The nation’s largest private student lenders — Sallie Mae, Wells Fargo, Discover Financial Services and Citizens Financial Group — may soon be facing stiffer competition.

Those four companies, led by Sallie, of Newark, Del., control an estimated 85%-plus of the market for private education loans to current students. Their position is sometimes described as an oligopoly within the relatively small portion of the student loan market where the federal government does not participate.

But now two other firms with deep knowledge of education finance — Navient Corp. and Nelnet Inc. — appear to be eyeing the niche of lending to college students who cannot get all the funds they need from Uncle Sam.

Navient, which was spun off from Sallie Mae in 2014, specializes in collecting payments from borrowers who have taken out federal student loans. The Wilmington, Del.-based company is currently bound by certain restrictions on its ability to compete with Sallie. But those provisions expire at the end of 2018, which means that Navient could start offering loans to college students enrolling next fall.

Nelnet, of Lincoln, Neb., is another large servicer of federal student loans. In June, the firm announced that

Analysts said that if Navient and Nelnet do enter the market, they could put pricing pressure on its more established participants.

“For a long time, it’s been a fairly rational competitive environment,” said Michael Tarkan, an analyst at Compass Point Research & Trading. “I do think it has the potential to alter the competitive dynamic a little bit, particularly relative to where it’s been.”

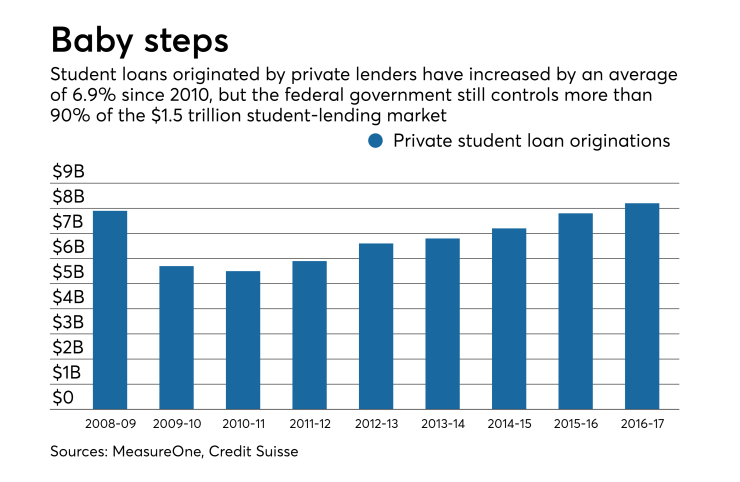

At the end of March, approximately $118 billion in private student loans were outstanding in the U.S., equal to 7.75% of the total student loan market, according to the data provider MeasureOne. The market contracted after the credit crisis brought big losses a decade ago.

Lenders were also hit by a change in federal law that eliminated their role in the government-backed portion of the market.

The split-up of Sallie and Navient initially gave the two companies different niches to pursue. But at an industry conference this week, Sallie Mae CEO Raymond Quinlan acknowledged that Navient will soon be freed from the restrictions it has been operating under.

“We fully expect to see them as a competitor. There are a lot of people who worked at both companies,” Quinlan said.

At the same time, Quinlan suggested that it will be hard for Navient to overcome certain disadvantages. For example, he said that Sallie Mae, which enjoys the benefit of low-cost bank deposits, has a 2% to 3% lower cost of funds than Navient.

Another potential advantage for Sallie is its large sales team, which has relationships on college campuses across the country. Students often make decisions about which lender to use in consultation with university financial aid offices.

“Our headquarters is in Delaware, but we do business in all 50 states,” Quinlan said.

Speaking at the same conference, Navient CEO Jack Remondi noted that his company also has relationships on campus, since it works with colleges as part of the federal student loan business.

And he touted his company’s ability to acquire customers through the use of digital marketing. Navient projects that it will refinance more than $2 billion in student loans during the first nine months of 2018, following last year’s acquisition of the startup lender Earnest.

“At Earnest, our operations are entirely digital,” Remondi said, drawing a contrast with lenders that rely heavily on mailing solicitations to consumers.

In a recent research note, analysts at Credit Suisse said that Navient would have to make a significant marketing investment in order to grab a 10% share of the market for private loans to today’s college students.

“We continue to believe that Sallie Mae’s market share is secure in the near-term,” the Credit Suisse analysts wrote, “given that brand recognition is key.”