-

More than 90% of the collateral for Ford Credit Canada's CAN$614M transaction is popular light-duty trucks that have propelled the automaker's leading 15.5% domestic market share.

October 16 -

Ocwen Financial Corp. is settling allegations by Alabama and Minnesota that it engaged in improper mortgage activities, bringing the total of states it has settled with to 17.

October 13 -

The allure of promised savings persuaded most Chicago City Council members.

October 11 -

Over 80% of the cars are diesel-engine vehicles, bringing potential volatility to the portfolio cash flows given the public debate over potential panning such cars in several European urban centers.

October 11 -

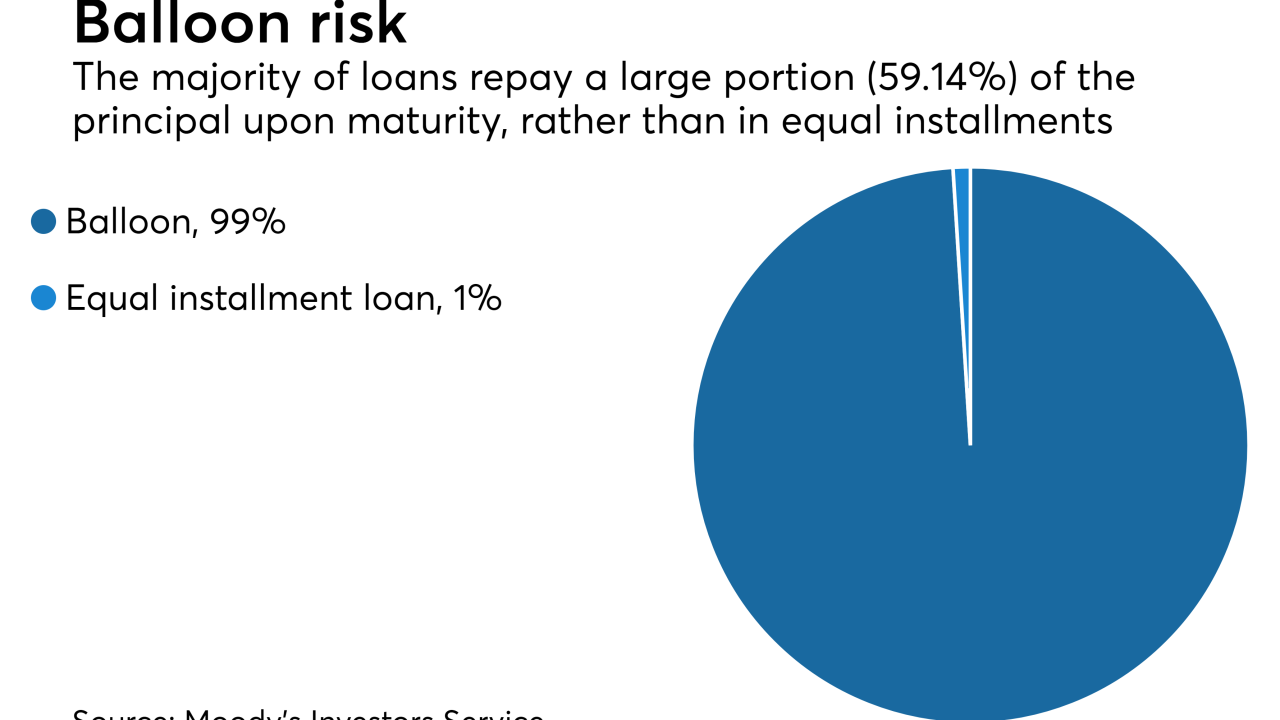

A wave of corporate loan refinancings is putting collateralized loan obligations afoul of a covenant designed to safeguard their own investors.

October 11 -

Belmont Green Finance, which began originating loans in late 2016, has gathered up its first round of originations through 3Q2017 in a transaction that will issue up to £230.6 million in notes.

October 6 -

Chicago hopes to get into the market by year's end with the first of up to $3 billion of refunding under new credit.

October 5 -

Ocwen Financial Corp. received more breathing room on the legal front as the Securities and Exchange Commission is not pursuing an enforcement action against the company regarding its debt collection practices.

October 4 -

The French specialty lender, owned by a consortium of mutual insurers, is pooling over 54,000 loans it originated and services for clients of its shareholders.

October 4 -

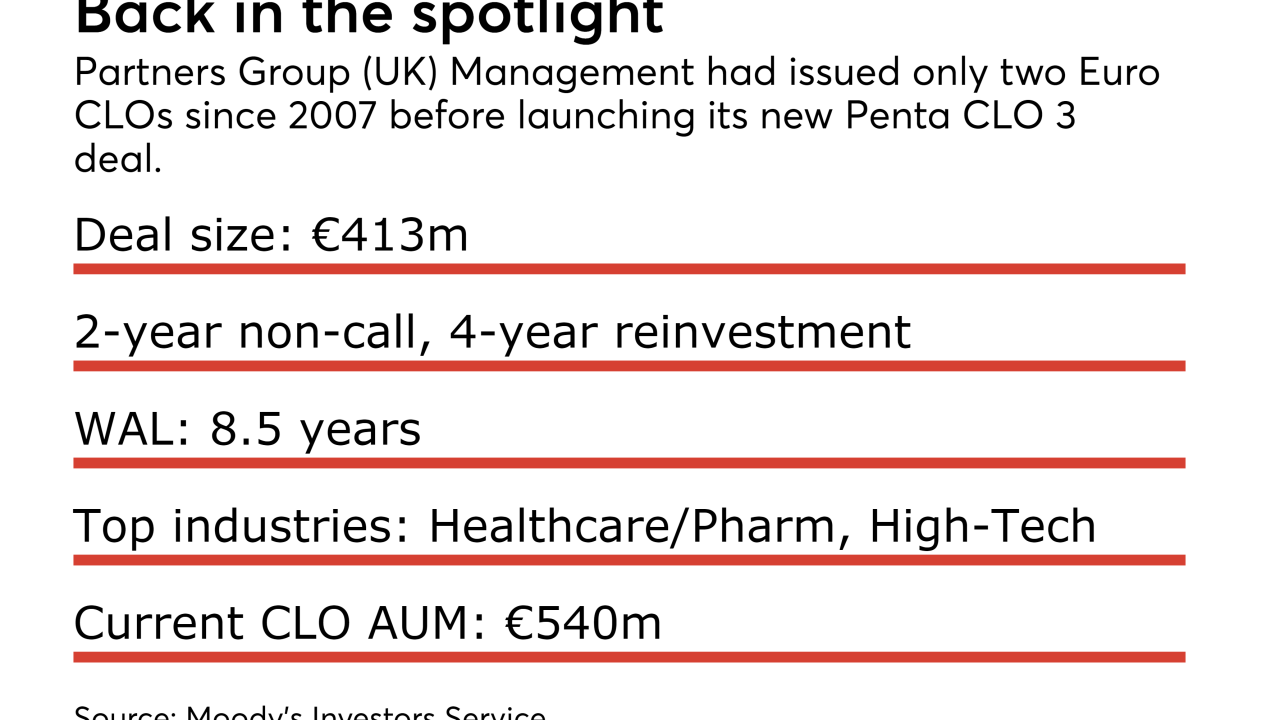

Penta CLO 3 is the first CLO since 2015 for the UK subsidiary of Swiss global asset management Partners Group Holdings AG.

October 2 -

The majority of borrowers impacted by Hurricane Harvey have a significant amount of equity, while many in Hurricane Irma disaster areas have limited or negative equity, according to Black Knight Financial Services.

October 2 -

The deal, Sunrise SPV 20 S.r.l., is collateralized by more than 120,000 auto, furniture and personal loans originated by the Italian lender.

September 28 -

Most of the 181 jets used as collateral were acquired from GE Capital Corp. in 2015; proceeds from prepayments and liquidations can be used to acquire additional aircraft.

September 27 -

The loans have an average balance of €18.5k (US$22.1k) and went to 39,698 borrowers; they are secured by a pool of new (46.8%) and used (53.2%) cars, according to Moody's Investors Service.

September 24 -

Mortgage delinquencies in areas affected by Hurricane Harvey last month were 16% higher than in July, according to Black Knight Financial Services.

September 21 -

Mortgage investors want Freddie Mac to align its policy with Fannie Mae's when it comes to how delinquencies related to Hurricane Harvey affect credit risk transfer deals.

September 19 -

Cisco DeVries, the chief executive of Renew Financial, said the bills will bring much-needed stability to Property Assessed Clean Energy, which uses a property assessment to finance upgrades.

September 18 -

The €684.8 million transaction is backed primarily by new-car leases to German prime borrowers. It's the 21st German securitization by FCE Bank, Ford's UK-based captive finance arm.

September 13 -

Hurricane Irma could potentially affect more private-label mortgage securities collateral than any other recent storm.

September 11 -

New issuance of U.S. collateralized loan obligations reached $11.9 billion across 24 deals, taking year-to-date volume past $72.3 billion, according to Thomson Reuters LPC. The eight-month total is higher than the total issuance for all of 2016.

September 10