-

Increasing COVID-19 numbers offset promising economic figures, resulting in minimal changes.

August 26 -

Refinancing, high home prices, the concentration of pandemic-related hardships in the FHA market, and the lingering impact of last year’s market disruption all likely played a role in the intensified discrepancy.

August 20 -

Meanwhile, investors await word from the central bank regarding monetary policy, as limited housing supply continues to drive prices upward.

August 19 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18 -

The wholesale lender has a cost structure aimed at beating the competition in a rising rate environment, Chairman and CEO Mat Ishbia said on the second quarter earnings call.

August 17 -

While the company's mortgage originations saw a 46% annual drop in gain on sale margin, it anticipates that annual volumes will exceed 2020 levels.

August 13 -

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10 -

An equal split of refinance and purchase rate locks occurred during July, helped by elimination of the adverse market fee, Black Knight said.

August 9 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

Such applications have declined on an annual basis for the past three months, but overall weekly numbers increased due to a jump in refinances amid plummeting rates.

July 28 -

Despite lower numbers, refi applications continued trending strongly, while purchases fell close to lows from more than a year ago.

July 21 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

“One” is the first in a series of non-agency mortgages the wholesaler plans to introduce this year.

July 15 -

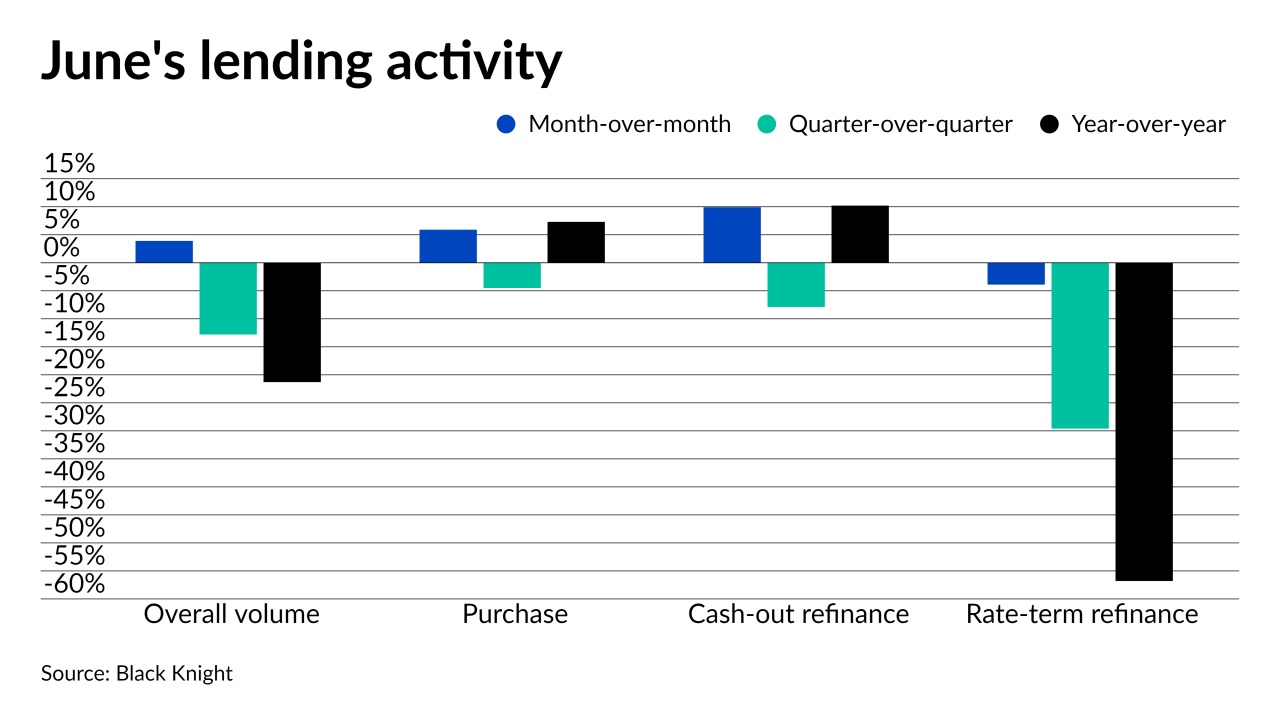

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

Increases in refinances, both in applications and average size, help lead overall numbers higher

June 23 -

The data also showed that more purchase loans were made to low- and moderate-income borrowers last year, but fewer refinances.

June 18 -

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16