It's been a little more than a month since Silicon Valley Bank and Signature Bank collapsed, amid missteps in risk and liquidity management on bank balance sheets, but the market volatility that followed still had enough time to dampen asset-backed securitization (ABS) production, worsening what was already expected to be a slower production year.

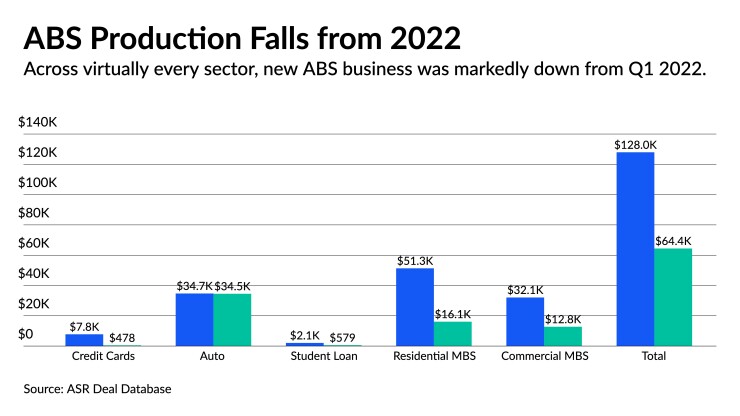

New originations amounted to about $64.4 billion through March 31, a 49.7% drop from last year's production, according to Asset Securitization Report Scorecard deal database. By the end of Q1 2022, issuers had brought $127.9 billion in asset-backed notes to the market, according to the data, which tracks activity in the core asset classes such as credit card, auto, student loans, residential mortgage-backed securities (MBS) and commercial MBS.

It confirmed what market professionals had expected after 2022 also shaped up to be a year of lower production numbers. Now, in the wake of the banking crisis, the Federal Reserve's bomb technician effort to contain inflation without endangering the stability of the markets, and widespread expectations for a recession—however mild—most market professionals expect tighter spreads to define the market for the time being.

Inflationary pricing dynamics did play a significant role the ABS issuance slowdown. Issuers looked to funding sources outside structured credit market, Theresa O'Neill, an ABS strategist at BofA Securities said in an interview.

By the time the fast-moving first quarter came to a close, however, the structured credit market was facing intense credit tightening pressures. Mismanagement of durations spurred the banking collapses, Tracy Chen a portfolio manager at Brandywine Global said during a webinar hosted by Franklin Templeton ahead of the FOMC meeting in March. Ultimately the crisis was expected continue to drive bank balance sheet consolidation, almost guaranteeing consequences for the structured credit market.

"Banks will tighten lending standards and we might have a credit crunch if that is not managed well," Chen said from the panel.

The tightening is broadly expected across lending markets, not just asset-backed securities, and the dynamic might actually do some of the work of the Fed's monetary policy, Chen said.

"There will be credit tightening and [that] may do the work of the Fed," Chen said. "Credit tightening had already begun prior to this banking crisis. We will see less credit availability, less origination and more difficulty in refinancing."

The view at BofA Securities is for spreads to tighten on benchmark assets in particular, such as credit cards and auto asset-backed securities, O'Neill said.

"For higher-yielding assets they could be more range bound," O'Neill said.

In some cases, even 'AAA's widened

For now, the structured credit market is managing its expectations of credit contraction amid drops in origination numbers across the board. Q1 2023 auto ABS production was $34.5 billion, falling short of $34.7 billion that issuers in the sector did in the same period a year earlier. The drop off was not nearly as severe as other sectors, according to the ASR database. The auto ABS sector was a standout as the most productive asset class, even though it experienced a drop in production like all of the other asset classes.

The residential MBS sector produced $16 billion in new paper, making it the second-busiest sector at the end of Q1 2023. After the same period last year, RMBS had done $51.3 billion in new paper, according to ASR.

The mortgage-backed securities market will be affected by the forced bank liquidations, Chen said, but it has plenty of liquidity support from a deep pool of buyers.

"The agency MBS market is very deep," Chen said. "We have foreign buyers, insurance companies, and money managers waiting to buy if the spread becomes cheap enough."

On the non-agency MBS side, however, spreads actually widened, especially on non-QM offerings that are so commonplace. The Mill City Mortgage Loan Trust, for instance, offered a coupon of 6.24% on its nearly two-year 'AAA' notes that priced on March 31, according to the ASR database. That compares with the 6.05% that the 'AAA's are paying on the 2023-NQM1 issuance that priced on February 24, but closed on the same day.

Contraction in action

Credit card ABS had a mixed story, because despite the looming recession fears and low issuance, ABS notes posted strong performances. The sector saw a staggering 93.8% plunge in new issuance, ending Q1 2023 with $478 million in originations, while the sector did $7.7 billion in new business in Q1 2022, the ASR database shows.

Deals that were completed, and that offered the highest quality paper, did see tighter spreads. The recent Discover Card Execution Note Trust, 2023 A-1, for instance offered $1.2 billion in notes at a spread of 72 over the I-Curve, slightly tighter than the expected 73-75 basis point range. Those spreads tightened markedly from the 81-82 bps guidance on the $1 billion offered through the DCENT 2022-A4, which paid 81 bps, according to the ASR deal database.

There will be credit tightening and [that] may do the work of the Fed.

Delinquencies and charge-off rates worsened in Q4 2022 compared with the year-earlier period. New credit card delinquencies were 5.9% in Q4 2022, up from 4.1% in the same period a year earlier, according to Moody's Investors Service. The increase is more pronounced because they are coming off of previously low levels, Pedro Sancholuz Ruda, a vice president of consumer ABS research said in an interview.

"These are coming off of historically strong levels of charge-off and payment rates, so there might be a trend toward normalization," Sancholuz Ruda said.

Underwriting standards had tightened, bearing out some of the expected credit tightening, while outstanding balances increased to 6.6% to $986 billion, up from $925 billion in Q3 2022. Payment rates, yields and excess spreads all improved as well, the rating agency said.

These metrics aren't necessarily contradictory, however, Sancholuz Ruda said. During periods of government stimulus in response to the COVID-induced economic slowdown, and payment rates increased significantly.

"The payment rates peaked last year at some point, and we should see some decreases—but only from historic levels, so ... not too large," said Sancholuz Ruda.

This trend is shifting, however. Moody's expects credit card payment rates to drop slightly during the rest of 2023, Sancholuz Ruda said.

The market moves on

Despite the various shockwaves spreading through the ABS market and expectations of credit tightening, the new issue market remains open, O'Neill said.

"Issuers are able to get deals done, and frequently they are oversubscribed," she said.

Moving ahead the ABS market's credit views remain, even though inflation trends appear to be loosening and federal officials take a more positive view on bank lending, which fuels the ABS pipeline.

"I have not really seen evidence at this stage suggesting a contraction in credit, although that is a possibility," U.S. Treasury Secretary Janet Yellen recently said during a news conference ahead of the World Bank Group's 2023 spring meetings. "I believe our banking system remains strong and resilient."