Bankers are defending the industry's aggressive push into commercial real estate despite regulators' warnings about the growing risk — and the potential for losses — in that sector.

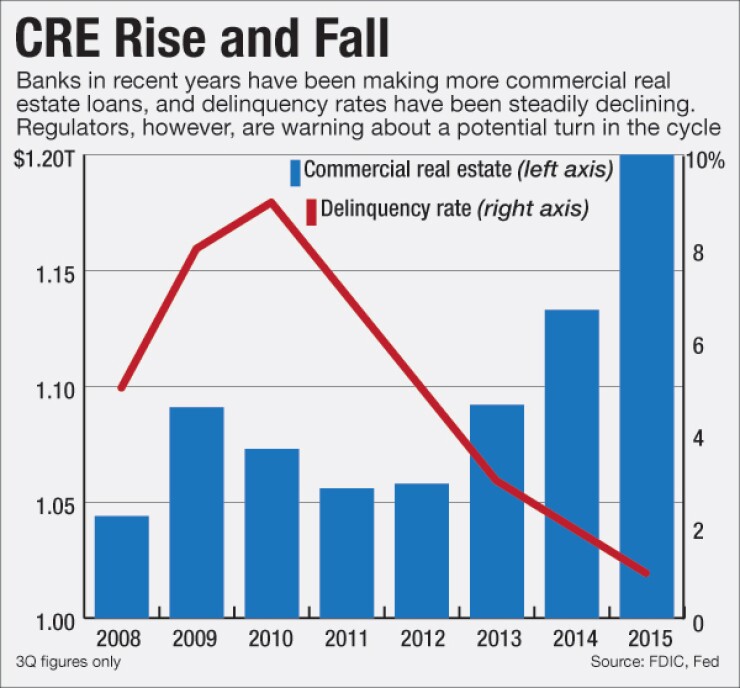

Federal banking regulators issued a joint statement in December that warned of a "substantial" rise in exposure to loans backed by commercial real estate that often included loosened underwriting standards. Total CRE loans, meanwhile, increased 6% in the third quarter from a year earlier, to $1.2 trillion, according to the most recent data from the Federal Deposit Insurance Corp.

The warning — a focus during recent quarterly earnings calls — has done little to dull the industry's growing appetite to make loans for apartments, offices and retail sites. During the quarterly calls, most bankers stood by their moves to bulk up on commercial property as a way to drive loan growth.

"CRE continues to be bread and butter for our institution and our space," Kevin Kim, BBCN Bancorp's chairman and chief executive, said during an earnings call last week, adding that the regulatory warning "isn't going to have a meaningful impact" on the Los Angeles company's outlook. BBCN closely monitors its commercial real estate loans, which accounted for 81% of the $7.9 billion-asset company's originations during the fourth quarter, he said.

BBCN is among the banks whose CRE exposure has risen in excess of federal guidelines, according to data from Keefe, Bruyette & Woods.

Regulators encourage banks to limit concentrations in commercial real estate, including multifamily loans, to 300% of total capital. They also encourage banks to keep growth under 50% over a three-year period. The guidelines aren't prohibitive; exceeding them typically results in added scrutiny from examiners, industry experts said.

About 50 small banks have surpassed the recommended limits, according to KBW. For instance, the $6.6 billion-asset Opus Bank in Irvine, Calif., grew its CRE book by 239% over the past three years. Lenders around New York, such as the $4 billion-asset ConnectOne Bancorp in Englewood Cliffs, N.J., and the $1.3 billion-asset Bankwell Financial in New Canaan, Conn., increased the size of their portfolios at a similar clip.

"The regulators are getting scared," said Hal Reichwald, a lawyer at Manatt, Phelps & Phillips. "They are afraid that banks will be led into the trap [where] so many to fail during the 2009 through 2012 timeframe."

Still, credit quality continues to improve. Loan losses and chargeoffs across all asset classes have declined steadily since the financial crisis, according to third-quarter data from the Federal Deposit Insurance Corp. The delinquency rate for CRE loans was 1.14% in the third quarter, marking an improvement from 1.76% a year earlier and 8.58% in 2009, according to data from the Federal Reserve Board.

"There's a school of thought that says when your asset quality is good, this is the time for banks to reexamine what their risk profile looks like," Reichwald said.

Signs of weakness have emerged, said Allen Tischler, an analyst at Moody's. Loan-to-value ratios for commercial real estate — a leading indicator of the last downturn — have increased to peaks last seen in 2007, he said.

Regulators want to be proactive after facing criticism for missing early signs of the last crash, industry experts said. Still, regulators issued a similar warning on CRE exposure in December 2006, when the real estate bubble was in full swing.

"Regulators want to make sure banks have their house in order," especially in a rising rate environment, said Chris McGratty, an analyst at KBW.

Several major markets could be vulnerable to credit issues, McGratty wrote in a recent report. Office vacancies have picked up in Houston, given depressed oil prices. Luxury condos in New York, along with corporate offices in San Francisco, are also vulnerable to declining property values.

Bankers, overall, remain optimistic about asset quality and the prospects for more growth.

"The New York market is going to change over the period ahead," Joseph Ficalora, president and chief executive of the $50.3 billion-asset New York Community Bancorp, said during the Westbury company's earnings call. "But we will continue to have a growing share of this market."

Commercial real estate loans — including multifamily — accounted for 831% of New York Community's risk-adjusted capital at Sept. 30, according to the KBW report.

Ficalora assured investors that New York Community can withstand a decline in property values, adding that New York City rent regulations protect cash flows from tenants. Also, demand for real estate of all types remains strong throughout the region.

"We will have consistency in our performance metrics, despite [a] substantial downturn in the economics of New York City, should that occur," Ficalora said.

New York's real estate market has soared in recent years. The value of apartments sold in the city has tripled, to $24.4 billion, since 2011, according to a report from real estate brokerage firm Cushman & Wakefield. The value of office property doubled over the same period.

"We've done significant work on stress testing and data enhancement, and that will continue," Joseph DePaolo, president and chief executive of Signature Bank, said during the New York company's quarterly call. The $33.5 billion-asset company passed the 300% guideline six years ago, he said.

Several other banks across the country, however, struck a more skeptical tone about looming credit risk during their quarterly calls.

Preferred Bank is working to reduce its exposure to commercial property, Chief Executive Li Yu said on the Los Angeles company's earnings call. After years of bulking up on commercial real estate loans, the $2.6 billion-asset Preferred has sold off some of those assets. It also plans to focus on other types of originations, Yu said.

CRE accounted for about 380% of Preferred's capital, Yu added. "We're very mindful of keeping the number a little bit lower," Yu said.

Executives at Western Alliance Bancorp., which has 12 branches in northern California, told investors that they plans to pull back on real estate lending in the region, where property values have spiked due to a recent tech boom.

"We're not going to be real aggressive in northern California," Robert Sarver, Western Alliance's chairman and chief executive, said. The $14.2 billion-asset company is "a little more cautious" about commercial real estate, he said.

Bigger banks have also started to limit their exposure. The $95.1 billion-asset KeyCorp in Cleveland plans to pull back from multifamily lending, as competition heats up in several of its major markets. CRE at Key held steady in the fourth quarter, compared to a year earlier.

"That's intentional, as far as some of the credit disciplines we're maintaining," Don Kimble, Key's chief financial officer, said during the company's quarterly call.