-

The loans have an average balance of €18.5k (US$22.1k) and went to 39,698 borrowers; they are secured by a pool of new (46.8%) and used (53.2%) cars, according to Moody's Investors Service.

September 24 -

The €684.8 million transaction is backed primarily by new-car leases to German prime borrowers. It's the 21st German securitization by FCE Bank, Ford's UK-based captive finance arm.

September 13 -

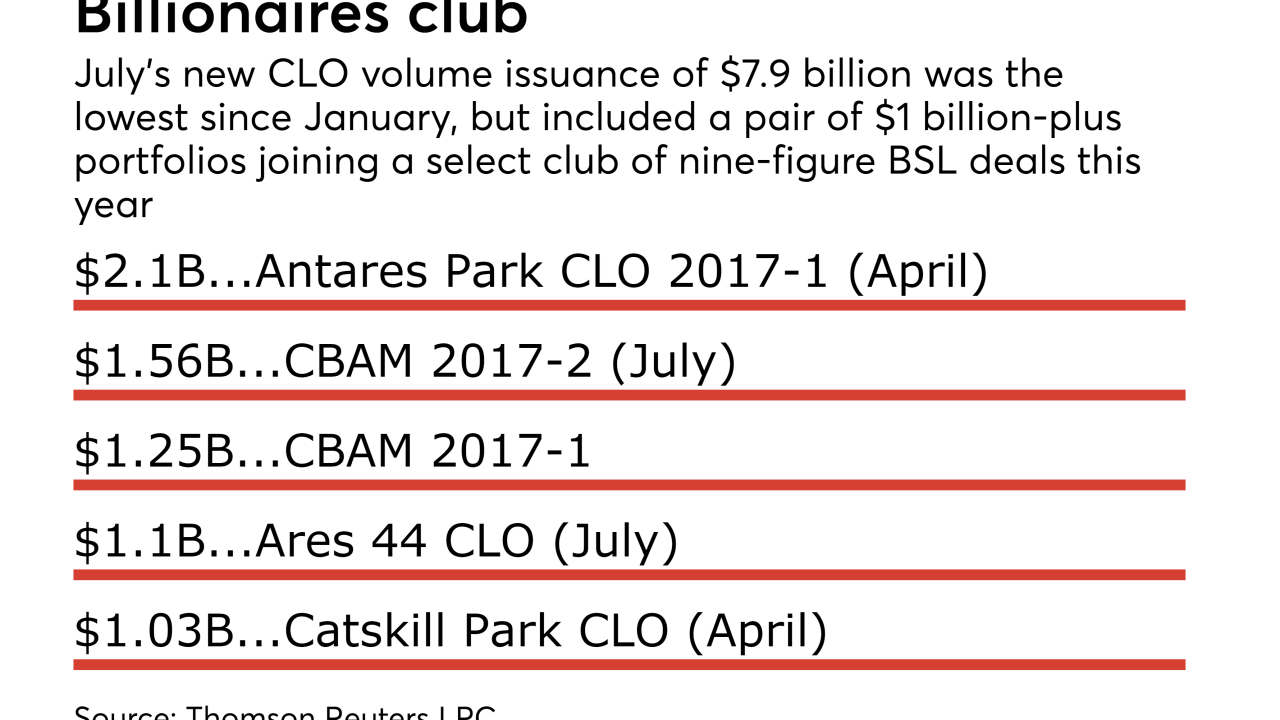

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

The proceeds will be used to repay three existing bonds series, as well as pay down commercial paper and credit line debt of the real estate investment trust, formerly known as Land Securities.

September 7 -

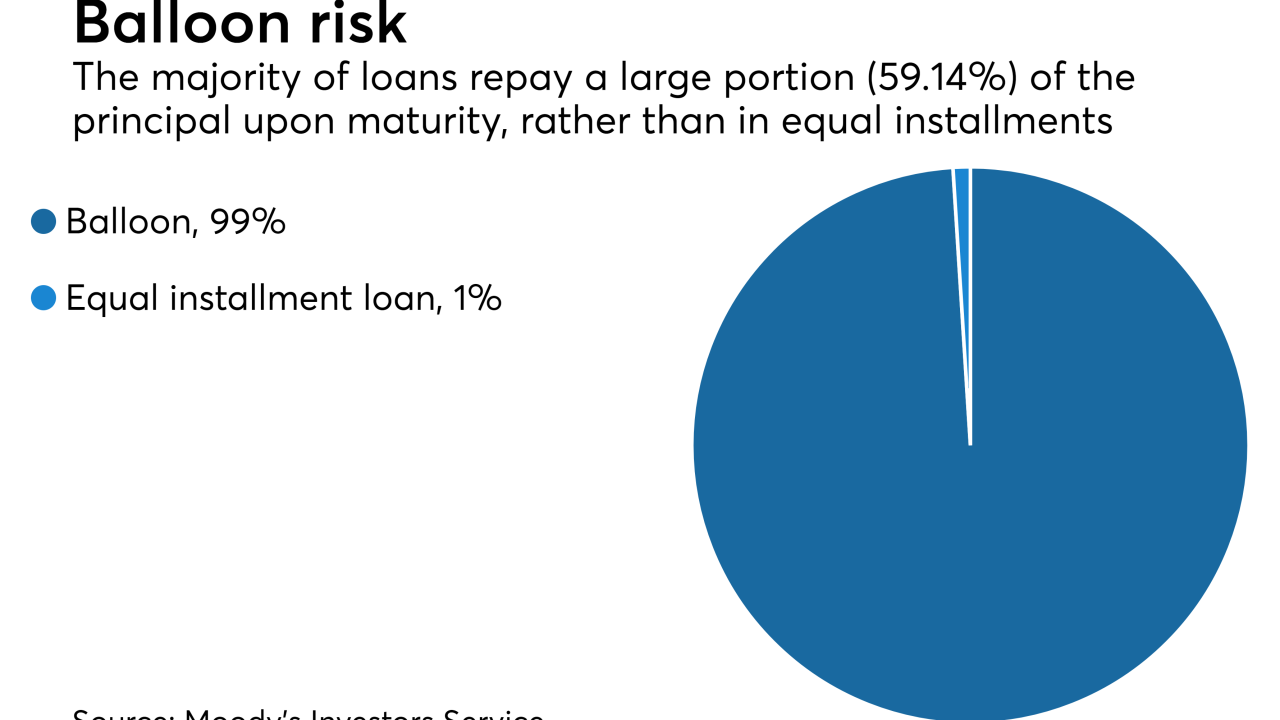

S&P says exclusion of the value of "personal contract purchase" balloon payments from Santander's Motor 2017-2 transaction will benefit the deal through excess spread and recoveries from contract defaults.

September 4 -

CVC Cordatus Loan Fund IX is CVC's ninth overall Euro-denominated CLO, and only the second that will price since early June, according to Thomson Reuters LPC.

September 1 -

The size of the two classes of notes on Volkswagen Financial Services' Compartment Driver UK SK deal is to be determined; they will be backed by receivables on 24,238 prime retail customer lessors.

August 29 -

The prime mortgage securitization is the fourth by Bank Nagelmackers, a small player on the Belgian mortgage scene that is owned by a Chinese insurance group comglomerate.

August 29 -

The pricing of BlueMountain Fuji's second-ever transaction pushed the monthly new issuance total to $10.1 billion - only the third time since last November the market has eclipsed the $10 billion barrier.

August 27 -

The diverse mix of collateral ranges from vehicles and medical equipment to high-end fitness machines and tanning beds that Abcfinance provides for German SMEs and entrepreneurs.

August 18 -

In Europe, €1.6 billion of new collateralized loan obligations priced during the month July, taking issuance volume for the year to date to €10 billion across 25 deals. That's in line with the €9.7 billion issued during same period last year.

August 7 -

A German judge's support behind efforts to ban diesel-engine vehicles in Stuttgart could set in motion a decline in performance for German and European auto loan securitions, says Moody's.

August 6 -

Belgium-based diamantaire Diarough is offering $150 million in notes backed primarily by its inventory of rough and polished diamonds, according to a presale report from Kroll Bond Rating Agency.

August 3 -

An affiliate managing the loan for the reinsurance giant's investment advisory arm will keep a horizontal equity strip of the deal for dual EU/US risk retention compliance.

August 1 -

While leveraged loans may use prime as a fallback, getting unanimous consent from collateralized loan obligation investors to use an alternative benchmark could be a challenge.

July 30 -

Moody's believes that rules grandfathering existing transactions increase the risk that these deals could be left unhedged; it may downgrades some European RMBS and U.S. student loan-backed securities.

July 27 -

One potential area of concern is commercial real estate; more than two-thirds of respondents in the latest IACPM survey quarter believe defaults will increase in this area over the next year.

July 24 -

The Series 2017-F1 transaction is secured by receivables from CAN$1.78b in dealer advances; the senior tranche of notes earned triple-A from both Moody's and DBRS.

July 13 -

The UK lender has issued eight prior securitizations, but Charter Mortgage Funding 2017-1 is its first that does not include either non-conforming or 'buy-to-let' loans in the collateral.

July 13 -

The £310.3 million (US$401.26 million transaction, Twin Bridges 2017-1, is backed by 965 prime mortgages underwritten to UK landlords by Paratus AMC Ltd., formerly known as GMAC-RFC.

July 6