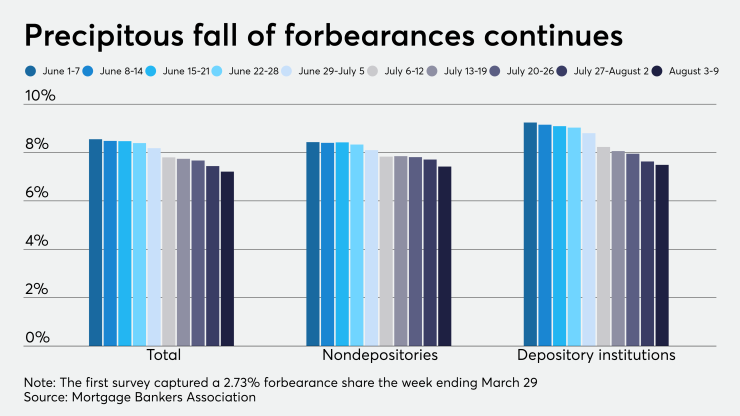

After dropping 23 basis points a week ago, the pace of mortgages going into coronavirus-related forbearance plummeted another 23 basis points between Aug. 3 and Aug. 9, according to the Mortgage Bankers Association.

The rate declined for the ninth week in a row with an estimated 7.21% of all outstanding loans — or an estimated 3.6 million — sitting in forbearance plans compared to 7.44% and about 3.7 million

The forbearance share of both conforming mortgages — those purchased by Fannie Mae and Freddie Mac — and Ginnie Mae loans —

The conforming share fell 25 basis points to 4.94% from 5.19%, marking the first time it went below 5% since April. Ginnie Mae's share dropped 52 basis points to 9.54% from 10.06%.

"Borrowers with conventional mortgages have been faring somewhat better throughout the current crisis, and there is no sign to date from these data that the risk to the GSEs is increasing," Mike Fratantoni, the MBA's senior vice president and chief economist, said in a press release.

"The decline in Ginnie Mae loans in forbearance was again because of

Private-label securities and portfolio loans — products not addressed by the coronavirus relief act — actually rose this week to 10.34% from 10.12%.

Forbearance requests as a percentage of servicing portfolio volume edged down to 0.11% from 0.12%, while call center volume as a percentage of portfolio volume inched up to 7.9% from 7.8%.

The MBA's sample for this week's survey includes a total of 50 servicers with 25 independent mortgage bankers and 23 depositories. The sample also included two subservicers. By unit count, the respondents represented about 75%, or 37.3 million, of outstanding first-lien mortgages.