Four mortgage wholesalers recently introduced or loosened terms on their prime jumbo products, and a pair of them are taking the unusual step of offering these loans as qualified mortgages.

Because of the displacement that resulted from the Federal Reserves' mortgage-backed securities purchases in the early days of the pandemic, most of the non-conforming secondary market participants stopped buying jumbos and they disappeared from lenders' menus. But private-label secondary market securitizers

With the U.S. economy doing better in recent weeks, nonbanks have been

The revisions to Appendix Q that changed the QM test from the hard and fast debt-to-income ratio to

Mortgage rate movements can be seen as a proxy for interest in the product. Traditionally, the jumbo mortgage business is dominated by banks and when the housing market is doing well, they typically offer lower rates than

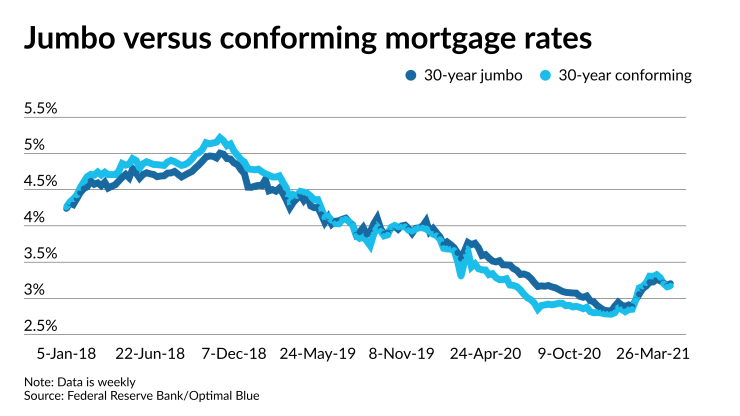

For much of the period between 2017 and August 2019, jumbo rates were actually lower than conforming rates, according to data from the Federal Reserve Bank of St. Louis and Optimal Blue. After that point through the start of the pandemic, there was a narrow spread between those two rates.

Between March 2020 and February, conforming loans on average were clearly priced below jumbo, but the rate inversion returned through much of April.

The Biden administration's hold on Appendix Q only affected its enforcement date, so Rocket Pro TPO was able to go ahead with Jumbo Smart, the company explained.

"When you couple intense housing demand with limited inventory, having a great jumbo option is an absolute must for loan officers in this purchase market," said Austin Niemiec , executive vice president of Rocket Pro TPO. "Also, most refi clients have been sitting on the sidelines the last year due to the lack of a great product."

Rocket Pro TPO does not currently offer a non-QM jumbo mortgage.

"The beauty of Jumbo Smart is it aligns with the updated QM rule, which makes this offering incredibly strong," said Niemiec. "The product is a great blend of solid and sound pricing, while also allowing the loan to feel very similar to a conventional loan from a processing and documentation standpoint."

It's available on a range of property types, including primary and second homes, and non-owner-occupied. Jumbo Smart is available for loan amounts up to $2 million, a 45% or lower DTI and 80% LTV.

Investor interest in jumbo products has returned, Niemiec noted and that's a great thing for mortgage brokers and for homeowners.

"We have witnessed this recently with a very successful jumbo mortgage-backed security Rocket recently offered," Niemiec said. "This is critical as we are entering what will surely be an intensely hot spring and summer homebuying season."

UWM also brought back its prime jumbo product, with CEO Mat Ishbia making the announcement at the start of the same

"We've pivoted to an easy, simplified, one-stop product, where you can run it through [Desktop Underwriter] and you're good to go," Ishbia said on the video. "There are a couple of overlays, but a lot less because Appendix Q. That's gone away, we don't have to follow that."

This jumbo qualified mortgage product levels the playing field for mortgage brokers to compete against the banks, the company added.

Prior to the pandemic, UWM offered two jumbo products, High Balance Nationwide and Jumbo Bank Buster, but removed both from its rate sheets in March 2020.

UWM's new prime jumbo product has a $2 million loan limit and an 89.99% LTV maximum.

Meanwhile, non-qualified mortgage lender Deephaven Mortgage has brought to market in its wholesale channel expanded prime jumbo products, non-prime loans and investor debt service coverage ratio mortgages in what it's calling the Spring Slam.

"We looked at our product set as a whole, at things that will fit into our mix well," said Jeff Burrus, its senior vice president, wholesale sales and operations. "So, at the loan amount we're currently underwriting, switching over to a prime jumbo fits into our mix pretty well."

The company's average loan size is in the mid-$400,000 area, below the current conforming limit of $548,250. But the upper end of its business is in the $1-million-to-$1.5-million range. Those loans "are not something that scares our underwriters or scares our people, it's kind of the norm," Burrus said.

Deephaven entered the wholesale channel in 2018, after starting out in 2012 as a correspondent aggregator. Now, Burrus said, it is "actively looking to grow our wholesale side right now" and "actively hiring" both on the sales and operations sides. Its entrance into wholesale and this product expansion were spurred by the channel's rebound from the depths it sunk to following the financial crisis.

"We're already doing the correspondent side, so it just fit into our model well," said Burrus. "We thought we could help the brokers out on some products that they may not have access to right now."

Deephaven was

Among the changes to its products was bringing the credit scores on wholesale prime jumbo down to 660 with a 90% loan-to-value ratio for purchase or rate-and-term refinance. It was something that was available pre-COVID and thus "we have historic data showing those [borrowers] paid us and we wanted to go ahead and we pushed it down," Burrus said. "We were at a 720" and "looking for ways we can help more borrowers get in a house but also making sure we're not putting people into a bad situation, that they'll be able to pay us back."

Another non-QM lender offering prime jumbo loans is A&D Mortgage. The company said in a press release that what sets its product apart from the others is that it is underwritten through Fannie Mae's Desktop Underwriter. If the loan comes back approve/ineligible because of the loan amount, it is acceptable for the A&D program.

Parameters include loan limits up to $2 million for primary and secondary residences and investor properties, LTV up to 89.99%, a minimum credit score of 660 and no mortgage insurance.

"We partner with brokers to make home financing accessible to as many people as possible, and our new Prime Jumbo loan product helps us turn that goal into a reality," Max Slyusarchuk, CEO of A&D Mortgage, said in the press release. "We are excited to offer this product, and will continue to adjust our program terms and offerings to be as competitive as possible and to meet the needs of our partners and the borrowers they serve."