-

The majority of borrowers impacted by Hurricane Harvey have a significant amount of equity, while many in Hurricane Irma disaster areas have limited or negative equity, according to Black Knight Financial Services.

October 2 -

The deal, Sunrise SPV 20 S.r.l., is collateralized by more than 120,000 auto, furniture and personal loans originated by the Italian lender.

September 28 -

Most of the 181 jets used as collateral were acquired from GE Capital Corp. in 2015; proceeds from prepayments and liquidations can be used to acquire additional aircraft.

September 27 -

The loans have an average balance of €18.5k (US$22.1k) and went to 39,698 borrowers; they are secured by a pool of new (46.8%) and used (53.2%) cars, according to Moody's Investors Service.

September 24 -

Mortgage delinquencies in areas affected by Hurricane Harvey last month were 16% higher than in July, according to Black Knight Financial Services.

September 21 -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Cisco DeVries, the chief executive of Renew Financial, said the bills will bring much-needed stability to Property Assessed Clean Energy, which uses a property assessment to finance upgrades.

September 18 -

The €684.8 million transaction is backed primarily by new-car leases to German prime borrowers. It's the 21st German securitization by FCE Bank, Ford's UK-based captive finance arm.

September 13 -

Hurricane Irma could potentially affect more private-label mortgage securities collateral than any other recent storm.

September 11 -

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10 -

The proceeds will be used to repay three existing bonds series, as well as pay down commercial paper and credit line debt of the real estate investment trust, formerly known as Land Securities.

September 7 -

As housing demand continues to challenge low levels of supply, home prices are overvalued in 34% of the largest U.S. metropolitan areas, according to CoreLogic.

September 5 -

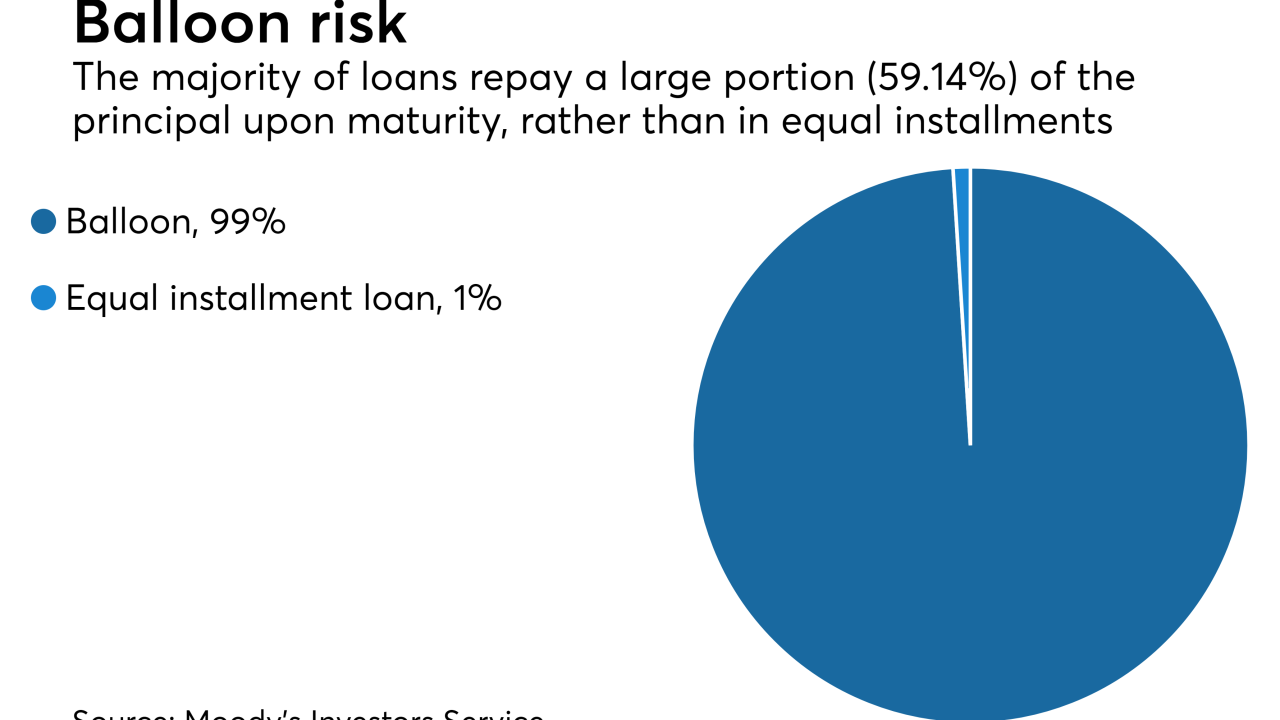

S&P says exclusion of the value of "personal contract purchase" balloon payments from Santander's Motor 2017-2 transaction will benefit the deal through excess spread and recoveries from contract defaults.

September 4 -

CVC Cordatus Loan Fund IX is CVC's ninth overall Euro-denominated CLO, and only the second that will price since early June, according to Thomson Reuters LPC.

September 1 -

The $418m OSCAR US 2017-2 transaction is the 7th securitization of prime auto loans originated by Orient Corp. (or Orico) in Japan and packaged into U.S.-dollar denominated securities.

September 1 -

The size of the two classes of notes on Volkswagen Financial Services' Compartment Driver UK SK deal is to be determined; they will be backed by receivables on 24,238 prime retail customer lessors.

August 29 -

The prime mortgage securitization is the fourth by Bank Nagelmackers, a small player on the Belgian mortgage scene that is owned by a Chinese insurance group comglomerate.

August 29 -

The pricing of BlueMountain Fuji's second-ever transaction pushed the monthly new issuance total to $10.1 billion - only the third time since last November the market has eclipsed the $10 billion barrier.

August 27 -

The diverse mix of collateral ranges from vehicles and medical equipment to high-end fitness machines and tanning beds that Abcfinance provides for German SMEs and entrepreneurs.

August 18 -

Lawrence Berkovich joins as a partner from a nearly two-year stint at Ashurst; he follows in the footsteps of five other A&O finance practice partners who left Ashurst's NY office last year.

August 17