Deutsche Bank and Cantor Fitzgerald plan to issue $1.2 billion of commercial mortgage backed securities via COMM 2014-CCRE20.

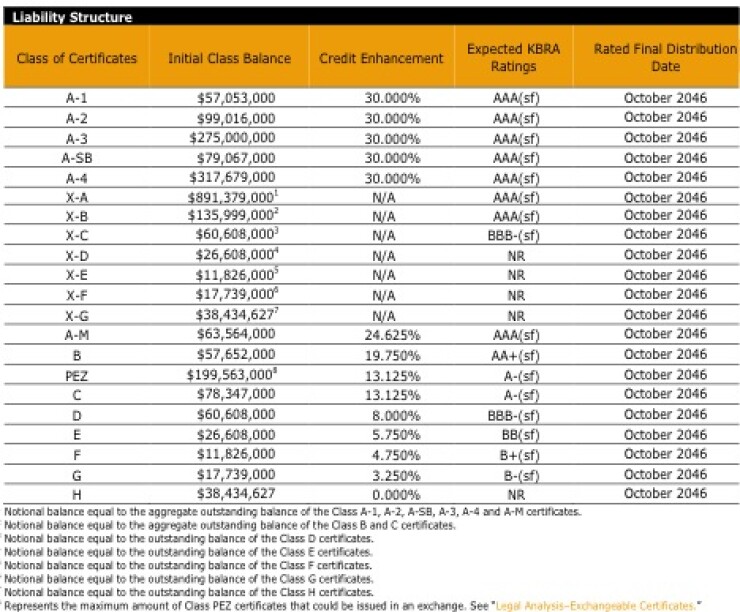

The deal is collateralized by 64 fixed-rate commercial mortgages that are secured by 101 properties. Kroll Bond Rating Agency (KBRA) has assigned preliminary ratings to 16 classes of notes to be issued by the trust .

The pool is exposed to all major property types but three make up over 10% of the pool each: retail represents 27.4%, hospitality represents 27.9% and office accounts for 26.3%. A $120 million loan secured by Gateway Center Phase II, a 602,164 sf retail power center located in Brooklyn, New York is the single largest of the pool.

The top five loans, which make up 36.9% of the pool, also include InterContinental Miami, at 9.7% of the pool; Marriott Atlanta Airport Gateway at 7.2%, Harwood Center at 5.1%, and Culver City Creative Office at 4.8%.

KBRA notes in its presale report that the pool offers a good mix of properties; however, as has been the case in recent deals rated by the agency, the overall pool is highly levered. KBRA said that the weighted loan-to-value ratio of 104.6% is above the average of the last 16 conduit transaction it has rated over the past six months. These transactions had LTVs ranging from 94.0% to 106.0%, with an average of 101.0%.

The pool’s exposure to high leverage loans (40 loans, or 67.7% of the pool) with LTVs in excess of 100% is also above the average (60.4%) of the last 16 conduit transactions KBRA has rated over the past six months. The exposure to high leverage loans among these conduits ranged from 37.4% to 77.7%.

Higher leverage implies that borrowers have lower levels of equity in their property, bringing a greater probability of default and higher overall loss severity should a default occur.

Among other indications of leverage, one loan, which represents 1.2% of the pool, has existing subordinate debt in the form of mezzanine financing. Two loans, or 13.8% of the pool, have existing mezzanine debt and also permit future mezzanine financing. Eight additional loans, which make up 12.6% of the pool, permit future subordinate debt in the form of mezzanine financing.