Marketplace consumer loan ABS volume is expected to rise in 2020, aided by strong 2019 economic tailwinds benefiting originations as well as favorable federal regulatory proposals that could encourage more securitizations.

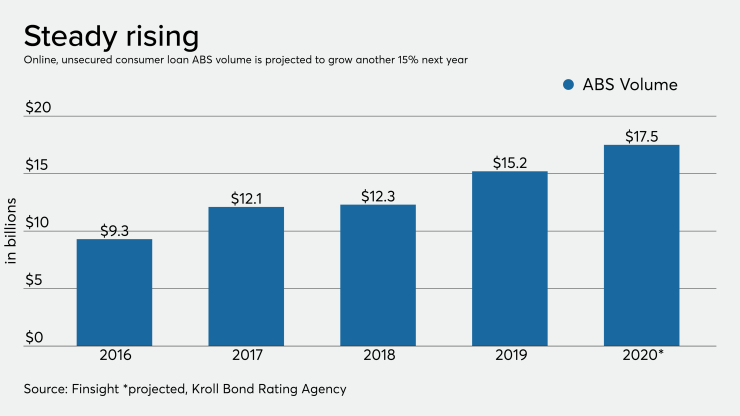

The ongoing expansion of the unsecured online loan market should continue in 2020, with Kroll Bond Rating Agency projecting the asset class will total $17.5 billion in securitized volume next year, compared to $15.2 billion for 2019.

The annual total has grown annually the past four years, and as projected would be nearly double the $9.3 billion that priced in 2016, according to data from Finsight.

“When it comes to growth this year and next, we expect the growth trajectory of big players such as LendingClub and Prosper to continue into 2020,” said Harry Kohl, director at Fitch Ratings.

The volume growth continues despite the fact consumer-loan losses and delinquencies have risen in 2019, and marketplace lenders have tightened their underwriting standards.

Maturing asset class

Jerry Marlatt, a partner at law firm Mayer Brown, said that marketplace lenders tightening their lending standards results partly from credit concerns, since competition prompted some to lend to less creditworthy borrowers in prior years.

But he says the stricter guidelines also signal that the industry is maturing, and could lead to a contraction of players in the market that in 2019 included 22 originators that placed loan pools with institutional investors, according to Finsight. The largest issuer in unsecured online consumer loan ABS was Social Finance, with four note offerings totaling $2.2 billion. (SoFi compiles loans from a coterie of prime, higher credit-quality borrowers that it also targets for its more-established professional student-loan securitization platform).

“We will probably see some winnowing in the market—some consolidation, others dropping out or realigning” with banks, he said.

Marlatt said that the surviving lenders will likely continue to originate higher-quality loans, and that those loans will be directed toward securitizations, strengthening marketplace ABS, while lower quality loans are either retained by lenders to pick up extra spread or sold to whole-loan investors.

In a December report, Kroll stated “[w]e expect the trend to stabilize next year as many of the issuers that we rate have recently tightened underwriting criteria, shifted internal credit grade mix, shortened duration, and reduced loan size in response to observed and/or anticipated credit softening,” Kroll’s report states.

And marketplace lenders’ fine-tuning and improving their underwriting capabilities should bode well for investors.

“We expect performance to improve next year as earlier vintage loans, which have generally exhibited higher losses, continue to roll off,” according to the ratings agency.

One of the ongoing concerns with marketplace ABS is that the sector has yet to be truly tested in a significant economic downturn. As unsecured loans they are particularly risky with limited recovery prospects, Fitch’s Kohl said “we’re still not convinced marketplace loans are high up on borrowers’ priority of payments.”

Kohl said, however, marketplace lenders have enough cushion against losses to pare back lending when they see credit weakness without affecting top-line revenue or bond payments to investors.

Both agencies have differed on the evolving risks of the asset class, with Kroll (which issues the majority of ratings for MPL deals) generally maintaining the single-A ratings for 2019 deals sponsored by near-prime lenders like Avant and Marlette

Last May, Fitch cautioned that while MPL securitizations are frequently structured with "rapidly deleveraging" schedules for note paydowns, the smaller cushion against losses in more recent deals could leave noteholders "likely to be subject to downgrades across the capital structures” in the event of an economic downturn.

Usury law challenges

Mayer Brown's Marlatt said another element to keep an eye on for 2020 is the likelihood of new federal regulation affecting marketplace ABS pools.

The most significant developments in 2019 were proposals by the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. to allow national banks

The proposals are the latest to resolve the uncertainty surrounding MPL and other securitizations since 2015, when a federal court decision (Madden vs. Midland Funding) held that a non-bank debt collector could not claim the same cross-state exemption from local usury laws that apply to originating bank lenders. (The Madden decision from the U.S. Second Circuit involved only New York, Vermont and Connecticut, which has frequently led to MPL ABS issuers

The Madden case (which the U.S. Supreme Court declined to hear) opened the door for potential consumer protection challenges in states where Prosper, LendingClub and other issuers originate loans but bypass local usury restrictions in favor of higher rates from the home states of partner underwriting banks. Madden was later cited

“That’s really important for all loans sold into securitizations, because a securitization trust is not a bank,” Marlatt noted.

The OCC has also proposed giving federal special-purpose fintech charters to marketplace lenders, as a means to allow lenders a nationwide platform without having to obtain 50 state licenses. A challenge filed by the New York State Department of Financial Services

“Federal action tends to simplify all that and would make marketplace securitizations more like those by banks,” Marlatt said, adding, “It should make marketplace ABS a bit easier to sell.”