-

Recent remarks from Federal Reserve Chair Powell suggest more upward movement is ahead.

June 23 -

The latest Federal Reserve move to combat inflation led to a weekly increase of more than 50 basis points.

June 16 -

Rising interest rates eliminated any refinance incentive for 30% of the loans analyzed by Standard & Poor's, marking a turnaround from the start of the year when prepay speeds were expected to increase

June 14 -

A positive employment report, robust consumer spending and Fed comments on inflation counter measures drove rates upward.

June 9 -

The inventory shortage is beginning to ease, while demand is slowing due to high prices and rising mortgage rates.

June 3 -

With anticipated Federal Reserve moves already factored in, inflation and jobs data could play a bigger role in driving movement over the near term.

June 2 -

Averages rose sharply across the board, as investors focus on the central bank's response to ongoing economic and geopolitical developments.

March 24 -

Executives speak on the uncertainty created by the Russia-Ukraine war and Federal Reserve announcements.

March 14 -

In addition to the Russia-Ukraine conflict, persistent inflationary pressures and expected monetary policy moves are contributing to volatility.

March 10 -

The effect of the conflict and upcoming Fed announcements have left much of the industry guessing about what happens next.

March 3 -

Strong economic data was countered by international political developments, sending the 30-year rate lower for the first time in a month.

February 24 -

Inflation data showing a 7.5% increase in consumer prices will likely lead to Federal Reserve moves that apply continued upward pressure.

February 10 -

The latest jobs and economic numbers pave the way for additional upward movement throughout 2022, analysts said.

January 13 -

December's activity was down 18% from November, led by a 23% drop in purchase volume and a 17% decline in rate-and-term refinancings, Black Knight said.

January 10 -

Despite the rising number of COVID infections, investors made no moves that would apply downward pressure.

January 6 -

The central bank’s new tone has many in the industry planning for potential volatility in 2022.

December 16 -

However, economic data points to likely future increases, with investors awaiting numbers from upcoming jobs report.

October 7 -

Taper announcement, slowing COVID cases help remove downward pressure, leading to increases across all loan-term types.

September 30 -

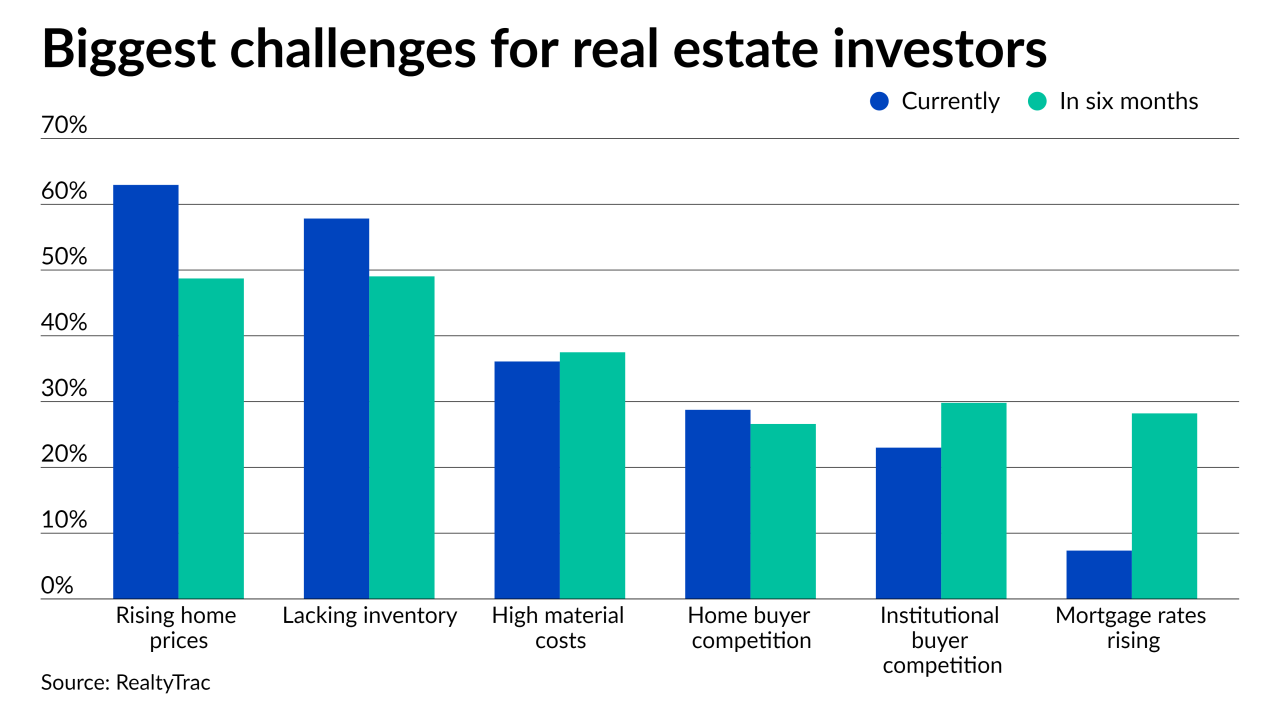

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Foreign investment helped offset a slowing domestic recovery, causing few ripples for the week, but economists expect future taper of bond purchases to lead to upward movement.

September 23