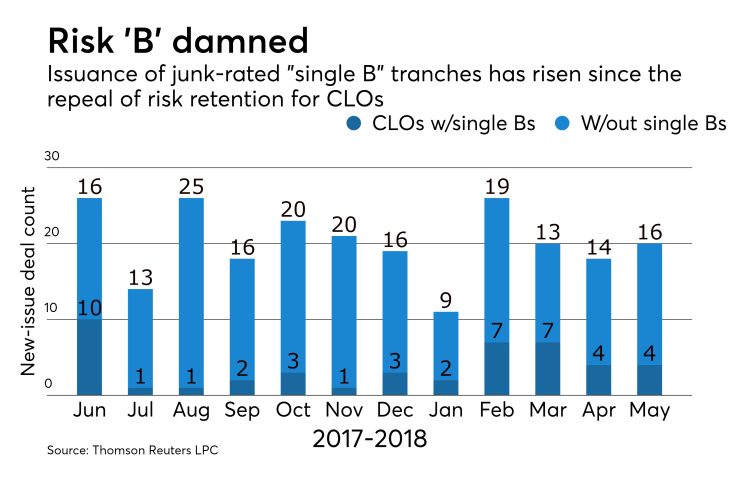

Not all CLO managers fulfilled risk retention requirements by holding large amounts of equity; some complied by holding a portion of each tranche of notes issued in their deals. So it was possible to structure deals with single-B tranches even while the rules were in effect. Still, the pickup in issuance of new deals with single-B tranches roughly coincides with a Feb. 9 ruling by a U.S. court of appeals that “open market” CLOs – those that purchase, and do not originate, their collateral – are exempt. As the accompanying chart shows, only two CLOs with single-B tranches were issued in January, but that figure rose to seven each in February and March, followed by four each in April and May.

(The court ruling was not finalized until late March when an appeals window expired without regulators filing a response.)

Exempting CLOs from risk retention didn’t just give managers more leeway to structure deals with single-B tranches; it also freed up an estimated $10 billion stockpile that had been raised in the fourth quarter of 2017 to help managers comply with risk retention rules, according to a survey by JPMorgan. Those funds that now can be used to instead perhaps back more below investment grade securities and less equity.

Solis said it’s not clear whether funds raised to invest in CLO equity are instead being put to work in single-B tranches of deals, though he says it’s quite likely that some of it is.

It’s not just new CLOs that are exempt from risk retention; managers are also free to unload their risk retention stakes in existing deals. Although drawing correlations to risk retention strategies is not clear-cut, Shenkman Capital, Octagon Investment Partners, THL Credit Advisors, CIFC Asset Management and GSO/Blackstone, are each among recent issuers since risk retention’s appeal who have chosen to introduce a single-B tranche of notes to older deals via a refinancing or reset.

For CIFC, the addition of a $6.25 million B3-rated tranche to the May reset of CIFC Funding 2013-IV came a year after its initial refinancing of that transaction.

To be sure, managers are unloading their equity holdings/risk retention stakes in other ways, including selling the securities in the secondary market. In a May 22 report, Deutsche Bank noted that an increasing number of “vertical strips,” industry lingo for 5% stakes in each tranche of CLO notes, were “presumably” risk retention interests that have recently been put out for bid. Two managers, Blue Mountain Capital and MountainView Capital, put out for bid 5% of all debt tranches from a pair of existing deals, according to Deutsche Bank. Also on bid lists are 5% of the double-B- and single-B-rated tranches of “a number” of deals from PGIM’s Dryden CLO platform.

Given how much spreads on senior CLO securities have tightened this year, it’s possible that some of the demand for subordinate tranches could come from investors who normally invest higher in the capital stack but are starved for yield. Some spreads on triple-A CLO securities offered by top-tier managers moved this spring inside 100 basis points, one of the tightest levels for AAAs in the post-crisis era.

“I don’t know if there’s been a general migration from the investors in the upper tiers down to that single B, but I suspect that for certain of those investors the single Bs have some appeal, depending on one’s risk appetite,” said Chris Duerden, a partner with the law firm Dechert.

With the additional issuance, spreads on single-B CLO securities have held relatively still. Single-B tranches of deals that priced between February and May were as wide as 866 basis points over Libor, according to Thomson Reuters. The current average spread has since narrowed to 790 basis points, per Deutsche Bank. That’s only 85 basis points tighter than a year ago, a much smaller move, both in absolute terms and relative terms, compared to the 100- to 110-basis-point tightening on BBB- and BB-rated CLO securities.