Mortgage rates climbed again

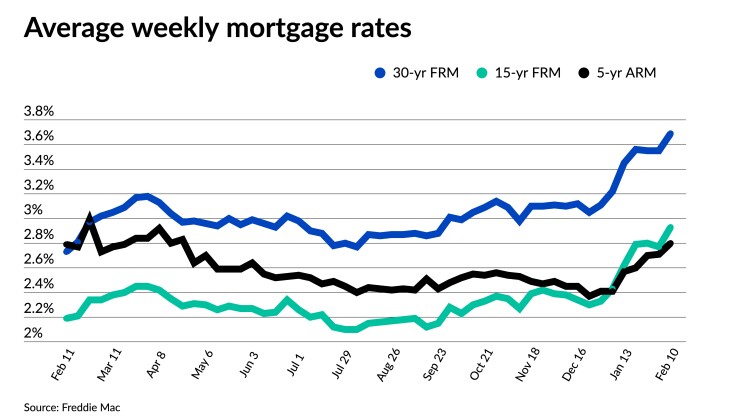

The 30-year fixed-rate mortgage averaged 3.69%, jumping another 14 basis points from the previous week, according to Freddie Mac’s Primary Mortgage Market Survey. The survey covered the seven-day period ending Feb. 10. In the same week a year ago, the average was 2.73%.

“The normalization of the economy continues as mortgage rates jumped to the highest level since the emergence of the pandemic,” said Sam Khater, Freddie Mac’s chief economist, in a press release.

Recently released economic data point to continued inflationary pressures in the short term, said Paul Thomas, Zillow’s vice president of capital markets. “Payroll data released late last week showed much stronger than anticipated job and wage growth, as many expected some slowdown due to the surge in COVID-19 cases in January,” he noted in a research blog.

Meanwhile, all vectors indicate that the Federal Reserve will make moves that will likely drive interest rates even higher in March, Thomas said. Consumer price data released on Thursday showed

After spending much of 2021 well under 3%, the 30-year average has come in above that threshold in 18 out of the last 20 weeks. The rate has risen 58 basis points since the final week of last year.

According to Khater, rate increases “likely will have an adverse impact on home buyer demand.” But thus far this year, home buying interest has

After declining slightly a week ago, the average rate for the 15-year fixed mortgage came in higher at 2.93%, up 16 basis points from 2.77%. One year ago, the 15-year rate averaged 2.19%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage increased for the fifth consecutive week, averaging 2.8% compared to 2.71% seven days earlier. In the same weekly period last year, the average rate came in at 2.79%.