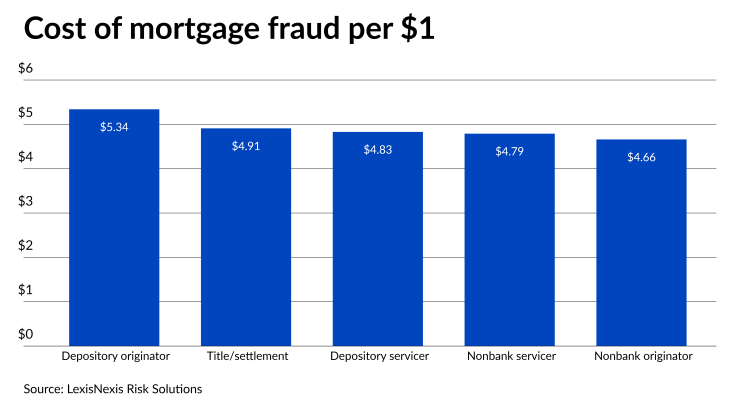

Real estate scams have the highest impact on depository mortgage originators, costing them $5.34 for every $1 of fraudulent transactions, a study from LexisNexis Risk Solutions revealed.

That is 68 cents per dollar more than the effect on nondepository originators, at $4.66. For servicers the numbers are much closer, at $4.83 for depositories and $4.79 for nonbanks. For title and settlement agents, a group on the front lines when it comes to

While no specific answers for the difference were available, Dawn Hill, director of real estate fraud and identity strategy at LexisNexis Risk Solutions, explained that "a sizable portion of fraud costs are related to labor, including manual reviews, fraud investigation, reporting and recovery."

Internal labor is the single largest cost center for each group, except for nonbank originators. It makes up 26% of the depository fraud costs versus just 20% for nondepositories. But for title and settlement service providers, it was a whopping 35%. For nonbank originators, the leading cost area was the face amount of the fraudulent transaction at 21% of losses.

When it comes to average monthly attacks, bank originators have 1,756 incidents of which 613 are successful. For nonbank lenders, the average is 1,618, with 607 successful.

However, the group reporting the largest number of incidents by far is depository servicers. This group averages 2,625, with 875 successful. Nonbank servicers average only 707 attacks per month, with 259 successful.

Title and settlement providers have the second highest number of successful incidents, an average of 633 per month from a total of 1,511 attempts.

As the mortgage industry shifts to increased transactions with no or little direct contact, a vast majority of fraud attacks are now coming through these impersonal means.

Only 24% of depository and 19% of nondepository originations are in person; the fraud costs from each are 23% and 19% respectively. But the combined

The remaining channel, call center, represents 15% of depository transactions and 14% of nondepository; fraud costs average 14% at both.

But for title and settlement providers, which scammers target through

"Although the future is uncertain, it's safe to assume that the accelerated movement to online/mobile transactions will continue to grow and that mortgage originators, servicers and title/settlement companies should build out and enhance the digital customer experience while protecting against fraud," said Hill. "A successful fraud detection and prevention approach involves an integration of technology, cybersecurity and digital experience operations in a way that addresses the unique risks from different transaction channels and payment methods, as well as by individuals and types of transactions."

By category, 126 respondents were depository originators, 124 nondepository originators, 29 bank servicers, 58 nonbank servicers and 20 title and settlement services companies.