Fannie Mae's current tack could help it weather some of the new challenges confronting it, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

Fannie already has begun reducing its exposure to loans with higher debt-to-income ratios for reasons that include credit risk management and a proposed capital rule, executives noted in the company's second-quarter earnings call. This was occurring even before the Consumer Financial Protection Bureau

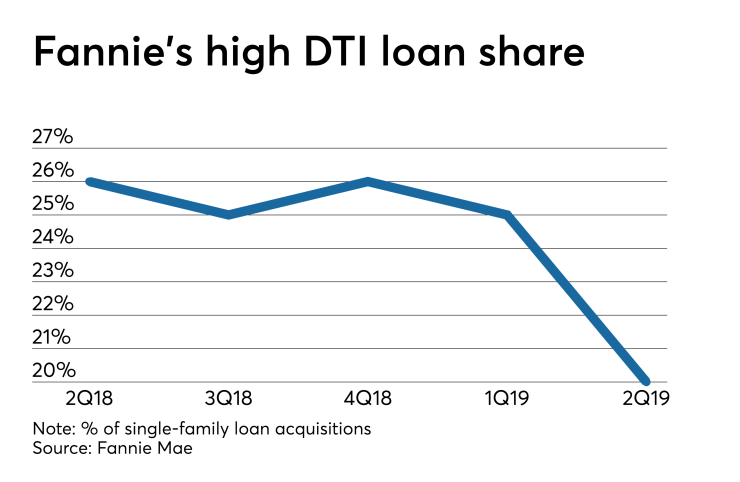

Following the application of tighter rules to Fannie's Desktop Underwriter system, the share of loans with DTI ratios greater than 45% has fallen. It was 20% in the second quarter, down from 25% the previous quarter and 26% during the same quarter a year ago, according to Fannie Mae's earnings supplement.

"The QM patch generally has not been a driver of the changes we've made to DU but there is some overlap between the business that we do under the QM patch and some of the tightening we do," Celeste Brown, Fannie's chief financial officer and executive vice president, said in an interview Thursday. "One is not driving the other, but we have seen those numbers come down in the past several quarters."

In the private market, lower DTIs are a key determinant of whether an owner-occupied home mortgage meets the QM definition. That definition determines whether a loan can obtain safe harbor protection from ability-to-repay rule liability. The cutoff for the QM definition is a 43% DTI. Fannie Mae's defining line for higher DTI loans, at 45%, is close to it.

There are many considerations when it comes to the QM Patch's removal, including the extent to which Fannie needs to make high DTI loans to fulfill its affordable housing mission and the fact that

Brown said the impact looks so far like it will be manageable for Fannie Mae from a financial perspective.

"It's very, very early to comment on what the impact of the change in the QM patch would mean for us. They just put out the notice of proposed rulemaking and there are so many things that need to be defined, but I would say that the returns on those loans typically tend to be on a lower end, so depending on how it flows through [to earnings] we wouldn't necessarily expect it to have a significant impact," she said.

More significant in the context of Fannie's earnings could be the recent shift in mortgage rate direction and general interest rate volatility, which played a primary role in the fact that its $3.4 billion in net income was down more than 24% year-to-year, but up nearly 42% on a consecutive-quarter basis.

But Fannie plans to eventually lessen the degree of its quarterly swings related to interest rates with hedge accounting, something

"There are a number of things that come into play, so we're looking to do it in 2020 or 2021," Brown said.

While Fannie may be in a good position already to address some of the potential challenges that lie ahead, others may require more drastic change.

Under conservatorship rules, the GSEs can each have a maximum $3 billion capital buffer. But second-quarter calculations suggest Fannie Mae would need to hold $86 billion or more in capital if released from conservatorship and subject to proposed capital rules, Brown said.

Fannie is keeping an eye on the possibility there will be a future change in its conservatorship status, Fannie Mae CEO Hugh Frater said during a press briefing that followed the release of the GSE's earnings.

"We have watched with interest the evolving policy discussion about the future of the GSEs, including the possibility of ending the conservatorship," he said. "The administration has put forth a number of principles for reform with the goal of ending the conservatorship. We cannot predict the outcome of these plans or their timing."

In the meantime, Fannie plans to work on continuously improving the strength and resiliency of its current business model and on addressing known challenges that lie ahead.

This includes sizing up the impact the Current Expected Credit Loss standard could have when it is implemented.

Brown's early estimates suggest CECL could require Fannie make as much as a $4 billion adjustment at the balance sheet level initially. That could potentially lead to

Fannie has said