The dropoff in mortgage lending activity in the early weeks of 2022 continued, with new applications at their lowest in more than two years, according to the Mortgage Bankers Association.

The MBA’s Market Composite Index, a measure of weekly loan activity based on a survey of association members, fell 13.1% on a seasonally adjusted basis for the seven-day period ending Feb. 18, and volumes were also 41% lower compared to the same week one year ago.

Numbers dropped across categories, declining for both conventional and government activity. While rising mortgage rates have had a

Seasonally adjusted purchases dropped 10% compared with activity in

“Higher mortgage rates have quickly shut off refinances, with activity down in six of the first seven weeks of 2022,”l Kan said in a press release. “Conventional refinances, in particular, saw a 17% decrease last week.”

Refinance volumes relative to total new activity also dropped again one week after tumbling to its lowest share since July 2019. Refinance loans accounted for 50.1% of new applications, compared to 52.8% seven days earlier. Adjustable-rate mortgages, though, represented a larger portion, equaling 5.1% of all applications, up from 5% the prior week.

Following six weeks of rising purchase-loan averages — with new all-time highs set in five of those, the mean

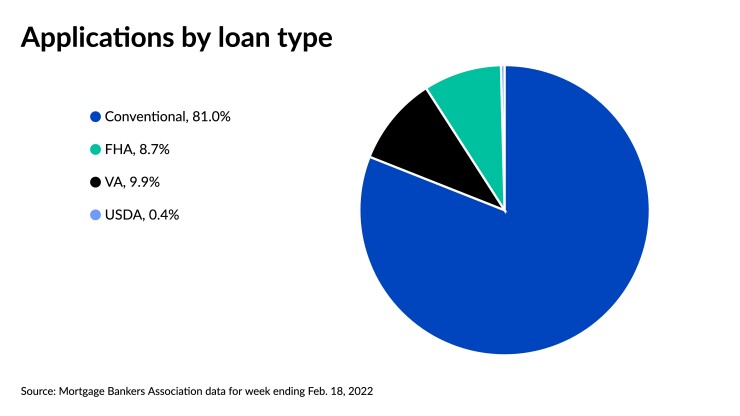

The share of federally backed mortgages saw an uptick over the seven-day period as conventional activity fell off at a faster pace compared with government loans during the week. Federal Housing Administration-backed applications represented 8.7% of all new mortgage activity, up from 8.3%. Loans coming through the Department of Veterans Affairs accounted for 9.9% relative to all activity, up from 9.3% a week earlier, and the share of U.S. Department of Agriculture-backed applications remained at 0.4%.

Fixed interest rates continued their upward trajectory among MBA lenders, with the contract average for conforming 30-year mortgages with balances under $647,200 inching up to 4.06%. One week earlier the conforming 30-year average had jumped to 4.05%.

The contract average of the 30-year fixed-rate jumbo loans exceeding $647,200 climbed up another three basis points to 3.84% from 3.81% one week prior.

Thirty-year contract fixed rates for FHA-backed loans surged past the rate for conventional loans, landing at 4.09%, an 8-basis-point rise from 4.01% seven days earlier.

The average contract interest rate for 15-year mortgages likewise increased, going up to 3.42% from 3.37% the previous week.

Among the averages for the loan types tracked, the 5/1 adjustable-rate mortgage registered the only decrease, falling 10 basis points to 3.26% from 3.36% in the prior reporting period.