-

Like the stock market rout around news of the Omicron variant, the recent increase in payment suspensions suggests financial troubles associated with the pandemic may not be over.

November 29 -

However, the median monthly expense associated with financing is still lower than that for a lease.

November 24 -

The decline in late payments recorded in a trade group survey raise hope that many servicers will bear up under a wave of tighter enforcement coming from regulators.

November 10 -

The number of plans is less than one-fourth of what it was at its pandemic peak, and many are expiring, so the group will replace the weekly measure with a monthly one.

November 8 -

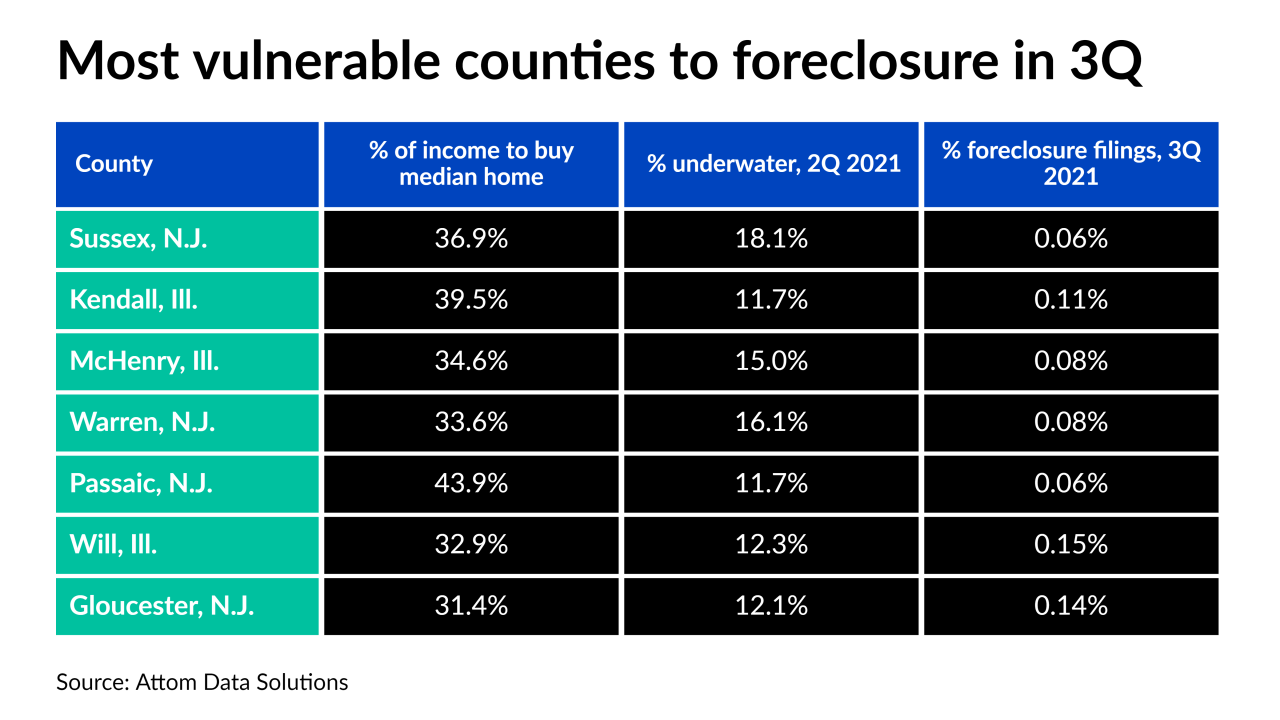

Counties in the West faced the least risk from pandemic distress in the third quarter, according to Attom Data Solutions.

October 21 -

The drop over the 30-day period was in line with a large number of plan expiration dates, and occurred despite the extension of an initial filing deadline for government loans.

October 15 -

Following the federal moratorium’s end, the number jumped, marking the highest quarterly growth on record, according to Attom Data Solutions.

October 14 -

Two Wall Street firms and a single-family rental investor have purchased portions of the government-sponsored enterprise's latest nonperforming loan package.

October 12 -

Those leaving forbearance or other relief plans generally had higher credit utilization rates, were more likely to have mortgages, and experienced lower levels of bank card delinquencies, according to TransUnion.

October 7 -

Common Securitization Solutions has disbanded a group of independent board members originally brought on in early 2020 to look into using the government-sponsored enterprises’ platform to serve a broader market.

October 6 -

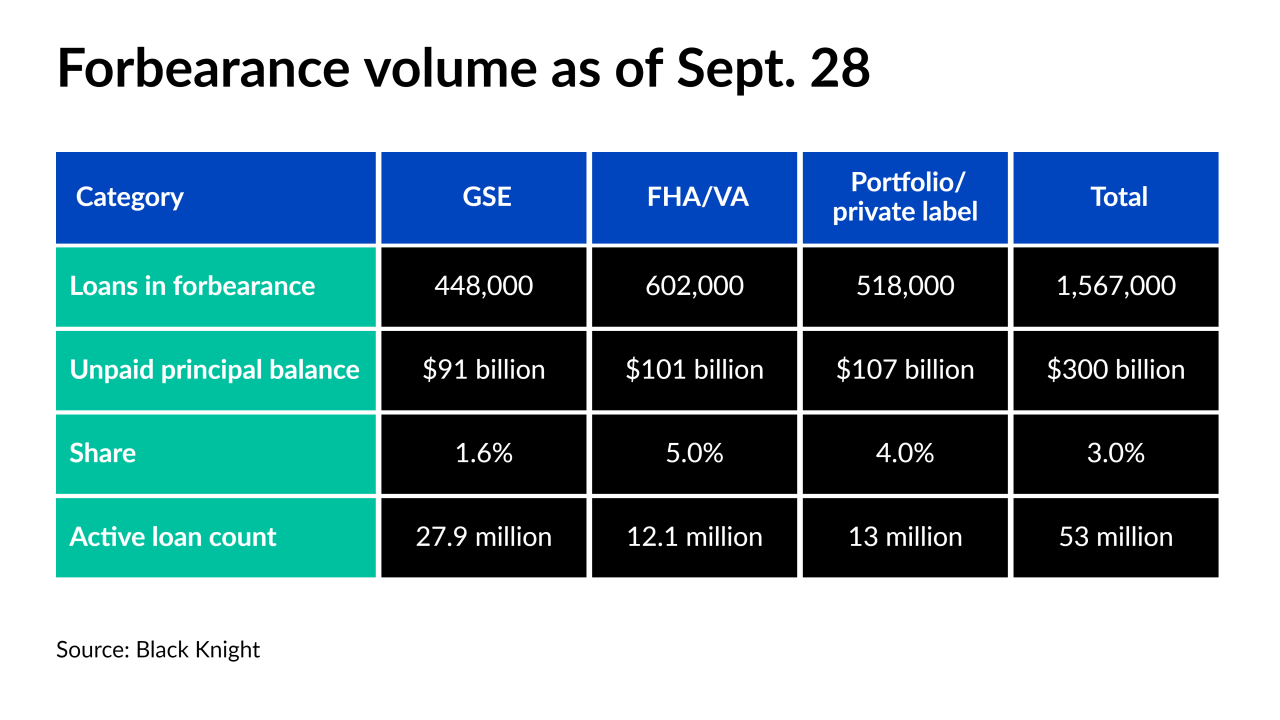

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

While the collateral is high quality, analysts raised concerns about a number of key parties that they feel lack robust securitization experience and financial strength.

September 30 -

CIM is secured by home loans making the most of second chances, and borrowers retaining their homes throughout several economic dips.

September 29 -

Despite the increase, adjustments to single-family loan terms aimed at making payments more affordable remain historically low at the government-sponsored enterprises. But they could grow in line with forbearance expirations soon.

September 24 -

The need to size up the impact of hurricanes and pollution is increasing and current measures aren’t as precise as credit or rate models, according to the Research Institute for Housing America.

September 23 -

The decline from 4.4% in July and 6.88% a year ago brings the number much closer to pre-pandemic norms, but foreclosure starts are a different story.

September 22 -

Elizabeth Warren asked the Federal Reserve this week to force the spinoff of the bank’s nonbanking operations. Wells, which was recently hit with another $250 million fine, countered that it has made significant progress in improving its risk management and addressing misconduct.

September 14 -

About 400,000 plans are scheduled to drop out in September based on the limits afforded by the CARES Act.

September 3 -

The extension in the number of days investors are locked out of the process comes amid a broader push by the Biden administration to boost access to affordable housing.

September 1 -

More than 500,000 houses were potentially affected by this type of damage from the more recent storm, which was the second-most intense storm in Louisiana’s history.

August 31