-

The tech-driven asset management firm announced it had closed a $115 million asset-backed securities deal led by Cantor Fitzgerald, with unsecured consumer loans acquired from Prosper Marketplace.

August 22 -

The LendingPoint 2019-1 trust will market $169.4 million in notes backed by 18,760 loans with a collective balance of $178.3 million.

August 20 -

The LendingClubs and SoFis of the world have a big head start, but HSBC's U.S. unit says its partnership with the fintech Avant will help it close the gap in online personal loans.

August 14 -

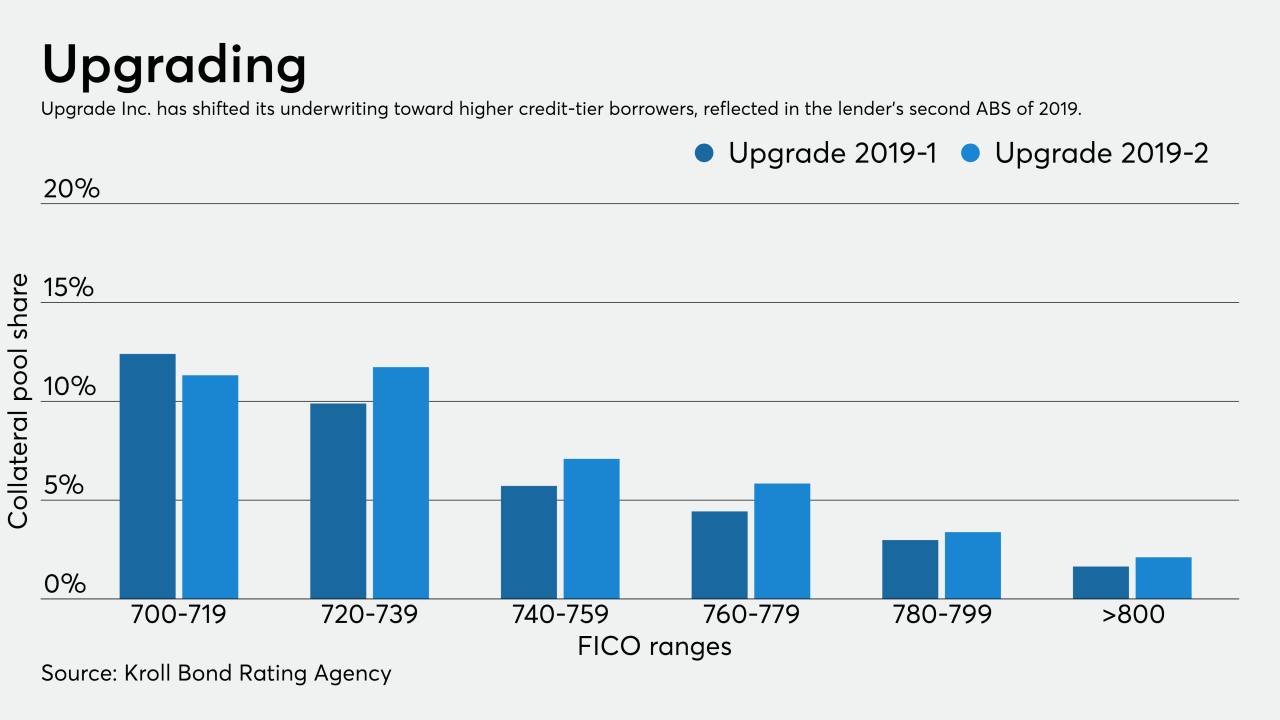

Online consumer lender Upgrade Inc. is including more higher-credit tier borrowers in its next securitization, reflecting the company’s focus this year on reducing lending to non-prime credit segments.

August 12 -

The online SME lender is marketing $198.45 million in notes backed by U.S. originations. Funding Circle has previously issued ABS deals backed by small-business loans in its native UK.

August 7 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6 -

The Upstart Network, the first and only startup to participate in the bureau’s program for promising digital platforms, claims that using nontraditional credit data items has helped loan volume and affordability.

August 6 -

The Atlanta fintech, whose shares have plummeted since it went public last year, also said it will stop providing financial guidance to its investors.

August 6 -

Though the use of alternative data in lending is seen by some as untested, several fintechs say they couldn't function without it.

August 5 -

The decision is a blow to OnDeck, which said Monday that it intends to pursue a bank charter, either by applying for one or by buying a bank.

July 29 -

The marketplace lender is marketing its third deal of 2019, and second issuance of notes through a newly formed master trust backed by unsecured consumer loans.

July 22 -

MPL securitizations have yet to face a credit-cycle test. The discussion over how they will handle one is intensifying.

July 14 -

In a downturn, some fintechs, such as independent lenders, will be more vulnerable to economic forces than those working to service banks' regulatory needs.

June 28 -

Kroll Bond Rating Agency is projecting lower net losses on Marlette Funding’s next online unsecured consumer-loan securitization pool because of slightly improved credit metrics.

June 24 -

The marketplace lender has garnered improved ratings in its latest securitization of unsecured consumer loans, a pool featuring a higher proportion of prime borrowers and additional credit enhancement compared to its prior deal.

June 17 -

The executives were hired for their focus on loan origination, portfolio management and securitization.

June 17 -

The two agencies offer fundamentally different views of the level of risk in ABS issuances by Avant, Prosper Marketplace, LendingClub and other online lenders.

May 27 -

Online lenders now have close to 40% of the unsecured personal loan market, much of which is refinanced credit card debt. Banks' card portfolios are taking a hit.

May 23 -

The online small-business lender said it tightened its underwriting standards during the first quarter as credit quality worsened.

May 2 -

Previous Freedom Financial securitizations were focused on the lender's controversial subprime consolidated loan originations.

April 24