First Investors Financial Services has increased the investor protections on its next offering of bonds backed by subprime auto loans.

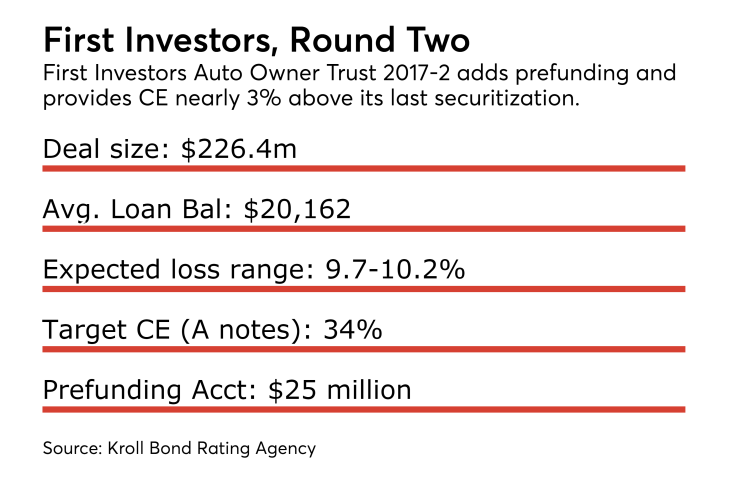

The $226.4 million First Investors Auto Owner Trust 2017-2 is the sponsor’s second deal of the year and its 21st overall. The senior notes, provisionally rated AAA by Kroll Bond Rating Agency, benefit from initial credit enhancement (CE) of 29.5%, building up to 34%; that’s an increase of almost three percentage points from the same tranche of the prior deal (26.7%, targeting 31.45%).

Three subordinate tranches also benefit from higher initial CE of 23.29% for the Class B notes (vs 20.85%) ; 14.3% for the Class C notes (vs 12.25%); and 7.03% for the Class D notes (vs 5.5%).

The additional CE offsets higher expected cumulative net losses on the collateral. Kroll expects these to be in the range of 9.70% - 10.20%, in its base case scenario, up from 9.30% - 9.80% for the previous deal.

The presale report does not explicitly state why Kroll expects higher losses; however it notes several differences between the two deals, including the introduction of a prefunding account of up to $25 million, or 11% of the collateral that may be acquired after the close of the deal.

The transaction involves about $202 million of receivables as of the June 30 cutoff date, amounting to an average balance of $20,162 per borrower. The average interest rate on the loans is 13.83% for buyers with average FICO credit scores of 587 and a loan-to-value ratio of 122.39% on their vehicles (a figure that continues to be slightly lower with each successive First Investors securitization).

Another change is a shift in the mix of origination channels. The collateral for the 2017-2 transaction has a lower proportion of loans originated by indirect program, 76.95% vs 78.47% in the previous deal. The proportion of loans originated via direct programs rose to 23.05% from 21.53%.