The pain is spreading among business development companies that put money to work in an unloved corner of the capital markets: CLO equity.

Business development companies, closed-end funds that trade on an exchange, like stocks, are themselves out of favor. They are trading at steep discounts to their net asset values as many of their investments sour, causing them to trim payouts to shareholders. That’s particularly true of BDCs that invest in the equity, or most subordinate tranches of notes issued by collateralized loan obligations.

This, in turn, is putting pressure on BDCs to sell assets to repair their balance sheets.

BDCs and CLOs are similar animals; both pool money from investors to lend to below investment grade companies. But CLOs are private funds and generally invest in loans to large companies; these loans are broadly syndicated and relatively easy to buy and sell. Publicly traded BDCs, on the other hand, typically invest in loans to smaller companies as well as in other, less liquid assets – such as debt and equity issued by CLOs.

CLO securities sold off sharply early in the year, and, sure enough, several BDCs that reported first quarter earnings in early May, including TICC Capital, KCAP Financial and Ares Capital, have significant realized and unrealized declining valuations of their CLO holdings, including third-party and internal equity.

This comes on top of the drops that were realized in the fourth-quarter by two other BDCs that are major buyers, American Capital Corp. and Prospect Capital.

Prospect, which at nearly $1 billion has the most CLO equity holdings among BDCs, was scheduled to release its first quarter earnings after markets close on May 10.

TICC’s Cohen Calling the Market’s Bottom

But despite the deterioration in their CLO holdings, these BDCs appear to be maintaining their dividends, and in TICC’s case, at least, to be in no particular hurry to unload holdings.

To the contrary, TICC added $400,000 in CLO equity to its portfolio during the first quarter, as well as $2.7 million in CLO debt, according to filings and statements from chief executive officer Jonathan Cohen in the company’s quarterly earnings call on May 3. This despite a market slide that wiped $9.5 million off the value of its existing CLO holdings (including equity) in the first three months of the year.

Apparently the bargains were just too good to pass up...and the price points to low to unload existing holdings.

“What we had seen...during the March quarter was really the low point in asset valuations,” said Cohen, according to a transcript. “And so, we certainly didn’t want to sell either corporate loan assets or CLO equity assets that we expected would experience some price rebound over the course of the coming months, which is so far what’s been happening.”

On May 4, Ares Capital reported it wrote down $1.6 million in depreciation in CLO debt and equity (none of it third-party), which are held and managed at its asset management subsidiary, Ivy Hill. Ares has an approximate $20 billion CLO portfolio that is the largest of any BDC in the market.

KCAP followed on May 5, reporting net $11.6 million in realized and unrealized depreciation in assets “primarily attributable to our investments in CLO fund securities and our asset manager affiliates.”

In a report published late last year, Keefe Bruyette & Woods (the boutique investment bank acquired by retail brokerage Stifel Financial in 2013) had estimated that KCAP had approximately 13% of its portfolio in CLO equity. The CLO portfolio is managed by KCAP’s Trimaran Advisors asset management firm.

(According to KBW, KCAP is one of a few BDCs allowed to own a registered investment advisor because it is grandfathered from a Dodd-Frank requirement prohibiting such holdings by a registered investment company).

Most BDCs Are Sustaining Their Dividends

Nevertheless, KCAP is maintaining its dividend at $0.15 a share. The company reported a first-quarter net income of $4.8 million, compared to $6.8 million in the first quarter of 2015, on its direct lending business and its overall investment portfolio fell to $378 million from $488 million a year ago March 31.

Ares is also sustaining a $0.38 a share dividend that it has paid for the last five quarters, and TICC’s dividend remains at $0.29 a share.

As regulated investment companies, BDCs have a pass-through tax structure; they must distribute at least 90% of taxable income as dividends to investors to avoid paying corporate income tax.

The devaluations will continue to prompt the market to question whether it is appropriate for BDCs to invest in CLOs, and in particular in third-party CLO equity, given the need for cash flow to meet distribution requirements.

The problem isn’t just that a selloff in CLO equity is depressing the value of these securities; in some cases, investors in CLO equity are not receiving any interest. That’s because, as conditions in the leveraged loan market deteriorate, some CLO managers are being forced to divert funds normally reserved for equity holders to benefit more senior investors.

“We just don’t organize the business inside the BDC,” said Ares chief executive Kipp deVeer in a May 5 earning conference call, “because we don’t see it as the right place to own CLO investments.”

TICC and THL Credit both announced last year plans to unload their CLO equity due to shareholder pressure.

THL Credit, which still has 2% of its portfolio in CLO equity, did not provide a breakdown of quarterly depreciation in its first-quarter earnings tally, but reported it has lost $3 million in the fair market value of the three remaining CLO positions since those assets’ purchase dates (2013-2014). The Thomas H. Lee Partners affiliate, however, earned a 14.9% yield in its CLO positions, on top of the 14.8% yield in the fourth quarter.

Chief operating officer Terry Olson said during a May 6 conference call that the company has not changed its plans to sell off the CLOs based on the NAV impact, but has widened its sell offer on the positions based on the overall loan market recovery.

There’s a potential upside to interest rate diversions. In a March report, KBW analyst Ryan Lynch noted that purchasing additional leveraged loans ultimately benefits all investors in a deal, since it can boost the overall quality of the portfolio - including that of equity holders.

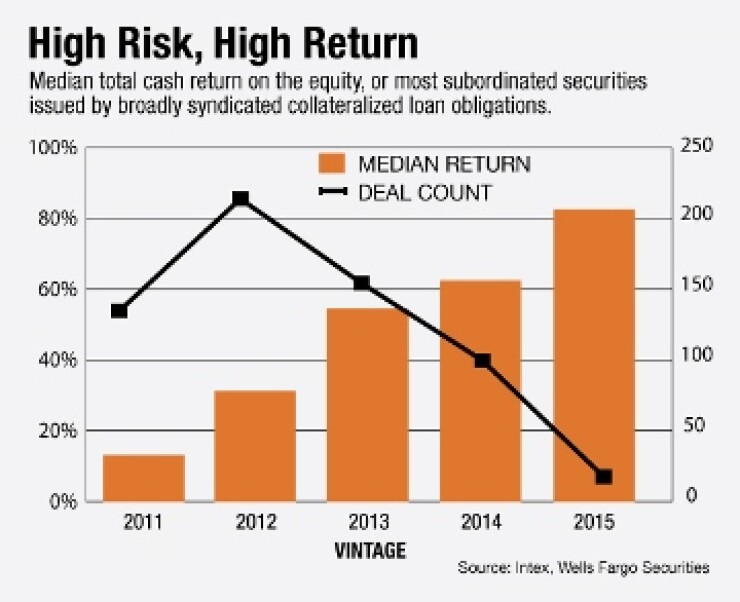

The report noted that, while CLO equity investments can be volatile, they “historically have produced attractive returns.”

But if those returns disappear, shareholders at some point may revolt. At least one BDC, TICC, is embroiled in a proxy battle with one of its largest shareholders, the specialty lending arm of private equity firm TPG, because of impairments in its CLO holdings.

On May 2, TPG send a letter to TICC asking its board of directors to address its concerns about the “rapid deterioration of the value of CLO equity investments held by TICC.”

“These consistent poor returns and ongoing deterioration of NAV per share are in part a result of a failed investment strategy into CLO equity,” the letter read. “This not only distorts management fees but also contributes to the unsustainable nature of TICC’s dividend.”

TPG points to a 26.6% slide in TICC’s NAV per share from $9.78 in March 2014 to $6.40 as of Dec. 31 of last year.

The fight with TPG has erupted well after TICC’s announced plans to divest of CLO equity assets. But that progress has been slowed by the fourth-quarter disruption of the corporate credit market as well as falling CLO equity valuations. (TICC’s Cohen did not address the TPG complaint during the May 3 analyst call).

“CLO equity pricing probably hit its low point mid-to-late February, March was an up month,” TICC’s Cohen said, according to the 1Q transcript. “The end of March was particularly strong for the CLO market, CLO equity market broadly defined and the month of April has been particularly strong in terms of CLO equity prices in the secondary market.

“We’re actually beginning to see some primary market activity. We continue to see significant strength across the CLO equity market concurrent with and partially as a function of, the strength in the syndicated corporate loan market,” he added.

Cohen had said in a previous earnings call that TICC remained “committed” to rotating out of CLO equity “over time.”