A newly closed fourth-quarter securitization turned out to be the hot topic in a third-quarter earnings report issued Tuesday by subprime auto lender Consumer Portfolio Services.

According to CPS chairman and chief executive officer Charles E . Bradley, Jr., CPS Auto Receivables Trust 2017-D last week priced at the tightest spread since its second transaction in 2014 – a result of the increasing demand for the bonds from the long-time auto ABS issuer.

Even with higher borrowing costs from increased funding rates for CPS (Nasdaq: CPSS), the overall cost of funds in deals continues to trend down because of the aggressive pricing CPS can command – which in this case was a blended coupon of 3.38% across five asset classes in the $196.3 million 2017-4 transaction. The spread on the Class A senior notes priced at a spread of only 33 basis points.

“We keep doing [ABS] deals and the deals just keep getting better,” Bradley told analysts in a third quarter earnings conference call Tuesday afternoon.

The 2017-D coupon bested the average 3.78% cost of all CPS’ year-to-date issuance of three prior securitizations, a rate only slightly up from last year in the third quarter (3.4%) but represents a streak of five consecutive quarters of declining funding costs for CPS’ deals.

“The ABS market has been very receptive,” said CPS chief financial officer Jeff Fritz, “and we’ve actually seen a generally improved cost of funds” since the second quarter of 2016.

In its earnings report, CPS reported slightly higher revenue of $109.5 million in the quarter compared to the third quarter of 2016 ($108.5 million) but a decline in earnings to $4.7 million from $7.3 million in year-over-year comparisons. The income decline was attributed to declining originations amid an industry-wide sales slump – a circumstance that is made more palatable because of CPS’ success in the securitization market.

Bradley told analysts that Irvine, Calif.-based CPS has instead focused on tightening up its underwriting and credit metrics - it's average borrower loan-to-value ratio of 111%, for example, is the company's lowest in five years, he said.

For the nine-month period ending in September, revenues were $327.2 million (up 4.2% from $314.1 million year-over-year) and net income was $13.7 million, down from $21.8 million a year ago.

Net charge-offs grew in the quarter, growing to 7.96% compared to 6.69% a year ago, but delinquencies over 30 downs declined slightly to 10.27% from 10.46% as of Sept. 30, 2016.

CPS, which purchases contracts originated through its network of partnering independent and franchised dealers, added $204.7 million in new loans to its managed portfolio in the quarter. The portfolio now stands at $2.35 billion, an increase from $2.34 billion in the second quarter and $2.3 billion in September 2016.

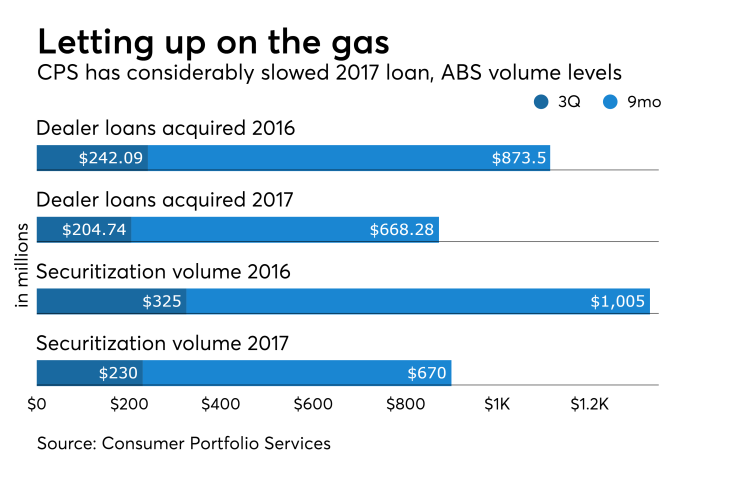

But CPS has drastically slowed its purchases of contracts to service and securitize this year. The volume of contracts acquired last quarter were down 16.7% from the $242.1 million in loans bought from dealers last year in the third quarter; year-to-date contract purchases through Sept. 30 were only $668.3 million compared to $873.5 million.

The level of securitization has leveled off to $670 million from the $1 billion in ABS deals issued in the first nine months of 2016.

“Our quarterly results are in line with our expectations as the company continues to prosper in a challenging environment," Bradley said, in an press release issued prior to the earnings call.