Mortgage applications increased 4.1% from one week earlier as consumers continued to pursue both purchases and refinancings even as conforming rates rose from their record lows, according to the Mortgage Bankers Association.

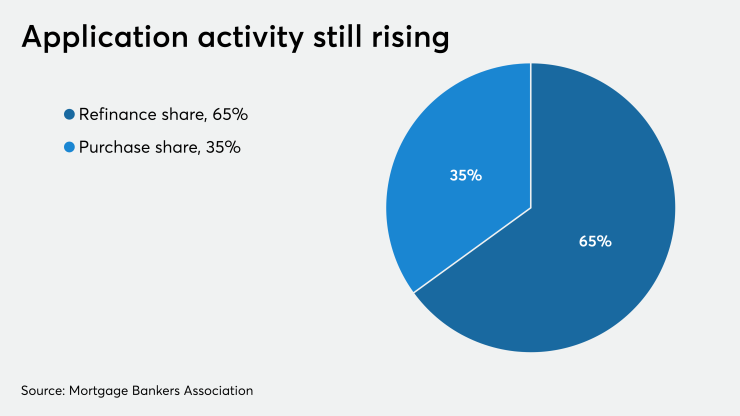

The MBA's Weekly Mortgage Applications Survey for the week ending July 17 found that the refinance index increased 5%

"Mortgage applications increased last week despite mixed results from the various rates tracked in MBA's survey," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "The average 30-year fixed rate mortgage rose slightly to 3.2%, but some creditworthy borrowers are being offered rates even below 3%."

That is why refinancing volume increased last week, he explained. Meanwhile, the recent upswing in the purchase index may have alleviated concerns from the end of June that the demand cycle had

"There continues to be strong homebuyer demand this summer, as home shoppers have returned to the market in many states," Kan said. "Purchase activity increased again last week and was up 19% compared to last year, the ninth straight week of year-over-year increases."

The seasonally adjusted purchase index increased 2% from one week earlier while the unadjusted purchase index increased 2% compared with the previous week.

Adjustable-rate mortgage activity remained unchanged at 3% of total applications, while the share of Federal Housing Administration-insured loan applications decreased to 10.8% from 11.1% the week prior.

The share of applications for Veterans Affairs-guaranteed loans decreased to 10.8% from 11% and the U.S. Department of Agriculture/Rural Development share remained unchanged from 0.6% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased 1 basis point to 3.2%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate decreased 2 basis points to 3.51%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased 11 basis points to 3.13%. For 15-year fixed-rate mortgages, the average increased 1 basis point to 2.71%. The average contract interest rate for 5/1 ARMs decreased to 2.89% from 3%.