It's hard to use your own real estate as an investment. Financial advisors

Investing in real estate companies, however, is a different story. Through exchange-traded funds (ETFs), real estate investment trusts (REITs) and other assets, investors can tap into the value of apartment buildings, rental homes, offices, warehouses, trailer parks and other properties across the country.

And over time, those values tend to rise. Ten years ago, the average price of a house sold in the United States was $324,400, according to

Most important for investors, real estate is fundamentally different from other sectors, which means more diversification.

"Real estate funds are a good diversifier in a stock portfolio," said Ed Snyder, president of

But is now a good time to invest in these funds? The post-pandemic period has been a roller coaster for American real estate. House prices, for example, rose steeply from 2020 through 2022, and then suddenly plunged by almost 9% at the start of 2023.

"The past few years have been pretty volatile on a calendar year basis," Snyder said.

That's why it's important to look beyond the calendar year. Over the longer run, from 2013 to 2023, many real estate funds have paid handsome returns. According to data from Morningstar Direct, many of the top 20 funds have yielded close to 10% per year.

READ MORE:

In the No. 1 spot is the Baron Real Estate Institutional fund, with a 10-year annualized return of 9.33% — considerably higher than its one-year return of 6.37%. The fund invests 80% of its assets in the stocks of real estate companies, both within and outside the U.S.

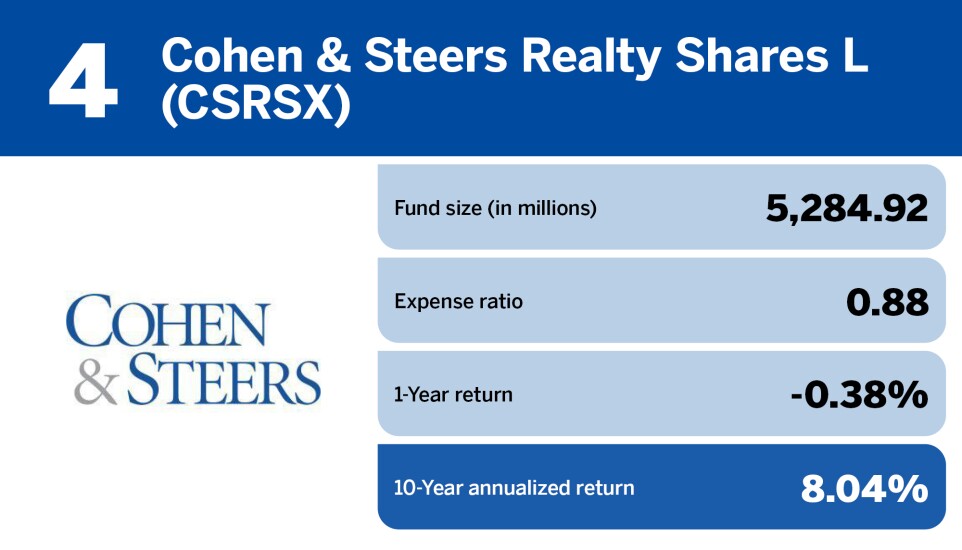

In second place is Cohen & Steers Real Estate Securities A, with an annualized return of 8.38%. And the bronze winner is Cohen & Steers Institutional Realty Shares, which yielded 8.24% per year, on average. Both funds used roughly the same strategy as Baron Real Estate, and both had negative one-year returns: minus-0.21 and minus-0.14, respectively.

How did these funds, which were so disappointing in the short term, come out on top by the end of the decade? Their success is a reminder that real estate, even as an ETF or a mutual fund, is a long game.

"I think it's a good time to invest because I'm not trying to time the market but, rather, building diversified portfolios," Snyder said. "And real estate funds are part of that."

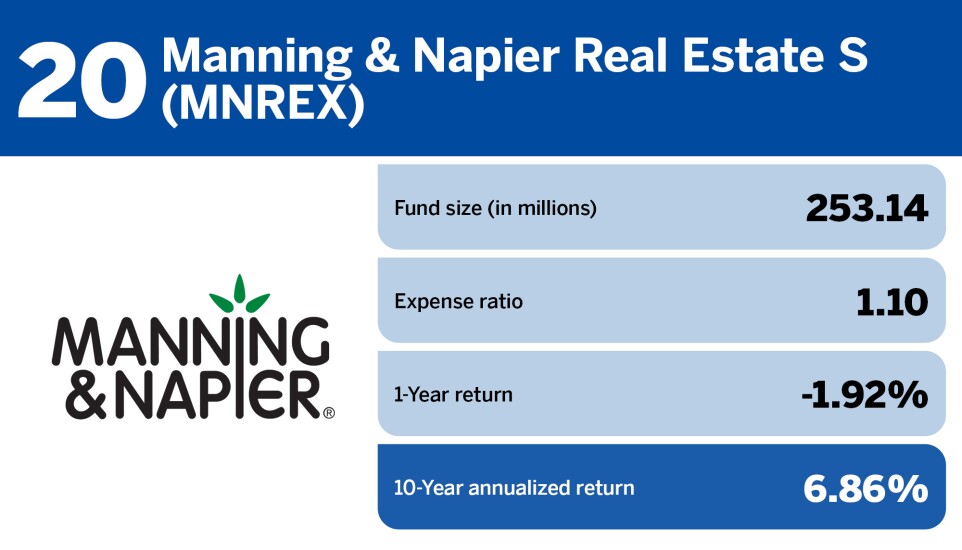

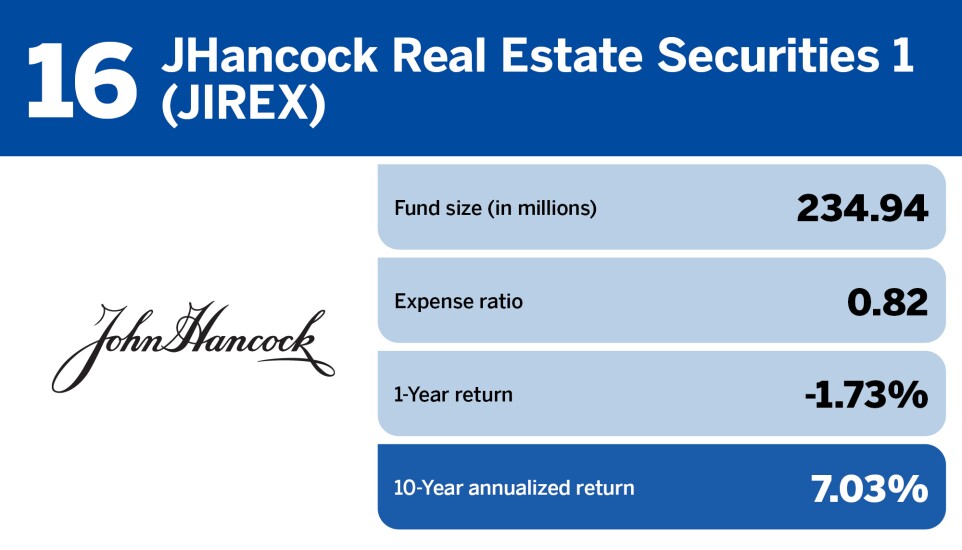

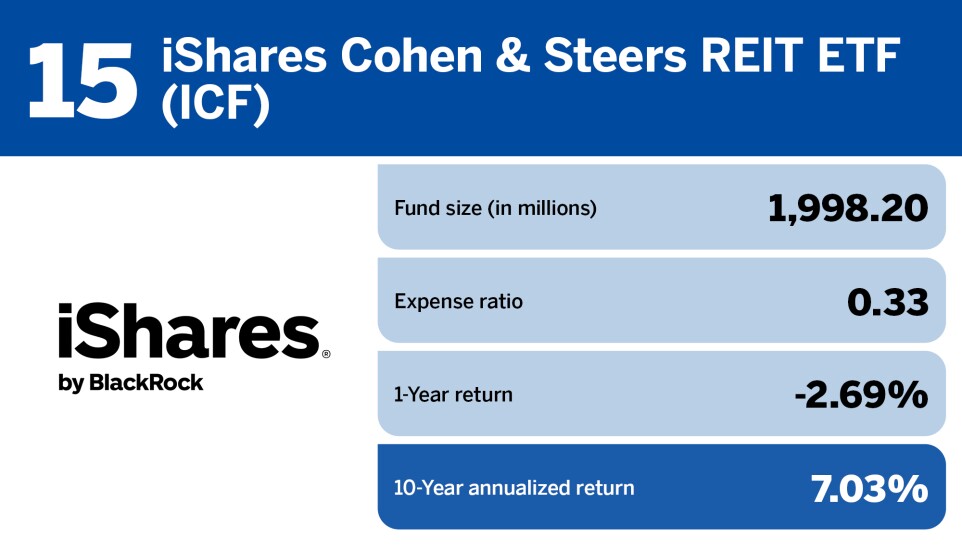

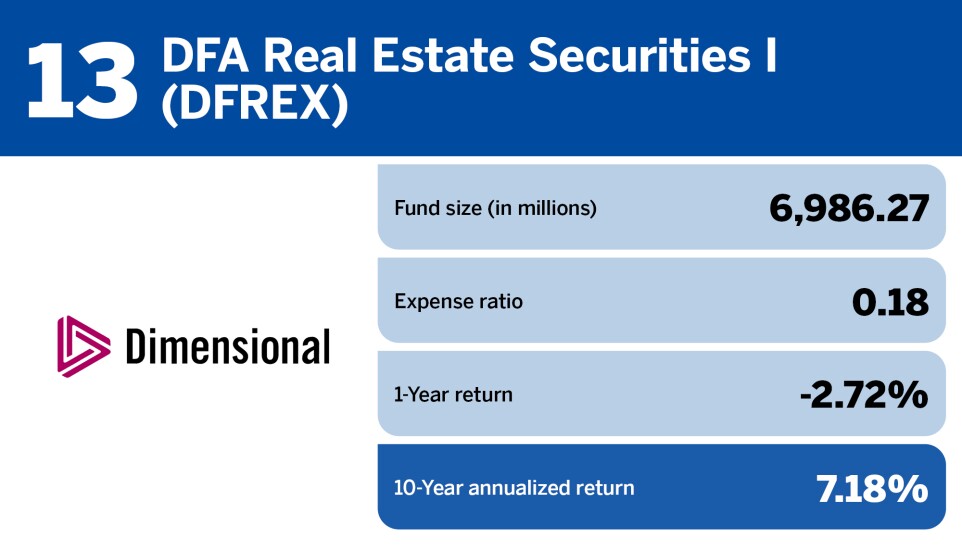

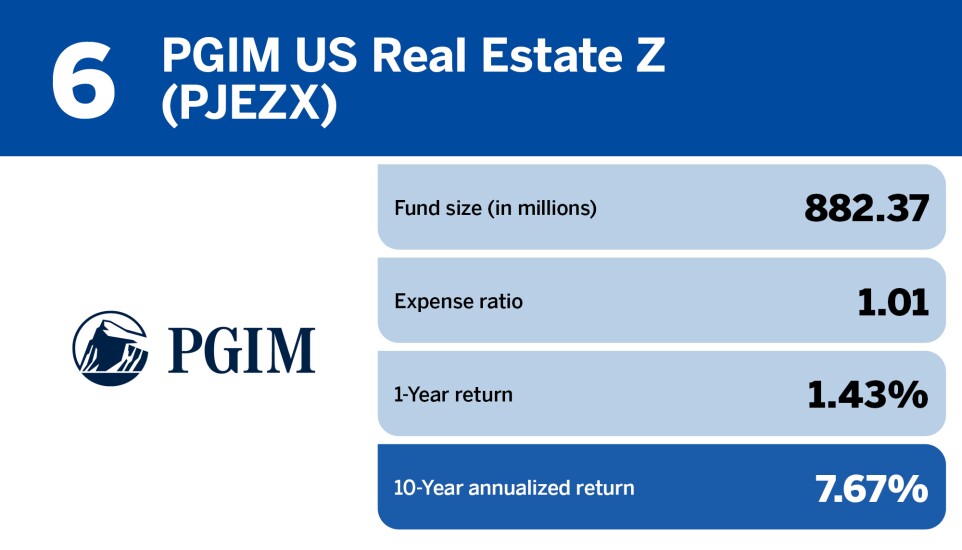

To see the rest of the top 20, scroll through the cardshow below. All data is from Morningstar Direct and is current as of Dec. 18, 2023.

READ MORE: