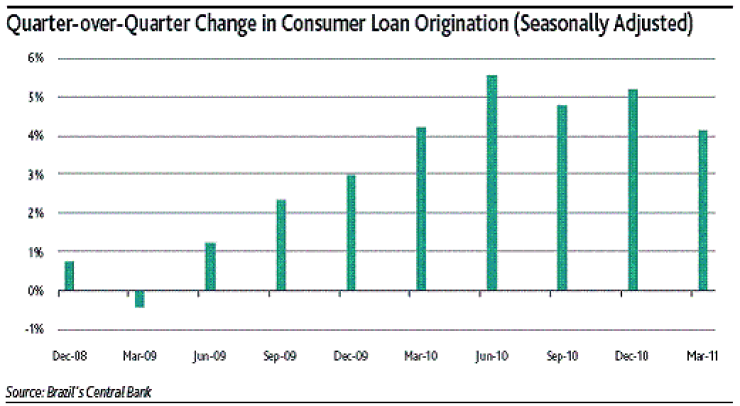

The Brazilian Central Bank’s efforts to rein in consumer lending growth are bearing fruit (see table below), a development Moody’s Investors Service sees as a credit positive.

The stock of total credit edged up 1% in March from February, and 2.7% in Q1 from Q4 of last year, when the Bank enacted the measures to dampen credit expansion. The figures were 1.3% for February month-on-month growth and 3.3% for Q4 from Q3, suggesting the tightened screws are working. “It’s noteworthy that the deceleration is more pronounced in the consumer segment, the driving force behind Brazil’s continued credit growth,” the agency said in a report.

White-hot credit growth had nudged up delinquencies in the sorts of consumer loans that are securitized. Only a few months ago, Moody’s warned of potentially slipping underwriting standards with lenders aggressively courting new borrowers.