-

The transactions grew between second and third quarter, with the new-home market seeing one of its largest surges in cash-buying in 13 years.

October 27 -

A shortage of listings has pushed up prices, boosting the total value of US homes to a record $47 trillion, Redfin reported.

August 11 -

Ten Western states that benefited from a pandemic-driven boom reported value declines in May, CoreLogic said.

July 11 -

But there are regional variations in housing markets across the country, the Federal Housing Finance Agency said.

May 30 -

Home price overvaluations over 10% are easing in some markets, analysts say, but RMBS investors are still cautiously tightening liquidity amid uncertainty.

May 10 -

Housing costs increased at the slowest pace in over a decade nationwide, even while monthly growth now exceeds its pre-pandemic level.

May 2 -

Fannie Mae researchers found housing costs decelerating for the fourth straight quarter, but limited inventory may be driving hopeful buyers to look for opportunities in the new-construction market.

April 18 -

And in January, all-cash buyers reached their highest share in nine years, at 32.1%, Redfin said.

March 22 -

By the end of December, 63% of borrowers saw home values increase by 7.3%, for a collective gain of $1 trillion, CoreLogic's report found.

March 9 -

"This is Han Solo in carbonite: This is a market that could stay frozen for quite some time," said Benjamin Keys, a real estate professor at the University of Pennsylvania's Wharton School.

November 28 -

The decline in loan activity and softening prices also helped drive down builder sentiment for the 11th month in a row.

November 17 -

Quarterly numbers also show the smallest gain in appreciation since 2011, with values decreasing on an unadjusted basis, according to Fannie Mae.

October 17 -

Housing's unusually high appreciation rates have now slowed for three months straight, and the number of metropolitan areas that are considered overvalued keeps growing, according to CoreLogic.

September 6 -

Prices are starting to fall in one of the most expensive cities in the U.S. but they are still much higher than their pre-pandemic levels.

July 8 -

Several Sun Belt cities popular for relocation over the last two years were among markets with the most reduced listing prices in April.

May 27 -

A measure of home prices in 20 U.S. cities jumped 18.3%, down from 18.5% in October, the S&P CoreLogic Case-Shiller index showed Tuesday. It marked the fourth straight month that home-price appreciation has cooled off ever so slightly.

January 25 -

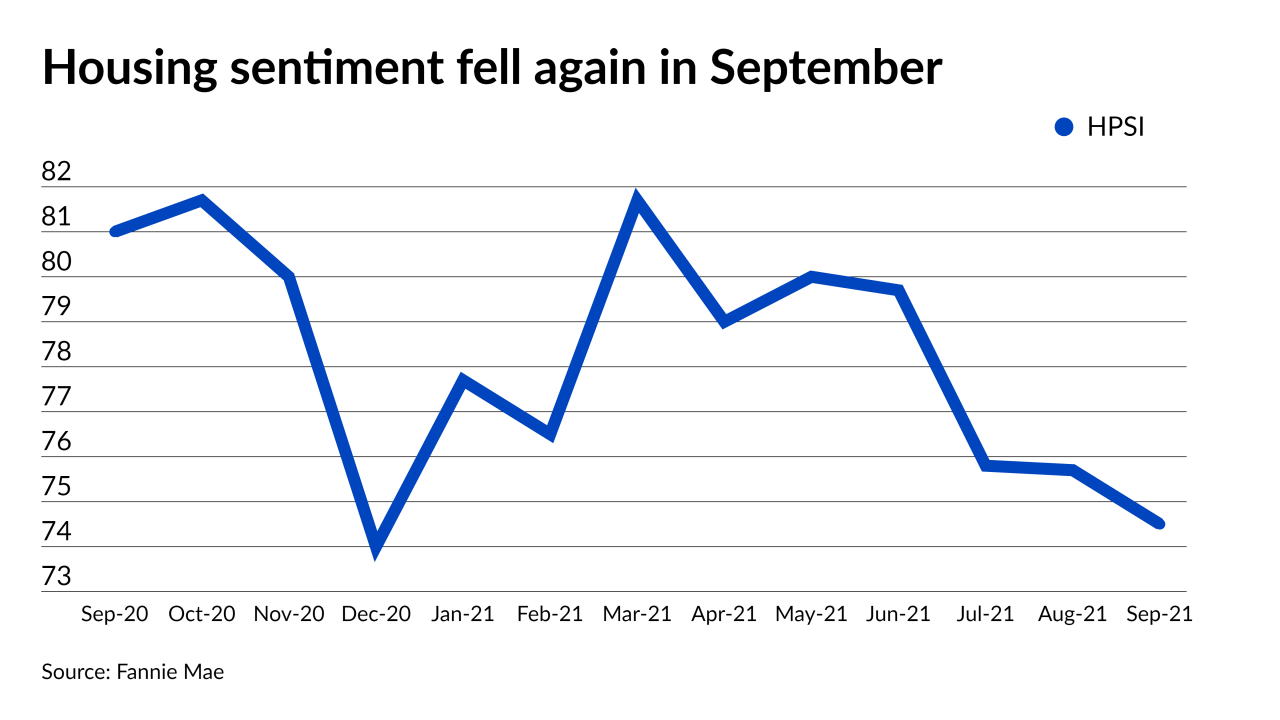

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

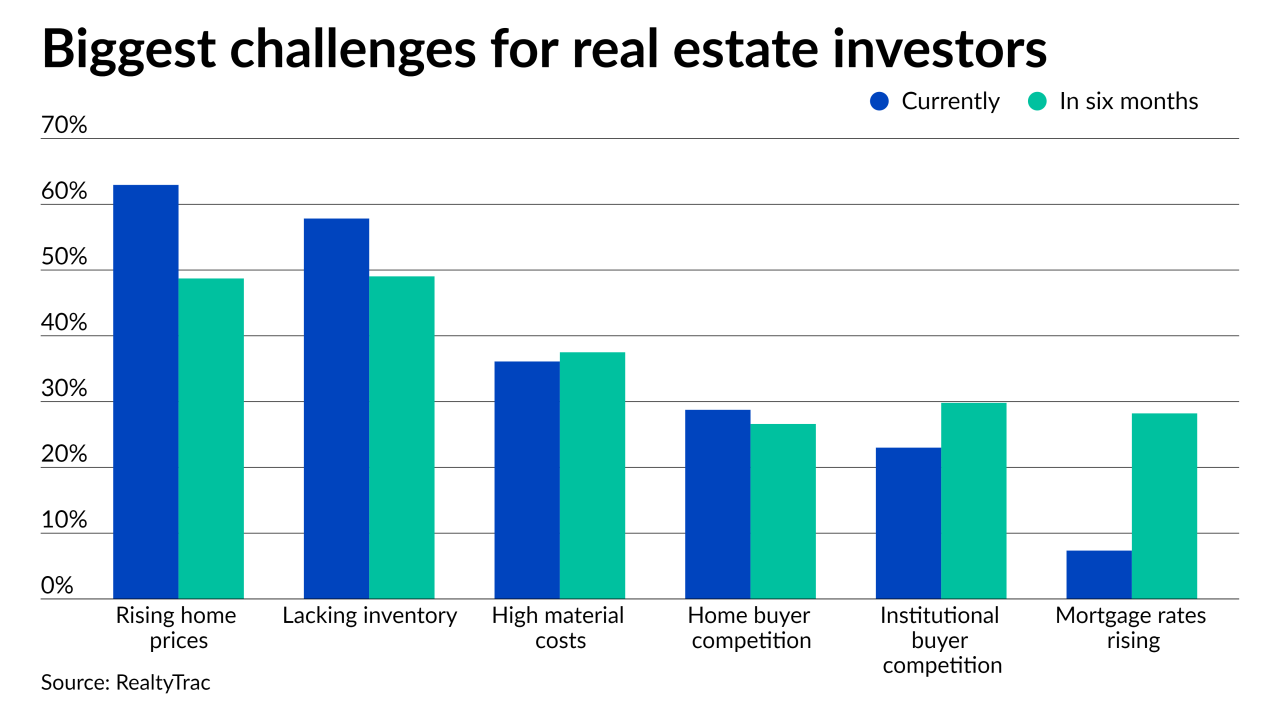

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Southwestern housing markets had the largest annual changes in median monthly home loan payments, with one increasing more than 30%, according to Redfin.

September 10 -

Meanwhile, property values across the U.S. have increased for 40 quarters in a row, according to the Federal Housing Finance Agency.

August 31