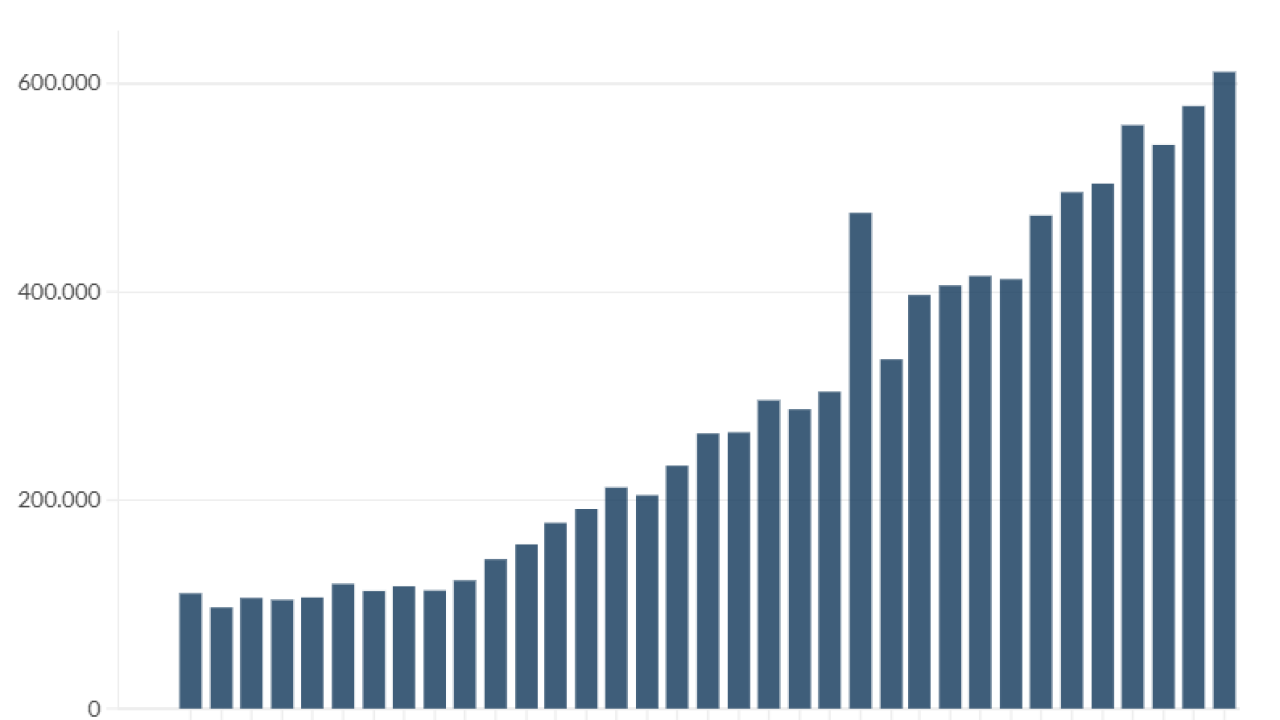

Subprime loans were the fastest-growing segment of the loan market, comprising a significant portion of new originations. An active securitization market fueled the rapid growth. Small nonbank lenders formed to take advantage of the profits to be made at the riskier edges of the market. Delinquencies rose. Lenders went deeper down the credit scale, targeting sub-subprime borrowers. Regulators issued warnings regarding rising delinquencies.

It all sounds like the lead-up to the 2007 subprime mortgage crisis, right? It's actually the state of the auto loan market in 2016. The similarities are there for all but the (willfully) blind to see. So where does this road lead?

To start, there are significant differences between today's subprime auto loans and subprime mortgages of the past. The auto loan securitization market is just a small fraction of the size of the subprime residential mortgage-backed securities (RMBS) market at its peak; thus, the auto loan securitization market's potential to disrupt the economy should be that much less significant. Moreover, this time around, large banks are generally not making the riskiest loans or taking the other side of big downside bets.

Further, the success of the auto loan securitization model is not premised on faulty assumptions of ever-rising collateral values and the ability of borrowers to refinance out of burdensome terms, as was the case when scores of adjustable-rate mortgages were set to readjust at the time of the housing market crash. There is also no government-sponsored buyer or guarantor in the market on the verge of collapse. Finally, auto loans are of much shorter duration and, in fact, delinquency rates may merely be normalizing, following a low-delinquency period.

Despite the differences, investors in subprime auto loans may not be in the clear. Asset-backed securities investors keep investing, relying on overcollateralization and subordination. However, similar credit enhancements were common in pre-crisis RMBS and investors have still sued and recovered significant claimed losses. Overextended borrowers once chose their cars over their homes, despite the prospect of rebounding home values. This time around, borrowers facing interest rates that exceed 20% may be more inclined to walk away from depreciating vehicles if they find themselves underwater and sinking deeper. Mechanisms that aid repossession of vehicles upon default provide some assurance of recoupment, but recovery of a continually depreciating asset is a doomed make-whole strategy.

Though some may dispute the magnitude of the issue, when credit enhancements can no longer absorb the impact of borrower defaults, cash flows will become constrained and bondholders and trusts will suffer losses.

A New York Times article in November observed that the impact of any fallout from subprime auto loans should be less damaging to the broader financial system. The largest banks, after all, are not providing the riskiest loan products. However, originations do not tell the full story. Some of the largest banks are managers, trustees and servicers in subprime auto loan securitizations.

And so the road seems to lead back where we have been before: There is the potential for significant losses by investors and hurt for lenders and other securitization participants. We know how it ended last time, and there are lessons to be learned from the litigation that ensued following the subprime mortgage crisis. The recent wave of RMBS litigation has exposed vulnerabilities in origination and the securitization process, from underwriting policies to pool selection, and from representations and warranties to deal structure. As we move forward through this cycle, the winners will be those who look in the rearview mirror to learn from the past and tackle problems larger than they may appear.

Joe Cioffi is chair of the insolvency, creditors' rights and financial products practice group at the New York-based law firm Davis & Gilbert LLP.